No.4009

Alcoholic Beverages Market in Japan: Key Research Findings 2025

Alcoholic Beverages Market Projected to Mark First Contraction in Four Years

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic alcoholic drinks (liquor) market, and found out the trends by product category, the trends by distribution channel, the trends of market players, and future perspective.

Market Overview

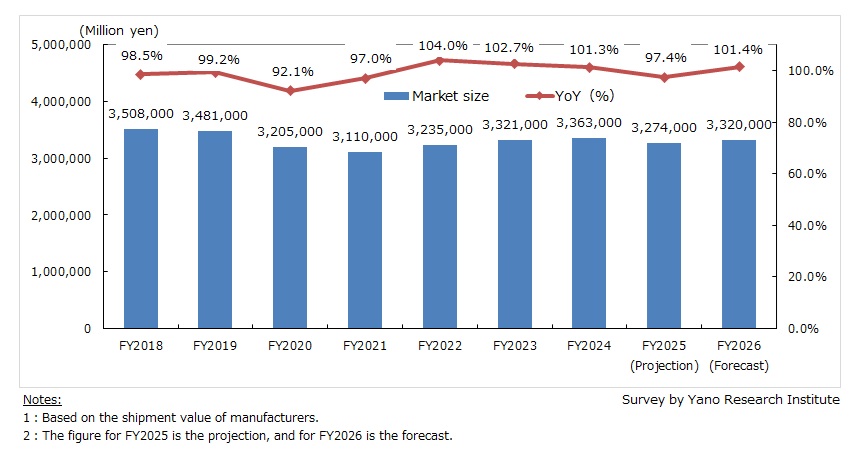

The alcoholic beverages market (based on the shipment value of manufacturers) grew to 3,363 billion yen in FY2024, marking growth for three consecutive years. While the growth was primarily driven by the rise in unit prices—while the shipment volume remained either flat or declined in some categories—record-breaking heatwave, resumption of events that were deferred during the pandemic (festivals, banquets) and increase of inbound tourists also contributed to the growth.

By distribution channel, on-trade segment (bars, restaurants, cafes) was fueled by the rising trend of experience-based consumption, which led to demand growth for high-end products such as premium beer and Japanese whisky. The sales in off-trade segment (retail stores, supermarkets, e-commerce) was underpinned by the demand for beers—whose tax has been decreased—and non-sugar RTDs—which provides satisfying tase at reasonable price—due to polarization of consumers into those in favor of ‘petit-luxury’ and those increasingly sensitive to price.

However, it should be noted that the market is projected to shrink in FY2025, down 2.6% to 3,274 billion yen.

Noteworthy Topics

Non-Alcoholic Beverages Market

Driven by rising health consciousness and evolving lifestyles, the non-alcoholic beverages segment has been expanding as it shifts from being positioned merely as an “alcohol alternative” to a category of “beverages chosen by preference.”

In Japan, non-alcoholic beverages garnered attention following the tightening of penalties for alcohol-impaired driving. Awareness increased sharply in 2009 with the launch of “Kirin Free”, the 0.00% ABV beer-flavored beverage by Kirin. More recently, concepts such as “sober-curious” and “mindful drinking” have gained traction, particularly among young generations. The wellness trend known as "zebra striping," in which consumers alternate between alcoholic and non-alcoholic drinks, is also becoming increasingly popular.

Product variety has since expanded significantly. Beyond non-alcoholic beer, offerings now include zero ABV lemon sours (a popular Japanese shochu-based cocktail), mocktails, and wine-flavored alcohol-free beverages. Major alcohol manufacturers are increasingly prioritizing this segment: Asahi Beer is promoting “Smart Drinking” to attract non-drinkers, while Suntory established a dedicated Non-Alcohol Division in 2025 and committed five billion yen to marketing non-alcoholic beverages.

Future Outlook

The alcoholic beverages market is projected to decline to 3,374 billion yen in FY2025, marking the first contraction in four years (down 2.6% year on year). The decline is primarily attributed to weakened beer consumption amid rising prices, compounded by a system failure at a major alcoholic beverage manufacturer following a cyberattack.

In FY2026, the market is projected to rebound modestly to 3,320 billion yen, representing 1.4% year-on-year growth. Although the unification of beer taxation scheduled for October 2026 is expected to weigh on demand for low-malt beer and new-category beer, demand for beer overall and ready-to-drink (RTD) is forecast to remain resilient.

Nevertheless, the FY2025 market size remains approximately 200 billion yen below the pre-pandemic FY2019 level of 3,481 billion yen, underscoring a longer-term downward trend in the alcoholic beverages market.

Research Outline

2.Research Object: Manufacturers and wholesalers of alcoholic beverages, related businesses

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey via telephone, questionnaire, and literature research

What is the Alcoholic Beverages Market?

In this research, the alcoholic beverages market encompasses 10 product categories: “Beers” (regular beer, low-malt beer [‘happoshu’], ‘new category’ beer [beer-like drinks made without malt]), “Sake” (rice wine), “Spirits” (high-class shochu, second-class shochu, whisky), “Wine”, “Ready-to-drink (RTD)” (including low-alcoholic drinks), and others.

From this year’s survey, the classification of low-ABV beverages is classified as RTD.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.