No.3982

Security Camera and System Market in Japan: Key Research Findings 2025

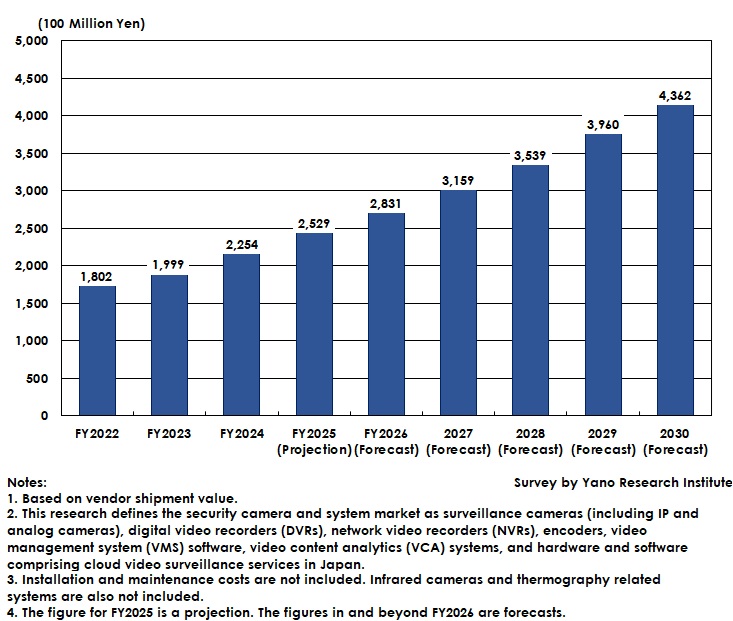

The Security Camera Market in Japan Expected to Reach 252.9 Billion Yen in FY2025, a 12.2% Increase from the Previous Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) surveyed the security camera and system market in Japan. The survey revealed the trends by item, trends of leading market players, and future market outlook.

Market Overview

Based on vendor shipment value, the domestic market size of security cameras and systems reached 225.4 billion yen in FY2024, marking a substantial 12.8% increase from the previous fiscal year. This growth was driven by AI-powered video content analysis (VCA) solutions and cloud surveillance camera systems. Beyond their traditional use in crime prevention and monitoring, these systems have become essential business infrastructure that supports the operation of commercial facilities, increases work efficiency, and improves data utilization. Deployment of edge cameras featuring AI-powered analytics has particularly expanded. This allows users to analyze footage in real time on site. Edge AI cameras have solved the latency of transmitting image signals from sources to destinations, which motivated proactive use of AI by on-site workers. Recently, incorporating AI into edge cameras has become standard rather than an advanced feature. With deeper integration with video management systems (VMS), edge cameras can integrate image management, analytics, and sharing. This is prompting major vendors to promote solutions for consolidating multiple-base operations.

Noteworthy Topics

Rapid Expansion of AI-Powered VCA Solutions and Cloud Surveillance Camera Systems

In FY2024, VCA solutions and cloud surveillance camera systems became the largest driver of the market expansion. VCA solutions expanded their applications from crime prevention and surveillance to include improving operational efficiency of facilities and enhancing company performance. Thanks to the progress in AI technology, VCA’s object detection, attribute estimation, and behavioral analytics have increased accuracy and established themselves as a core technology of video surveillance. Retail and commercial facilities use VCA solutions for marketing purposes, including counting visitors and analyzing traffic flow. Factories and the transportation sector increasingly use these solutions for safety management and operational efficiency. The configuration that aligns with edge AI cameras and the cloud enables real-time processing, which shortens the time needed for footage processing, saving electricity for the process. Meanwhile, cloud surveillance camera systems have been introduced primarily in retail and commercial facilities, small- and medium-sized offices, and public facilities. The simplicity in installation and operation, and the ease of aligning remote surveillance with AI analytics have expanded their applications from crime prevention and surveillance to include performance improvement.

In this context, software as a service (SaaS)-based recurring-revenue businesses, including cloud-based AI video analytic services, are garnering attention. To provide these services, major vendors are enhancing service features and optimizing prices. As users begin to use AI to analyze their cloud-stored footage and leverage the results to determine customer behavior in stores and facility operations, vendors are expected to earn additional revenues.

Future Outlook

Based on vendor shipment value, the domestic security camera and system market is projected to reach 252.9 billion yen in FY2025, which is a 12.2% increase from the previous fiscal year. Due to the anticipated robust growth, the market is expected to reach 436.2 billion yen by FY2030. The major driving factors continue to be VCA solutions and cloud surveillance camera systems. These systems' applications for facility operations, work efficiency, and data utilization are likely to progress further. As the source of added value shifts from hardware to software solutions, the idea of viewing footage as a marketing and work efficiency tool that contributes to management assets rather than merely as a surveillance method, is likely to proliferate.

Security cameras can be categorized as IP or analog. The deployment of IP cameras continues to expand. In FY2025, IP cameras are expected to account for 83.7% of the total domestic shipment volume of security cameras. This figure is expected to reach 89.1% by FY2030. This growth is driven by the prevalence of VCA solutions and cloud surveillance camera systems. The deployment is expanding into previously scarce areas such as schools and medical and long-term care facilities, public facilities, stores, and factories. In the future, companies that can offer consolidated solutions, optimally integrating AI, cloud, and edge AI cameras, are expected to drive market growth.

Research Outline

2.Research Object: Security camera manufacturers, distributors, system integrators, etc.

3.Research Methogology: Face-to-face interviews (including online interviews) by expert researchers, survey via telephone and email, and literature research

What is the Security Camera and System Market?

This research defines the security camera and system market as surveillance cameras (including IP and analog cameras), digital video recorders (DVRs), network video recorders (NVRs), encoders, video management system (VMS) software, video content analytics (VCA) systems, and hardware and software comprising cloud video surveillance services in Japan. Market size is calculated based on vendor shipment values. Installation and maintenance costs are not included. Infrared cameras and thermography related systems are also not included.

In this research, security cameras are categorized into two types: IP cameras and analog cameras. IP cameras, a.k.a. network cameras, have an IP address to individually connect to the Internet, making them suitable for business use. Analog cameras, on the other hand, must be physically connected to monitors and recording devices using coaxial cables. In general, analog cameras are less expensive than IP cameras.

A digital video recorder (DVR): A generic term for an electronic device that records and stores a video captured by an analog camera in a digital format on a hard disk.

A network video recorder (NVR): A generic term for an electronic device that records and stores a video captured by an IP camera in a digital format on a hard disc.

An encoder: A tool that converts video from large RAW files into streamable digital files.

A video management system/software (VMS): Software that stores and manages a video captured by a security camera on recording media.

Video content analysis (VCA): A function that digitizes various information by analyzing data from images and videos captured by cameras. VCA can include facial recognition, counting of the number of people or vehicles, and detecting moving or stationary objects, among other things. This increases work efficiency.

A cloud surveillance camera system: A service for recording and storing video from a camera in the cloud over the Internet.

<Products and Services in the Market>

Security cameras (IP and analog cameras), DVRs, NVRs, encoders, VMS, VCA systems, cloud surveillance camera systems

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.