No.3985

Otaku Market in Japan: Key Research Findings 2025

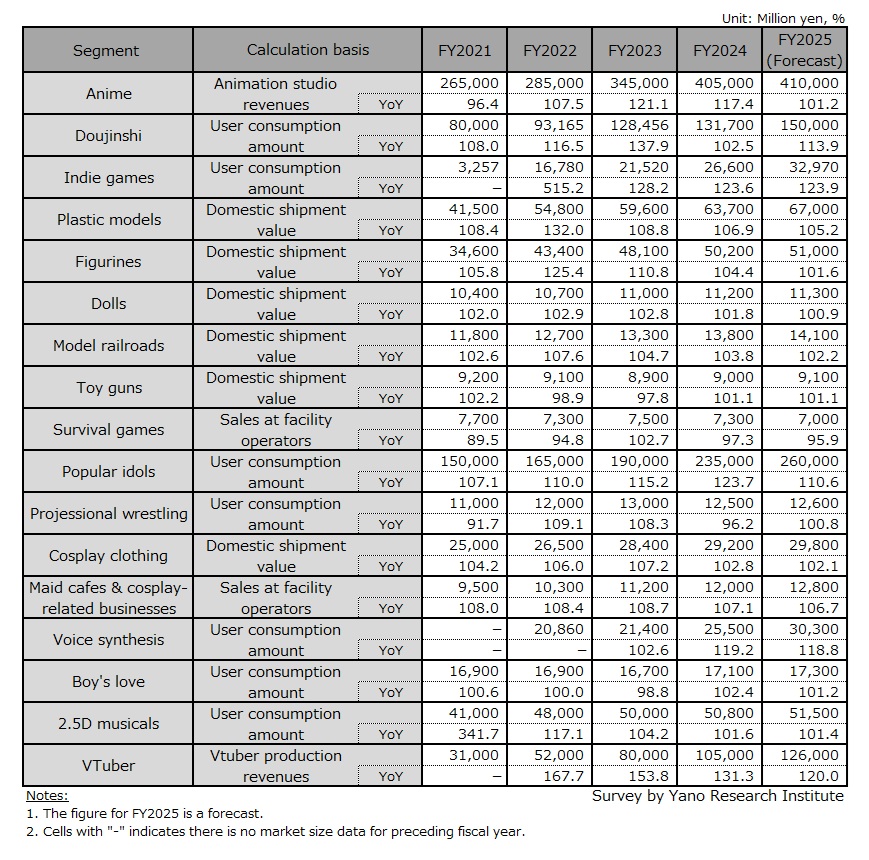

15 Segments Out of 17 Major Otaku Markets Post Growth in FY2024

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a survey on the Otaku market in Japan, and found out the trends by segment, the trends of market players, and future perspectives. This press release announces the market size of 17 major segments.

Market Overview

In FY2024, 15 segments of Otaku culture (anime, doujinshi, indie games, plastic models, figurines, dolls, model railroads [including dioramas and other peripheral products], toy guns, popular idols, cosplay clothing, Japanese maid cafes & cosplay-related businesses, voice synthesis, boys' love, 2.5D musical, and VTubers) showed growth, and 2 segments (survival games and professional wrestling) diminished.

Among the 15 growth sectors, the "idols" segment led the market with 23.7% year-on-year growth, driven by a significant structural shift. While traditional female idol groups saw a slowdown in new debuts, new-generation J-pop groups—utilizing K-pop-style trainee systems such as JO1, ITI, NiZiU and &TEAM—surged in popularity. They have revitalized the industry by combining top-tier performances with global promotion strategies to build international fanbases. This evolution marks a transition for the segment, moving away from simple music consumption toward experience-based consumption rooted in deep fan engagement.

Noteworthy Topics

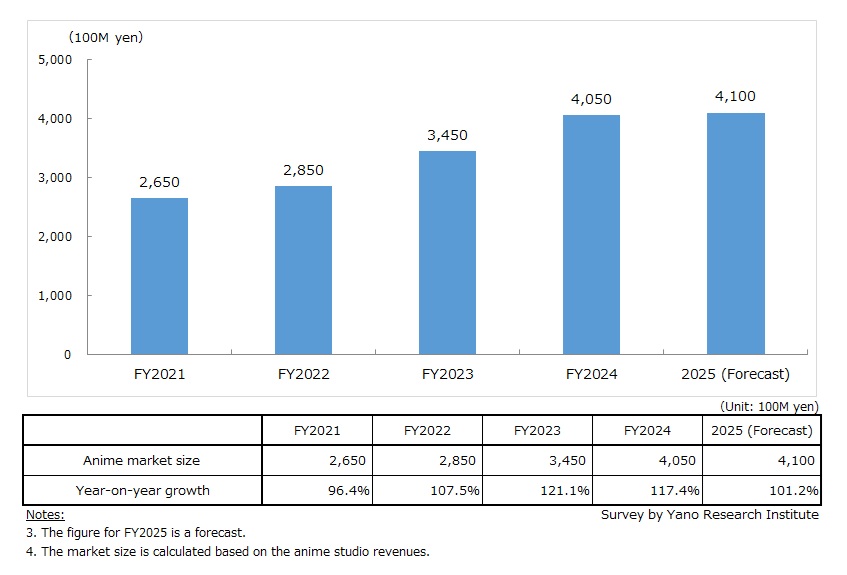

Anime Market Showed Growth for Three Consecutive Terms

The anime segment leads the 17 major Otaku markets, showing a 17.4% year-on-year increase to reach 405 billion yen in FY2024, based on animation studio revenues. This growth was propelled by a cinematic hit, notably Detective Conan: The Pentagram of Destiny and Haikyu!! The Movie: The Battle at the Garbage Dump, both of which surpassed the 10 billion yen box office milestone. This momentum was further sustained by the popularity of TV series such as Oshi no ko (My Favorite Child), Uma Musume: Cinderella Grey, The Apothecary's Tale, and That Time I Got Reincarnated as a Slime, alongside robust licensing earnings of major animation studios.

The market atmosphere reached a fever pitch in May 2024 with the airing of Demon Slayer: Kimetsu no Yaiba - The Pillars Training Arc. The release sparked a cultural phenomenon reminiscent of the original "Demon Slayer Boom," signaling a return to massive, mainstream sensations. While the industry is seeing increased polarization, where top-tier titles thrive while underperforming projects face sharper declines, the exceptional success of these leading properties ultimately drove the segment's overall expansion.

Future Outlook

Most major segments of the otaku market are projected to grow in FY2025, with the exception of the “survival games” segment.

Among the 16 expanding segments, indie games are expected to record the highest year-on-year growth, at 23.9%. Traditionally, indie games have been regarded as a niche for hardcore gamers who devote substantial time and spending to gameplay. Recently, however, the release of entry-level titles such as The Exit 8 (Active Gaming Media) and Urban Myth Dissolution Center (Shueisha Games) has significantly broadened the player base by attracting more casual gamers.

Market expansion has also been supported by the widespread adoption of the Nintendo Switch™. That said, the impact of the Nintendo Switch™ 2, launched in June 2025, remains uncertain.

In addition, temporary concerns arose after several Japanese platforms selling doujinshi and indie games faced restrictions on payments from major international credit card brands such as Visa and Mastercard. However, the impact proved short-lived, as users shifted to alternative payment methods. As a result, the indie game segment is expected to continue growing in FY2025.

Research Outline

2.Research Object: Organizations and providers of contents, products, and services pertaining to Otaku culture

3.Research Methogology: Face-to-face interviews by our specialized researchers (including online interviews), online questionnaire, survey via telephone, and literature search.

In this research, the Otaku market encompasses content, products, and services that are often associated with Akihabara, the "sacred land" of Otaku culture. The target Otaku segments include “anime”, “manga (including e-comics)”, “light novels”, “doujinshi” (fanzines), “smartphone games”, “indie games”, “plastic models”, “figurines” (collectible figures), “dolls”, “model railroads (including dioramas and related products)”, “toy guns”, “survival games”, “popular idols”, “professional wrestling”, “cosplay clothing”, “maid cafes & cosplay-related businesses”, “voice synthesis”, “boys' love”, “2.5D musicals”, and “VTubers”.

<Products and Services in the Market>

Anime, manga (including e-comics), light novels, doujinshi, smartphone games, indie games, plastic models, figurines, dolls, model railroads (including dioramas and other peripheral products), toy guns, survival games, popular idols, professional wrestling, cosplay clothing, maid cafes & cosplay-related businesses, voice synthesis, boys' love, 2.5D musicals, VTubers

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.