No.3959

Online Advertising Market in Japan: Key Research Findings 2025

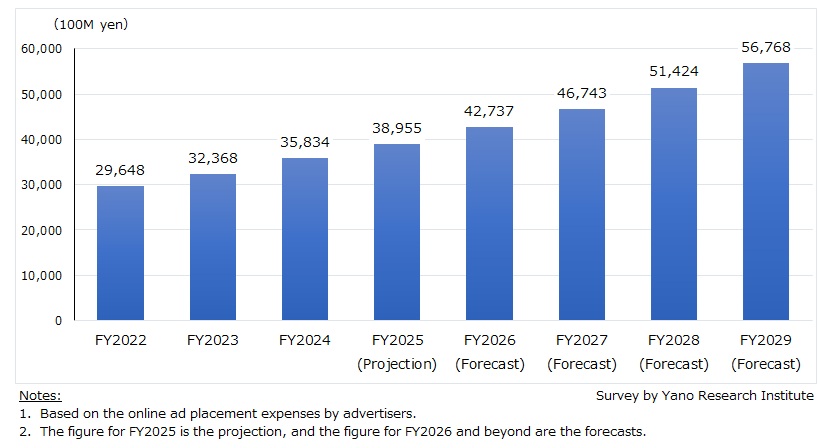

Online Advertising Market Sized at 3.6 Trillion Yen in FY2024, Expected to Reach 5.7 Trillion Yen by FY2029

Yano Research Institute (the President, Takashi Mizukoshi) has surveyed the online advertising market in Japan and has found out the current market status, the trends of market players, and the future perspectives.

Market Overview

Domestic online advertising market showed steady growth, with the market size estimated to have reached 3,583,400 million yen in FY2024 (based on the total amount of online ad placement).

Market expansion was driven by the increase in the amount of online ad placement, particularly for vertical video ads and timeline ads (advertisements that appear directly inside a user’s main scrolling feed on social media platforms).

Additionally, search advertising continues to have predominant status in the online advertising market in FY2024, marking more than 10% growth year-on-year. Favorable macroeconomic conditions and robust corporate earnings provided tailwinds in FY2024, leading to steady growth in sales and profits for listed companies. This environment saw an increase in the number of companies expanding their advertising budgets.

The domestic internet advertising market is expected to maintain steady growth in FY2025, with continued expansion in social media advertising and video advertising. Meanwhile, spending on display advertising—such as Google’s Responsive Display Ads, the displayed across Google’s affiliated external websites and apps and ads displayed on portal sites—has been declining in recent years.

This decline is influenced by a shift in consumer habits and decreased targeting accuracy due to tracking restrictions. As advertisers increasingly prioritize ROI (Return on Investment), the investment priority for traditional display ads has diminished. Consequently, advertisers are now concentrating their budget to areas where results are relatively measurable, such as search advertising, ads on social media, and video advertising.

Against these backgrounds, the pace of growth is expected to slow down moderately for FY2025. The market size is forecasted to reach 3,895,500 million yen, up by 8.7% from the previous fiscal year.

Noteworthy Topics

Changes Driven by AI Advancements

AI technology has automated and improved efficiency in creative production and ad operations (targeting and bidding) in the advertising industry. Online advertising agencies and media reps are increasingly required to deliver new added values.

Penetration of Search Generative Experience (SGE in short; AI-generated summaries appear alongside search results) is reducing website and SEO visits driven by informational query (searches aimed at gathering information).

Nonetheless, the impact on navigational queries (search queries entered with the intent to access a specific website or service) and transactional queries (search queries aimed at specific transactions or actions like purchasing products, requesting materials, or making reservations), which are highly relevant to online advertising, seems limited. At this point, direct impact of Google's SGE on advertising business is trivial.

In creative production, AI can generate large volumes of content quickly, but human oversight remains critical in maintaining quality and brand consistency. As a result, creative work will require a balanced division of roles between humans and AI. By contrast, operational tasks (such as targeting and bidding) can largely be automated, prompting humans to shift toward higher-level responsibilities like developing advertising strategies and designing frameworks for how AI should be adopted.

AI is bringing significant efficiency gains and new opportunities to the advertising industry. At the same time, it is creating new challenges: reduced website search traffic, increasing flatness in AI-generated content, growing dependence on major advertising platforms, copyright and compliance concerns associated with creative assets, and greater complexity in planning advertising strategies.

Future Outlook

Going forward, the shift from traditional mass media to online advertising is expected to gain further momentum. In particular, video ads on social platforms, such as YouTube Shorts, TikTok, and Instagram Reels, are projected to continue expanding.

Growth is also being driven by the automation of ad operations through AI. Tools like Google's P-MAX and Meta's Advantage+ are becoming widely adopted, streamlining campaign management and reducing the need for large teams or expertise. This trend is likely to encourage more small and medium-sized enterprises to enter the market as advertisers.

In the medium to long term, the expansion of retail media (where retailers monetize their e-commerce sites or apps as ad platforms) will further contribute to market growth. Demand for retail media is expected to rise steadily, driven by its ability to link ad impressions with both online and offline sales data.

Under the circumstances, the online advertising market is forecasted to grow at a CAGR of 9.6% between FY2024 and FY2029 to reach 5,676,800 million yen by FY2029.

Research Outline

2.Research Object: Online advertising agencies, media reps, DSPs for advertisers, SSPs for publishers, media, etc.

3.Research Methogology: Face-to-face and online interviews by our expert researchers (including online), and literature research

Online Advertising Market

The online advertising market size in this research has been calculated by totaling the expenses for ad placement by advertisers to various types of online media.

<Products and Services in the Market>

Programmatic advertising (search advertising, display advertising, social media advertising, video advertising), non-programmatic advertising (native advertising, tie-up advertising), advertising production cost

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.