No.3952

Retail & Ecommerce Logistics Market in Japan: Key Research Findings 2025

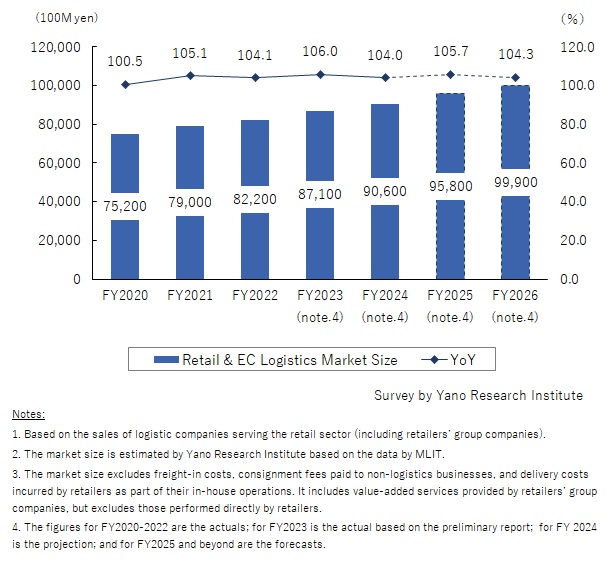

Retail & Ecommerce Logistics Market Projected to Grow by 4.0% YoY to 9.06 Trillion Yen in FY2024

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a survey on the retail and ecommerce logistics market, and found out the market overview, market player trends, and future perspectives.

Market Overview

The retail and ecommerce logistics market is projected to reach 8.71 trillion yen in FY2023, up 6.0% from the preceding fiscal year (based on the sales of logistic companies serving the retail sector). This growth outpaces the growth of retail industry, which expanded by 5.6% to 163.34 trillion yen in the same fiscal year*1.

Key drivers of market expansion include rising transportation costs stemming from higher fuel and labor expenses, and the rapid growth in last-mile logistics*1 associated with the increase of e-commerce sales ratio*2. Within retail logistics, transportation costs make up the largest share, accounting roughly 70% for e-commerce sector. The shift toward more frequent, small-lot deliveries across a wider range of products has pushed handling and transportation expenses, thereby increasing the overall retail and ecommerce logistics market.

*1. Source: METI (Ministry of Economy, Trade and Industry), “Current Survey of Commerce”; “E-Commerce Market Survey”

*2. Last-mile logistics refers to the very last step of the delivery process when a parcel is moved from a distribution hub (center) to its final destination in B2C context, and from an individual to individual in C2C context.

Noteworthy Topics

Revised Logistics Efficiency Act Changing Retailers’ Responsibility in Logistics

The business environment surrounding the retail industry is rapidly changing due to diversifying consumer needs, rising e-commerce usage rates, and the expansion of cross-border e-commerce. Additionally, truck driver shortages and rising logistics costs are becoming increasingly intense, threatening sustainable growth of logistics sector. Against these backgrounds the revised Logistics Efficiency Act* came into effect on April 1, 2025.

Conventionally, retailers have been positioned primarily as receivers of goods delivered from manufacturers and wholesalers, and their involvement in logistics has therefore been limited. Under the revised Act, however, retailers are expected to go beyond this traditional role, take on responsibilities as shippers, and actively contribute to logistics optimization. This includes improving efficiency of transportation and cargo handling, as well as securing appropriate logistics pricing and terms.

* The revised Act (Act on Advancement of Integration and Streamlining of Distribution Business) requires all retailers acting as shippers to implement “duty to endeavor” measures aimed at (1) improving loading efficiency, (2) reducing cargo waiting times, and (3) shortening cargo handling times. Furthermore, shippers that handle 90,000 tons or more of cargo annually—identified as having a significant impact on overall logistics—must prepare medium- to long-term plans and submit regular reports to the relevant authorities starting in FY2026.

Future Outlook

The retail and ecommerce logistics market is forecasted to reach 9.06 trillion yen in FY2024, up 4.0% from the preceding fiscal year (based on the sales of logistic companies serving the retail sector). This growth outpaces the retail industry itself, which expanded by 5.6% to 163.34 trillion yen. The growth rate is expected to continue outpacing real GDP growth from FY2024 to FY2026.

Rising transportation costs—driven by higher fuel and labor expenses—and the rapid growth of last-mile logistics due to increasing e-commerce penetration are evident. However, even though the retail and ecommerce logistics sector is expanding faster than the retail industry, this does not imply that distribution costs will rise as a share of each shipper's financials.

The growth of the retail and ecommerce logistics market will be driven by structural shifts in retail and ecommerce logistics sector, such as the growing ecommerce sales ratio, retailers assuming shipper responsibilities, and the wider use of centralized distribution hubs.

Research Outline

2.Research Object: Retailers, logistics companies

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), questionnaire, and literature research

Retail & Ecommerce Logistics Market

In this research, the term “retail and ecommerce logistics” is equivalent to what is often referred to as sales logistics in retail distribution, including operations performed at distribution centers (storage, cargo handling, value-added services, packaging/packing, and delivery of goods to retail stores) and at retail stores (back-of-house logistics, delivery from the store to respective customer, and delivery data management).

The market size of retail and ecommerce logistics is calculated based on the sales of logistic companies serving the retail sector (including retailers’ group companies).

Note that the market size excludes freight-in costs, consignment fees paid to non-logistics businesses, and delivery costs incurred by retailers as part of their in-house operations. It includes value-added services provided by retailers’ group companies, but excludes those performed directly by retailers. Retail sector in this study also includes non-store retailers, and the market size covers e-commerce logistics for retailers.

<Products and Services in the Market>

Operations performed at distribution centers (storage, cargo handling, value-added services, packaging/packing, and delivery of goods to retail stores), operations performed at retail stores (back-of-house logistics, delivery from the store to respective customer, and delivery data management)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.