No.3981

The Complementary Finance and Funding Support Solutions Market in Japan: Key Research Findings 2025

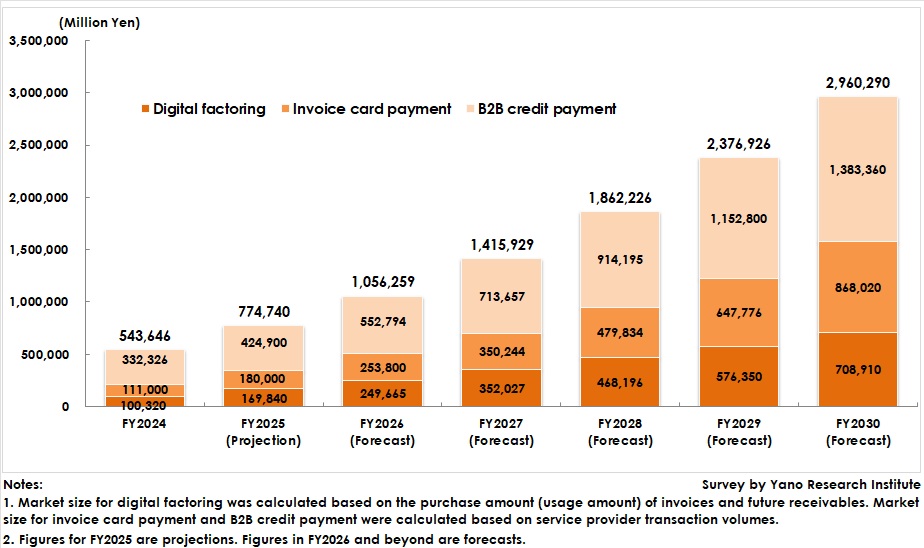

The Domestic Complementary Finance and Funding Support Solutions Market is Forecast to Reach 2.9 Trillion Yen by FY2030, with a CAGR of 32.6% from FY2024 to FY2030

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey of the domestic complementary finance and funding support solutions market. The survey revealed the trends by service, trends of leading market players, and future market outlook.

Market Overview

The complementary finance and funding support solutions market, which comprises digital factoring, invoice card payment, and B2B credit payment, reached 543.6 billion yen in FY2024 due to increased demand from small- and medium-sized enterprises (SMEs) and sole proprietors for improved financing and work efficiency.

The digital factoring market exceeded 100 billion yen in FY2024. This growth was driven by several factors, including expanded service provisions to SMEs stemming from the collaboration between factoring companies and financial institutions, digital marketing measures tailored to small businesses, and improved awareness of factoring services due to their integration with software-as-a-service (SaaS) platforms.

The invoice card payment market reached 111 billion yen in FY2024. The market has grown by acquiring demand from small businesses that wish to improve their financing. There has also been an increase in the use of credit cards by product and service suppliers because credit cards facilitate early payment.

The B2B credit payment market steadily grew to 332.3 billion yen in FY2024. This service is primarily used by businesses that handle a high volume of small-amount invoices, aiming to reduce operating costs. Businesses in this category include advertising and advertising production companies, food wholesalers, affiliate service providers, and software solution providers.

The complementary finance and funding support solutions market is growing constantly due to increased use of these services.

Noteworthy Topics

Progress in Efforts to Develop a Healthier Industry

Nonrecourse trade financing is a type of loan where repayment is limited to specific assets and their income. Factoring for nonrecourse trade financing does not fall under the category of loans. Therefore, this type of factoring cannot be applied to existing financial regulations.

Currently, self-regulatory rules are being developed primarily by the Online Factoring Association Japan, aiming for healthier operation. The 2020 amendments to the Civil Code clarified the treatment of assignment-restricted claims and future claims, enabling digital factoring operations to be more flexible. Additionally, reviews of the Small and Medium-Sized Enterprise Contract Transactions Rationalization Act and government policies trending toward reducing joint liability guarantees are expected to reshape the credit framework for SMEs and sole proprietors. This is projected to accelerate market adoption through collaboration with financial institutions. These systematic arrangements allow businesses to provide claims-based funding methods, including factoring, thus expanding the use of digital factoring.

It has been decided that an industry group will be formed to address invoice card payment due to an increase in businesses offering business invoice payment services (BIPS). This group is expected to establish self-regulatory guidelines. The current business structure causes credit card issuers to incur losses when bad debt occurs. To create an optimal environment for all stakeholders, including companies using the service, BIPS providers, and credit card companies, the ecosystem of the service must be reorganized.

Future Outlook

The market for domestic complementary finance and funding support solutions is forecast to reach 2.9 trillion yen by FY2030, with an estimate CAGR of 32.6% from FY2024 to FY2030.

Currently, confirmed receivables factoring businesses are driving the growth in the digital factoring market. The market is expected to grow further by acquiring new customers through touchpoints with financial institutions. The next phase will involve strengthening of future receivables factoring services and revenue-based finance (RBF) services by businesses with platforms available for peripheral credit and settlement operations. This expansion is expected to increase the use of digital factoring among existing member stores. These factors are projected to boost the digital factoring market to 4708.9 billion yen by FY2030.

The invoice card payment service is increasingly used by small businesses wishing to improve financing. Credit cards are projected to be used among more companies, including those without the need of funding, because of ease of expense management and point rewards. The invoice card payment market is expected to reach 868.0 billion yen by FY2030.

The B2B credit payment market is projected to grow steadily, as the service has been increasingly used for reducing operating costs. The market is forecast to reach 1.3 trillion yen by FY2030.

Research Outline

2.Research Object: Digital factoring providers, invoice card payment providers, B2B credit payment providers

3.Research Methogology: Face-to-face interviews (including online interviews) by expert researchers and literature research

What is the Complementary Finance and Funding Support Solutions Market?

This research defines the complementary finance and funding support solutions market as the total market for digital factoring, invoice card payment, and B2B credit payment, which are offered to small-to-medium enterprises (SMEs) and sole proprietors. These solutions aim to improve companies’ financing and prevent losses from bad debts by supporting healthier cash flows, saving labor, and streamlining processes for businesses that handle a high volume of small-amount invoices.

Digital factoring refers to factoring services completed entirely online, including confirmed receivables factoring and future receivables factoring. Market size is calculated based on the purchase amount (usage amount) of invoices and future receivables.

An invoice card payment is a service that allows businesses to pay invoices with a credit card. Market size was calculated based on credit card usage amounts (service provider transaction volume).

B2B credit payment refers to services that undertake all operations from invoice issuance to receivables collection, including credit screening, billing, payment confirmation/dunning, and debt guarantees. Market size is calculated based on B2B credit payment service usage amounts (service provider transaction volume).

<Products and Services in the Market>

Digital factoring, invoice card payment, B2B credit payment

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.