No.3934

Health Information Systems Market in Japan: Key Research Findings 2025

The Health Information Systems Market Size Exceeded 300 Billion Yen in FY2024

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey of the domestic health information systems market. The survey revealed the market trends by segment, trends among market players, and prospects.

This paper focuses on the transition and forecast of market sizes for health information systems, including electronic medical records (EMRs) for small and medium-sized hospitals.

Market Overview

Health information systems (HIS) are used in medical institutions, including general hospitals and clinics, to improve work efficiency and facilitate communication among medical professionals. These systems consist of core systems, such as electronic medical records and medical billing, and department-specific systems, including picture archiving and communication systems (PACS), radiology information systems (RIS), and clinical testing systems. These systems are essential for achieving digitization and dramatic innovations in medical care.

In 2010, the lifting of the ban on the external storage of medical records allowed hospitals to store health information in data centers operated by private companies. This has led to the proliferation of cloud-based electronic medical records (EMRs), in addition to on-premises EMRs that require on-site servers.

Recently, generative AI has been expected to reduce the workload related to medical records, such as entering records and creating discharge summaries, which further motivates the adoption of EMRs.

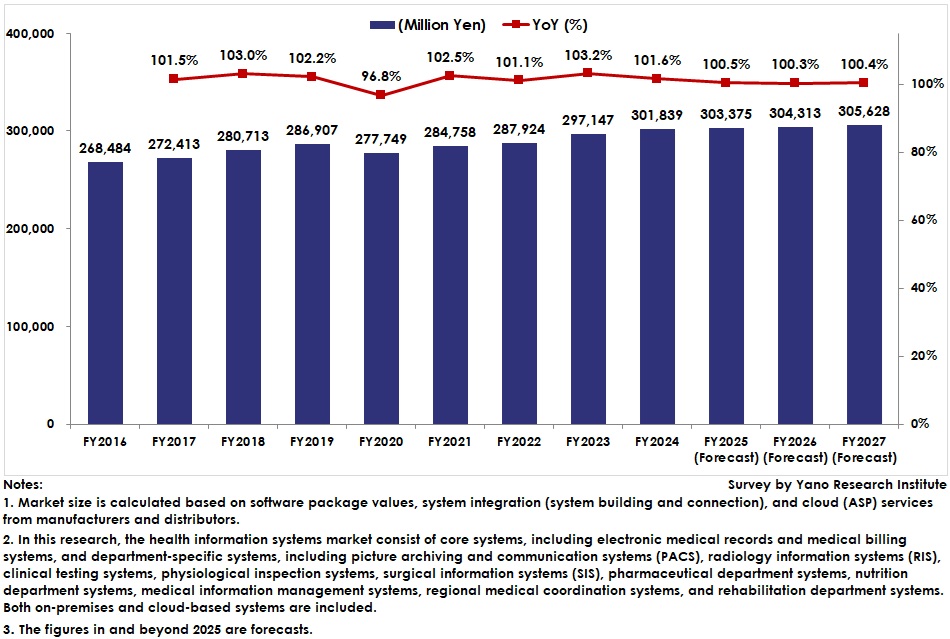

In this context, as HIS have become widespread, the HIS market has shifted from new deployments to replacements. The market grew steadily by around 2% year over year until FY2019, just before the pandemic. After shrinking by 3.2% year over year in FY2020, the market showed an upward trend in FY2021. Since then, the market has shown steady growth, reaching 301.839 billion yen by FY2024 and surpassing the 300 billion yen level.

Noteworthy Topics

Robust Increase in Cloud-Based EMR Deployments

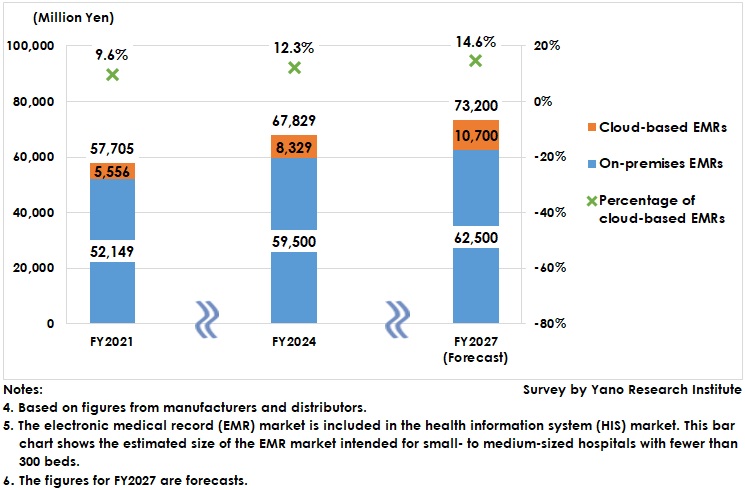

Cloud-based EMRs are contributing to EMR penetration in small and medium-sized hospitals and clinics with fewer than 300 beds.

The deployment of these EMRs is rapidly increasing in newly started clinics. According to a survey (*) of 210 clinics nationwide that opened between 2022 and 2023, 70.8% adopted cloud-based EMRs from the beginning. Deployment is also increasing among existing clinics.

Small and medium-sized hospitals with fewer than 300 beds are also adopting these EMRs, regardless of their business conditions. This is because electronic recording is essential for securing medical personnel, including doctors and nurses, and because being cloud-based reduces initial expenses and the human workload required for implementation. Recently, university hospitals have adopted cloud-based EMRs, and cloud-based EMRs intended for large hospitals have been launched.

In this context, the market for EMRs targeting small- and medium-sized hospitals is estimated at 67.829 billion yen in FY2024. This figure is expected to reach 73.2 billion yen by FY2027. Cloud-based EMRs are expected to account for 12.3% (8.329 billion yen) in FY2024 and 14.6% (10.7 billion yen) in FY2027.

*) Please see the press release “Corporate Questionnaire to Newly Started Clinics in Japan: Key Research Findings 2024” announced on 10/11/2024.

Future Outlook

Demand for replacements continues to outpace new implementations in many core and department-specific systems in health information systems. Additionally, the recent update frequency has reportedly decreased to around eight years, which could negatively impact the market. Consequently, the HIS market is expected to experience low growth of less than 1.0% year over year in and beyond FY2025.

The status of HIS cloud migration varies by system and target facility. Many system vendors offer EMR systems targeting general clinics and small- to medium-sized hospitals, which has led to a steady increase in deployments. However, there are few vendors offering EMRs for large hospitals. Therefore, full-scale adoption is not expected until around FY2030.

The emergence and adoption of peripheral services and systems surrounding HIS may significantly impact business models of HIS, particularly EMRs. These services and systems include generative AIs, commercial smartphone apps, reservations and inquiries, and personal health records (PHRs).

Some EMR vendors have started cross-selling these services while others have begun offering them as standard features. Given the high expectations for generative AIs to improve health record-related work efficiency, EMRs and generative AIs are expected to become inseparable.

Research Outline

2.Research Object: Domestic medical information system vendors

3.Research Methogology: Face-to-face interviews (including online interviews) by expert researchers and literature research.

What are Health Information Systems (HIS)?

HIS refer to all kinds of systems that increase work efficiency and facilitate communication among medical professionals in institutions, such as general hospitals and clinics. HIS include electronic medical records (EMRs) and electronic health records (EHRs). Core systems include EMRs, ordering systems, and medical billing systems. Department-specific systems include radiology and clinical testing systems. The specific systems vary among medical institutions according to the facility size and the system needs.

What is the HIS Market?

In this research, the HIS market consist of core systems and department-specific systems. Core systems include EMRs and medical billing systems. Department-specific systems include picture archiving and communication systems (PACS), radiology information systems (RIS), clinical testing systems, physiological inspection systems, surgical information systems (SIS), pharmaceutical department systems, nutrition department systems, medical information management systems, regional medical coordination systems, and rehabilitation department systems. Both on-premises and cloud-based systems are included.

Market size is calculated based on software package values, system integration (system building and connection), and cloud (ASP) services from manufacturers and distributors.

What is the Electronic Medical Record (EMR) Market?

According to the Ministry of Health, Labor and Welfare's “Survey of Medical Institutions,” medical institutions are categorized as general hospitals, psychiatric hospitals, medical clinics, and dental clinics.

For this research, the EMR market was calculated by institution type: large general hospitals (with 300 or more beds), medium-to-small general hospitals (with fewer than 300 beds), psychiatric hospitals, and medical clinics.

For more information, please see the press release, “Health Information System (HIS) Peripherals Market in Japan: Key Research Findings 2025” released on 19 December 2025.

https://www.yanoresearch.com/en/press-release/show/press_id/3979

We have prepared “Health Information Systems (EMR/EHR) Market 2025: Excerpt Edition (in Japanese language),” published on 26 September 2025. This report provides an excerpt on the EMR and EHR market among health information systems.

https://www.yanoresearch.com/market_reports/C67117700?class_english_code=9

<Products and Services in the Market>

On-premises and cloud-based health information systems for general hospitals, psychiatric hospitals, medical clinics

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.