No.3999

The Automotive Application and Platform Market in Japan in the SDV Era: Key Research Findings 2025

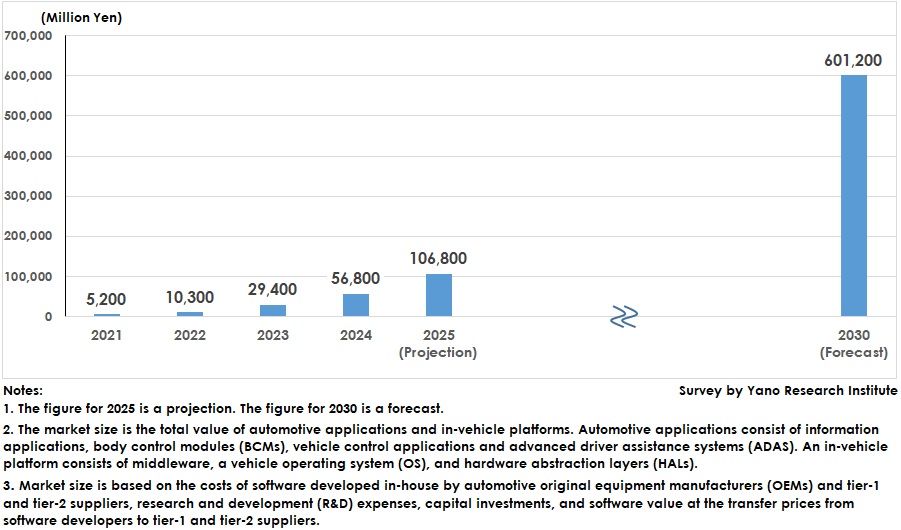

The Domestic Automotive Application and Platform Market is Expected to Reach 106.8 Billion Yen by 2025 and is Forecast to Jump to 601.2 Billion Yen by 2030

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey of the domestic automotive application and platform market. The survey revealed the development trends in in-vehicle platforms and applications by automotive OEMS, tier-1 and tier-2 suppliers, software developers and vendors. It also revealed trends in electric and electronic (E/E) architecture as well as in automotive application businesses and market outlook.

This paper focuses on the transition and forecast of the automotive application and platform market through 2030.

Market Overview

The research and development of software-defined vehicles (SDVs) has transformed automobiles from a mere means of transportation into sources of information and functionality for drivers and passengers. Automotive applications, or software that runs in cars, are poised to create excitement in driving experiences.

This research defines the automotive application and platform market as the total value of automotive applications and in-vehicle platforms. Automotive applications consist of information-based applications, body-related applications, vehicle control applications and applications related to advanced driver assistance systems (ADAS). In-vehicle platforms consist of middleware, a vehicle operating system (OS), and a hardware abstraction layer (HAL).

The market size steadily increased, reaching 10.3 billion yen in 2022, marking a 98.1% increase from the previous year. It then reached 29.4 billion yen in 2023, which was 185.4% larger than the previous year. In 2024, the market size grew to 56.8 billion yen, a 93.2% increase from the previous year. As automotive original equipment manufacturers (OEMs) continuously develop their own platforms, in-vehicle platforms accounted for 75% of the market in 2024, while automotive applications accounted for the remaining 25%.

Noteworthy Topics

Changes in Architecture of In-Vehicle Platforms and Applications

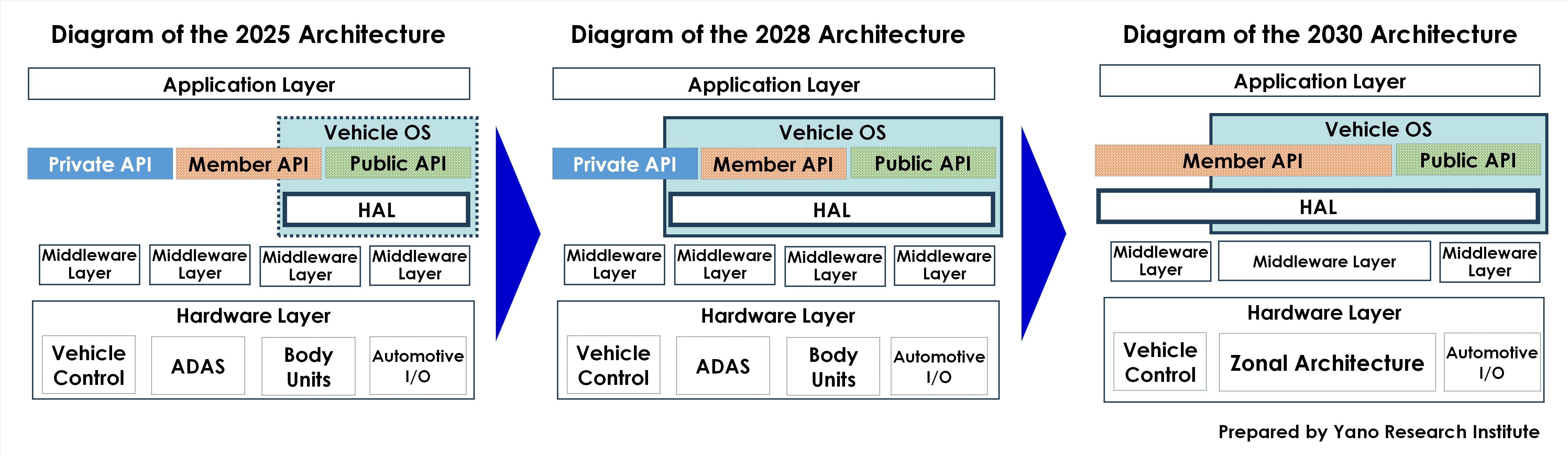

The research forecasts the architecture of automotive applications for the years 2025, 2028, and 2030.

“The Evolution of the Architecture for In-Vehicle Platforms and Applications” illustrates that, by 2025, many automotive OEMs will have adopted a domain-based electrical/electronic (E/E) architecture that divides functions per electronic control unit (ECU). However, in-vehicle platforms remain functionally siloed, resulting in fragmentation and poor interoperability. Technologies such as over-the-air (OTA) wireless application updates remain immature.

By 2028, hardware abstraction layers (HALs), which facilitate alignments among domains, are expected to expand their coverage from body-related and information I/O to include advanced driver-assistance systems (ADAS). Because ADAS involves vehicle control systems, it requires the automotive safety integrity levels (ASILs) “C” or “D”, with "D" requiring the most stringent level of safety measures. Meeting these safety requirements will necessitate middleware implementation, requiring collaboration with software development vendors. As part of this effort, the use of technologies like System on a Chip (SoC) is also expected to emerge.

By 2030, the architecture of body-related hardware will shift from a traditional domain-based structure to a zonal structure, marking a dramatic change. Currently, embedding system-on-a-chip (SoC) technology is cost-prohibitive. However, SoC costs are expected to decline by 2030, allowing for embedding in four locations on a vehicle, i.e., front right, front left, rear right, and rear left. This will enable ECUs to function as zonal controllers.

Future Outlook

The automotive application and platform market is projected to reach 106.8 billion yen by 2025, which is an 88.0% increase from the previous year. This makes the market consist of 30% automotive applications and 70% in-vehicle platforms.

As “the Diagram of 2025 Architecture” shows, the scope of in-vehicle platforms (middleware, vehicle OS, and HAL) currently extends to information I/O and body control systems. Despite remaining immature, this demonstrates that automotive OEMs are continuing to develop their platforms toward completion. In parallel, OEMs are developing a range of automotive applications centered on Member and Public API utilization (*), actively working to expand their app portfolio.

While these trends are likely to continue, by 2028, the coverage of HALs is expected to expand beyond information applications and body control systems to include ADAS applications. This, combined with the integration of middleware, will bring the structure closer to its final form.

While R&D for in-vehicle platforms stabilizes, the need to advance the development of automotive applications utilizing various APIs will increase, narrowing the market share gap between in-vehicle platforms and automotive applications. This strategic shift in R&D focus—from platform consolidation to application diversification—is expected to drive substantial market expansion. By 2030, the composition is expected to be nearly equal, with in-vehicle platforms accounting for 51% and automotive applications accounting for 49%. Consequently, the total market for automotive applications and platforms is projected to reach 601.2 billion yen by 2030.

*API Classification:

Private API: Used by OEMs and Tier 1/2 suppliers for software updates.

Member API: Available to OEMs, Tier 1/2 suppliers, and authorized third-party operators for software updates.

Public API: Available to all parties (OEMs, Tier 1/2 suppliers, and any third-party operators) for software updates.

Research Outline

2.Research Object: Automotive OEMs, automotive component suppliers (including tier 1 and tier 2 suppliers) and software developers and vendors.

3.Research Methogology: Face-to-face interviews (including online interviews) by expert researchers and literature search

What is the Automotive Application and Platform Market?

In this research, the automotive application and platform market is defined as the combined value of automotive applications and in-vehicle platforms. Automotive applications include information-based applications, body-related applications, vehicle control applications, and applications related to advanced driver assistance systems (ADAS). In-vehicle platforms consist of middleware, a vehicle operating system (OS), and a hardware abstraction layer (HAL)(*).

The market size is calculated based on the costs of software developed in-house by automotive original equipment manufacturers (OEMs) and Tier-1 and Tier-2 suppliers, including research and development (R&D) expenses and capital investment costs, as well as the value of software supplied on a transfer-price basis from software development vendors to OEMs and Tier-1 and Tier-2 suppliers.

Automotive applications comprise external, partner, and private applications.

External applications fall into the following categories: 1) music and audio, 2) navigation, 3) communication, 4) concierge services, 5) collecting and transmitting the vehicle's external information, 6) sharing information via smartphones and other devices, 7) telematics insurance, 8) message exchanges, and 9) miscellaneous applications.

Partner and private applications include those provided in automotive OEMs’ platform services. These applications include 1) Advanced Driver Assistance Systems (ADAS), 2) Human Machine Interface (HMI), 3) Over-the-Air (OTA) app updates, 4) remote operations and monitoring, such as remote keys, and 5) collecting and transmitting the vehicle's internal information.

The in-vehicle platform encompasses middleware, the vehicle OS, and HALs (*).

*A Hardware Abstraction Layer (HAL) sits between the hardware and software layers. It serves as a bridge by absorbing differences in each piece of hardware.

<Products and Services in the Market>

Automotive applications and platforms

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.