No.4015

Toiletries Market in Japan: Key Research Findings 2025

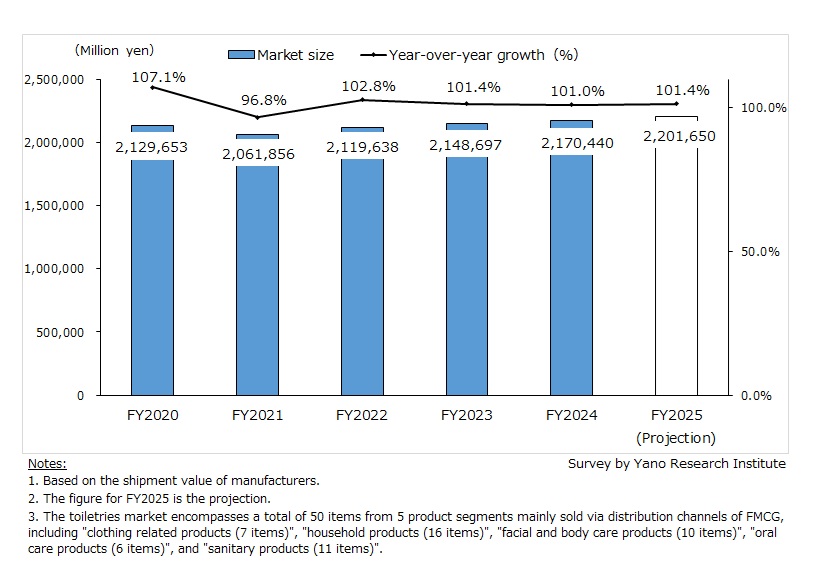

Toiletries Market Sized at 2,170,440 Million Yen in FY2024 (101.4% YoY), Hovering at 2-Trillion Yen-Level for Five Consecutive Years

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the domestic toiletries market (50 items from 5 product segments), and found out the market size, trends by item, market player trends, and future perspective.

Market Overview

The domestic toiletries market (50 items from 5 product segments) attained 2,170,440 Million Yen in FY2024, representing 101.4% year-over-year, making positive growth for three consecutive years (based on the shipment value of manufacturers).

With a shrinking population making volume growth difficult, brands are pivoting toward margin expansion, prioritizing value over volume. While consumer foot traffic has increased, the 'sanitary habit' remains, keeping demand for masks and wipes steady. Additionally, we are seeing a climate-driven surge in the personal care category. Intense summer heat has made etiquette-related products, such as high-performance deodorants and grooming essentials, a consistent growth driver.

Noteworthy Topics

Demand for Pest Control Expands Due to Climate Change

The insecticide market is characterized by seasonal volatility, as pest infestation levels are directly tied to fluctuations in temperature, humidity, and rainfall. Beyond the surge in demand during extreme heatwaves, market growth is being fueled by strategic price adjustments and the successful premiumization of value-added products.

Due to climate change, lingering summer heat is extending. Combined with the rising need for year-round pest management (such as mite and bed bug treatments), the industry is successfully transitioning toward a year-round sales model.

Future Outlook

Manufacturers are expected to implement further pricing actions through FY25 and beyond to offset persistent inflationary pressures in raw materials, energy, logistics, and labor. To drive margin expansion, toiletries players are accelerating portfolio rationalization: streamlining SKUs and divesting underperforming business units. This strategic shift focuses on resource optimization, concentrating capital on high-growth, competitive segments. Globally, as many regions face similar demographic headwinds like aging and declining populations, manufacturers must deploy bespoke strategies that reflect the unique aging and population trends of each specific market.

Research Outline

2.Research Object: Manufacturers of toiletry products, other related enterprises

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), mailed questionnaire, research on industry associations, and literature research

Toiletries Market

In this survey, the toiletries market encompasses a total of 50 items from 5 product segments mainly sold via distribution channels of FMCG, including "clothing related products (7 items such as synthetic detergents for clothing and fabric softeners)", "household products (16 items including kitchen detergents, wrapping films, room fragrance/air freshener and insecticides)", "facial and body care products (10 items such as body shampoos and hand soaps)", "oral care products (6 items such as toothpastes and mouth washers)", and "sanitary products (11 items including toilet paper, tissue paper and adult diapers)". The market size is calculated based on the shipment value of manufacturers.

<Products and Services in the Market>

(1) Clothing related products (synthetic detergents for clothing, laundry detergent for fashion wear, fabric softeners, liquid household bleach, deodorants for clothing/fabrics, insect repellent for closets/drawers, water-proof agents); (2)Household products (kitchen detergents, kitchen cleaners, wrapping films, oven sheets, aluminum foils, rubber gloves for kitchen, refrigerator deodorizer, sanitization agents for kitchen, dishwasher detergent, detergent for baths, room fragrance/air freshener/deodorant for rooms, dehumidifying agents, detergent for residence, wax for flooring, toilet detergents, insecticides); (3)Facial/body care products (soaps, body shampoos, hand soaps, anhidrotic agents, bath salts, hand cream, cosmetic cottons, spare blades, disposable blades for razors, shaving agents); (4)Oral care products (tooth pastes, tooth brushes, mouth washers, denture stabilizing agents, detergents for artificial teeth, dental flosses); (5) Sanitary products (diapers for babies, adult diapers, sanitary napkins, products for incontinence, tissue paper, wet wipes, towel paper, toilet paper, cooking paper, facial masks, oil blotting papers)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.