No.3900

Polyethylene Market in Japan: Key Research Findings 2025

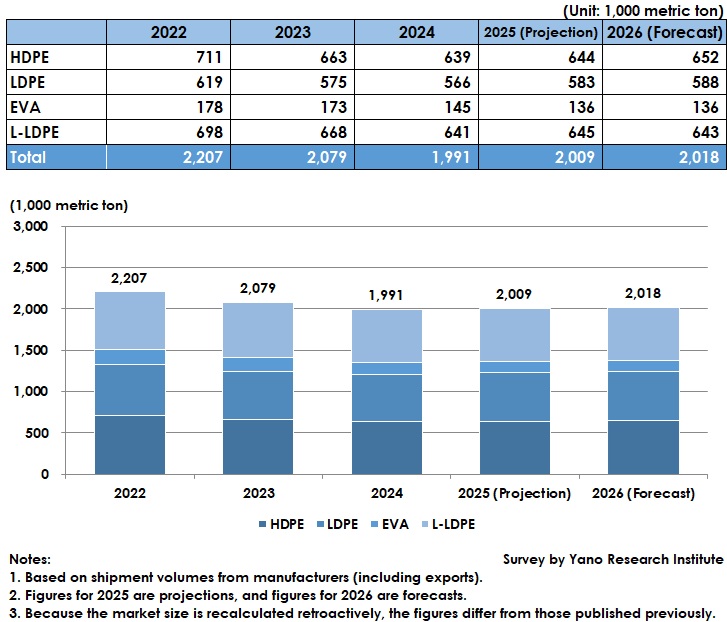

Shipment Volume of Polyethylene Projected to Attain 100.9% of Preceding Year’s Volume to 2,009,000 Metric Tons

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey of the polyethylene market in Japan, and found out the trends by type of resin, the market player trends, and future prospects.

Market Overview

Demand for polyethylene (PE) rebounded in 2021 after slumping in 2020 due to stalled economic activity during the pandemic. However, PE experienced negative growth for three years from 2022 to 2024. The influx of overseas products, coupled with consumers’ reluctance to purchase food and other items due to rising commodity prices, impacted PE demand because PE is used for food packaging and industrial materials. PE shipment volumes from domestic manufacturers (including exports) totaled 1,991,000 metric tons, which was 95.8% of the previous year's volume.

By segment, the shipment volumes overall declined in 2024. The shipment volume of HDPE fell to 639,000 tons (96.5% of the previous year), LDPE declined to 566,000 tons (98.4%), L-LDPE shrank to 641,000 tons (96.0%), and EVA dropped to 145,000 tons (83.7%). China used to be the primary export destination for EVA used in solar cell sealer applications. However, China’s shift from exporting to procuring EVA domestically led to a significant reduction in Japanese EVA shipment volume. This explains why the decline in EVA was greater than that of other resin types.

Noteworthy Topics

Sustainable PE Product Initiatives Are Gaining Momentum

Currently, very little sustainable PE (*1) is sold. With its similar domestic demand trend to PE, Polypropylene (PP) is also making slow progress to achieve sustainability. Nevertheless, demand for recycled PP is growing in anticipation of the revised European End-of-Life Vehicles Regulation, which will require automobiles to contain a certain percentage of recycled resins. Meanwhile, PE’s primary applications are food packaging and industrial materials, neither of which has regulations mandating usage ratios of sustainable materials, with a few exceptions. Consequently, PE's sustainability initiatives are delayed.

Since the sustainable PE market has not launched, sales of these products do not differ among PE manufacturers. However, business operations and efforts regarding sustainable PE will differ among manufacturers depending on their strengths and weaknesses, as various options are available, including material recycling (MR), chemical recycling (CR), and bio-PE.

For instance, PE manufacturers with brand design techniques, compound treatment technology, and technology to improve the quality of recycled materials, as well as a high-quality material procurement scheme and an alignment with a leading recycler will gain the upper hand if they choose MR.

Meanwhile, manufacturers that choose CR or bio-PE need to use a mass balance approach to receive credit. They must increase their visibility through branding to be chosen by consumers, because it will be difficult for them to differentiate themselves based on product quality and price.

PE manufacturers are starting to make themselves differ from existing recyclers in their own ways: improving their visibility by launching sustainable brands or providing added-value products through assuring and/or improving the quality of MR-PE. One manufacturer has licensed the technology for developing products from basic chemicals derived from bioethanol.

*1) In this research, sustainable PE refers to bio-PE that uses material recycling (MR), chemical recycling (CR, or biomass materials.

*2) The mass balance model is one option for chain of custody. It is often used in chemical production processes that involve the mixing of input materials of different origins and characteristics, such as recycled materials and fossil feedstocks. The model enables manufacturers to keep track of certified materials mixed into products throughout manufacturing and conversion processes using bookkeeping. Manufacturers can claim the percentage of certified materials within the end products according to the input ratio of certified materials and how they allocate the ratio of fossil feedstocks.

Future Outlook

The expected PE shipment volume from domestic manufacturers (including exports) is projected to reach 2,009,000 metric tons, which is 100.9% of the previous year's volume.

The shipment volume of PE is expected to level off or increase slightly, since the significant demand reductions in recent years have reportedly been alleviated, though the issues such as the influx of overseas products in general-purpose segments and consumers’ reluctance to purchase food and other items due to rising commodity prices have not been solved.

Research Outline

2.Research Object: Polyethylene manufacturers

3.Research Methogology: Face-to-face interviews by our specialized researchers, and literature research

What is the Polyethylene Market?

Polyethylene (PE) is a type of synthetic resin, or a polymer made by the polymerization of ethylene. This research calculates the PE market size based on shipment volumes (including exports) of high-density polyethylene (HDPE), low-density polyethylene (LDPE), linear low-density polyethylene (L-LDPE), and ethylene-vinyl acetate (EVA) from Japanese PE manufacturers.

PE is inexpensive, lightweight, and easy to process. It has a wide range of applications, including food packaging, various containers, and industrial materials.

<Products and Services in the Market>

HDPE, LDPE, EVA, Ethylene-based polymers, L-LDPE, V-LDPE, plastomer

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.