No.3972

Global Automotive Motor Market: Key Research Findings 2025

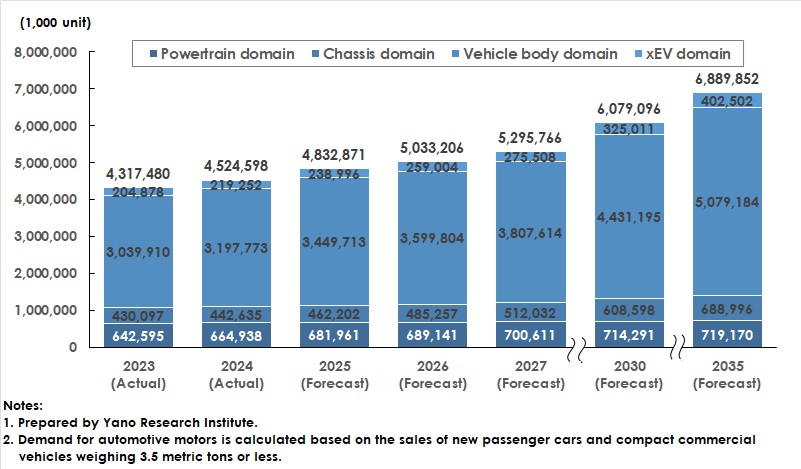

The Estimated Global Automotive Motor Market Reached 4.524598 Billion Units in 2024

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey of the global automotive motor market. The survey revealed the demand forecast for automotive motors by region and by car classification, the market forecast by system domain, the trends among market players, and the future outlook. Here discloses the global automotive motor demand forecasts.

Market Overview

In 2024, the demand for automotive motors reached 4.524598 billion units, marking a 4.8% increase from the previous year. The vehicle body domain accounted for the largest percentage of installed motors at 70.7%. The chassis domain followed with 9.8%, and the xEV* domain followed with 4.8%. While BEVs and PHEVs are experiencing growing sales, these vehicles face the challenge of extending their full charge range. Improving the energy efficiency of the entire vehicle body requires cooling heat sources, such as batteries and motors, and implement advanced heat management strategies, such as utilizing waste heat. This has led to increased installations of heat management components, including cooling fans as well as electric water pumps and valves. Additionally, there is an increasing demand for downsizing, modularization, and quietness from the perspective of expanding interior space and eliminating engines.

* xEVs refer to the following electric vehicles: HEVs (hybrid electric vehicles), PHEVs (plug-in hybrid electric vehicles), BEVs (battery electric vehicles), and FCEVs (fuel cell electric vehicles).

Noteworthy Topics

Surging Demand for Automotive Motors in Emerging Countries

In emerging countries, market growth is boosted by an increasing population, economic growth, increased automotive demand due to improved infrastructure, reinforced environmental regulations, and stricter safety standards. India's BS6 Stage II exhaust gas restrictions, which took effect in 2023, are a primary example of this. These regulations tightened the limits on nitrogen oxides (NOx) and particulate matter (PM). The country has also mandated real driving emissions (RDE) testing and the installation of OBD-II (on-board diagnostics) systems. In response, the use of electric actuators, such as electronic throttle control and exhaust gas recirculation (EGR) valves, has increased. In the same year, India launched a new car assessment program called Bharat NCAP (Bharat New Car Assessment Program). Starting in 2026, advanced driver-assistance systems (ADAS), anti-lock brake systems (ABS), and lane departure warning systems (LDWS) will be required primarily for commercial vehicles. To meet these requirements, the demand for electric-hydraulic brakes, ABS, and electric parking brakes (EPBs) will increase, which will boost motor installations in the chassis domain and drive the motor market. Additionally, rising incomes have increased demand for comfort features, raising the proportion of sport utility vehicles (SUVs) among new car sales in India from 30% in 2020 to over 50% in 2024. As cars have grown larger and more expensive, they have been equipped with comfort features such as sunroofs and power seats. Power windows have become standard features, even in compact cars. Consequently, demand for motors in the vehicle body domain is also increasing.

Future Outlook

A growing number of motors is expected to be installed in all domains through 2035, particularly in the xEV domain. Even with a conservative forecast, the number of motors installed in this domain is projected to be 1.643 times larger in 2035 than in 2024. With an aggressive forecast, this figure is expected to increase 1.836-fold.

During the 2030s, the number of motors in the chassis and xEV domains is expected to grow in advanced countries due to the progress in intelligent, software-defined vehicles (SDVs). As autonomous driving (AD) and ADAS become more prevalent and advance, by-wire technology has emerged in steering and braking systems. In many steer-by-wire architectures, two motors are installed at the front. Large automobiles with extended wheelbases may require a maximum of three motors due to the addition of rear-wheel steering. Brake-by-wire systems using electric mechanical brakes (EMBs) require a total of four motors, one for each wheel. Fully autonomous driving requires the redundancy in cooling circuits to cool electronic control units (ECUs) as well as additional comfort features, such as automotive displays and seats. These requirements are expected to increase the number of motors installed in the body domain. China's new energy vehicle (NEV) market has standardized automotive displays and power seats, even in compact cars. High-end models offer added value with second-row zero-gravity seats, massage functions, and refrigerators. With high assessments for new technologies including steer-by-wire systems and EMBs, China is likely to lead the way in terms of legal regulations and acceptability.

Research Outline

2.Research Object: Motor manufacturers, automotive system manufacturers, etc.

3.Research Methogology: Face-to-face interviews (including online interviews) by expert researchers, surveys via telephone, and literature research

What is the Automotive Motors Market?

In this research, automotive motors refer to those installed in all passenger cars and small commercial vehicles weighing 3.5 tons or less. This includes starters (powertrain domain), alternators, and main motors used in various auxiliary equipment and electric vehicles (EVs), including hybrid electric vehicles (HEVs), plug-in hybrid EVs (PHEVs), battery EVs (BEVs), and fuel cell EVs (FCEVs).

However, some motors for disc drives and hard disc drives used in car audio and car navigation systems are excluded.

<Products and Services in the Market>

Starters, alternators, auxiliary motors, and main motors

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.