No.4006

Battery Energy Storage System (BESS) Business Market in Japan: Key Research Findings 2025

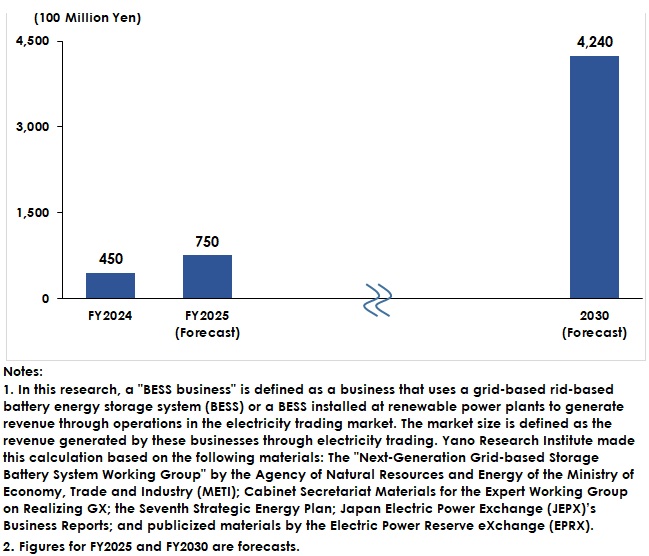

Domestic Market for BESS Business Forecast to Reach 424 Billion Yen by FY2030

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey of the domestic battery energy storage system (BESS) business market. The survey revealed the market overview, trends of leading market players, and future market outlook. In here discloses the market size forecast through FY2030.

Market Overview

Demand for battery energy storage systems (BESS) is growing in Japan, fueled by the increased use of renewable energy. According to the “Energy Supply and Demand Report” by the Ministry of Economy, Trade and Industry's Agency of Natural Resources and Energy, the proportion of renewable energy sources (comprising solar, wind, hydropower, geothermal, and biomass) accounted for approximately 23% of the total power source mix in FY2023, up from around 10% in 2012 when the feed-in tariff (FIT) program was launched. Since renewable energy sources fluctuate according to natural conditions (e.g., solar and wind power), BESS is attracting attention as a solution to balance and absorb these fluctuations.

BESS businesses generate revenue through their operations (i.e., electricity procurement and sales) in the electricity trading market. This market encompasses the wholesale electricity market, where the power is traded by the kilowatt-hour (kWh); the demand response market, which trades the ability to balance power supply and demand in delta kilowatt values, and the capacity market, which trades future power supply capacity. In April 2024, the demand response market fully opened, creating a favorable environment for BESS businesses.

In this study, a BESS business is defined as a business that uses a grid-based BESS or a BESS installed at renewable power plants to generate revenue through operations in the electricity trading market. Based on the BESS business revenue, the market size was estimated to be 45 billion yen in FY2024. The demand response market is the main destination for electricity sales. The most traded product is primary balancing capacity, which addresses instantaneous frequency fluctuations. Currently, the demand response market has received a small number of bids relative to the solicitation volume, resulting in procurement shortages. Consequently, more agreements on primary balancing capacity are being made near the bid ceiling price.

Noteworthy Topics

Starting from FY2026, Bid Ceiling Price for the Demand Response Market Will be Less than Half of the Current One

The demand response market (*) has suffered from chronic bid shortages since its full opening in April 2024. The market uses a “multi-price auction system,” in which trades are executed in order of the lowest bid price. This gives bidders pricing power during periods of insufficient bids.

To prevent a seller’s market from developing through soaring prices, the demand response market sets a bid ceiling price for products other than the tertiary balancing capacity②. As of December 2025, the ceiling price was 19.51 yen per delta kW for 30 minutes for complex products, primary balancing capacity, and secondary balancing capacity①, while the ceiling price for secondary balancing capacity② and tertiary balancing capacity① was 7.21 yen per delta kW for 30 minutes.

Bid shortages persisted in the market through FY2025. Since more contracts could be ba greed upon at high prices, METI’s Agency of Natural Resources and Energy suggested at the 108th System Review Working Group meeting, held on 29 October 2024, to reduce the bid ceiling price to 7.21 yen per delta kW for 30 minutes for complex products, primary balancing capacity, and secondary balancing capacity①. The suggested ceiling price is half the current one. If implemented, the new price will considerably impact BESS business in terms of revenue.

*) Products in the demand response market are categorized into primary balancing capacity, secondary balancing capacity① and ②, or tertiary balancing capacity① and ②, according to response time and control method.

Future Outlook

In response to the commencement of operations at storage battery facilities, the BESS business market is expected to reach 75 billion yen in FY2025. In the medium and long term, demand for BESS is expected to grow significantly due to further increase in the use of renewable energy sources. The government anticipates that the cumulative grid-based BESS capacity will range from 14.1 to 23.8 GWh by FY2030. The BESS business market is expected to reach 424 billion yen by FY2030, which is ten times larger than in FY2024.

Research Outline

2.Research Object: Domestic companies developing grid-scale battery storage systems and/or BESS installed at renewable power plants

3.Research Methogology: Face-to-face interviews (including online interviews) by expert researchers and literature research

What is the Battery Energy Storage System (BESS) Business Market?

Companies that develop business from battery energy storage systems (BESS) generate revenue by connecting large-scale batteries to the power grid and procuring and selling electricity in the electricity trading market. This market comprises the capacity, wholesale electricity, and demand response sectors. There are two types of BESS businesses. One type is a grid-based BESS, where the energy storage system is connected to the power grid alone to charge and discharge power through market operations. The other type is a BESS installed at renewable power plants from which to charge power, while discharging it through power trading in the electricity market.

In this research, a "BESS business" is defined as a business tthat uses either a grid-based BESS or a BESS installed at a renewable power plant to generate revenue through operations in the electricity trading market. Market size is defined as the revenue generated by BESS businesses through electricity trading. This calculation is based on the following materials: The "Next-Generation Grid-based Storage Battery System Working Group" by the Agency of Natural Resources and Energy of the Ministry of Economy, Trade and Industry (METI); Cabinet Secretariat Materials for the Expert Working Group on Realizing GX; the Seventh Strategic Energy Plan; Japan Electric Power Exchange (JEPX)’s Business Reports; and publicized materials by the Electric Power Reserve eXchange (EPRX).

*Related Materials:

Microgrid Business Market in Japan: Key Research Findings 2025 (Not translated)

https://www.yano.co.jp/press-release/show/press_id/4020

Global Market of Entire Stationary Energy Storage Systems (ESS): Key Research Findings 2025

https://www.yanoresearch.com/en/press-release/show/press_id/3871

Electricity Retail Market in Japan: Key Research Findings 2025

https://www.yanoresearch.com/en/press-release/show/press_id/3820

Energy Resource Aggregation Businesses (ERAB) Market in Japan: Key Research Findings 2025

https://www.yanoresearch.com/en/press-release/show/press_id/3710

<Products and Services in the Market>

grid-based BESS, BESS installed at renewable energy plants

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.