No.3920

Global Alternative Protein Market: Key Research Findings 2025

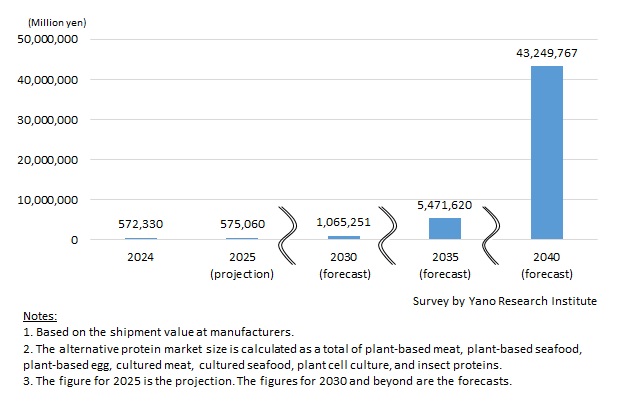

Global Alternative Protein Market (Plant-Based Meat, Plant-Based Seafood, Plant-Based Egg, Cultured Meat, Cultured Seafood, Plant Cell-Cultured Foods, and Insect Proteins) Valued at 572,330 Million Yen in 2024

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the global market of alternative proteins (plant-based meat, plant-based seafood, plant-based egg, cultured meat, cultured seafood, plant cell-cultured foods, and insect proteins), and found out the current status, market player trends, and future perspectives.

Market Overview

The global alternative protein market (plant-based meat, plant-based seafood, plant-based egg, cultured meat, cultured seafood, plant cell-culture foods, and insect proteins) is estimated at 572,330 million yen in 2024, based on the shipment value of manufacturers.

With the global population continuing to rise, demand for meat is expected to grow accordingly. Conventional meat production is increasingly constrained by its significant environmental footprint, including high emissions and intensive resource use. Geopolitical instability has further heightened food supply risks and driven up prices, making food security a critical global concern.

In this context, alternative proteins such as plant-based products, cultured (lab-grown) meat, and insect proteins are attracting greater attention. From the standpoint of marine resource sustainability, development of plant-based and cultured seafood is also advancing.

More recently, new categories such as plant-based eggs and plant cell-culture food like coffee and cacao, have emerged as a part of efforts to establish sustainable production technologies.

Noteworthy Topics

Plant-based Meat & Seafood Market: Sustainable Food Production Continues to Garner Attention

Among plant-derived protein products, plant-based meat continues to attract strong interest due to lower environmental impact and its role in supporting dietary diversity. In addition to being viewed as more sustainable than conventional meat production (requiring less water and generating fewer greenhouse gas emissions) market growth is supported by rising global food demand, greater health consciousness, and increasing acceptance of diverse dietary choices.

Market expansion for plant-based meat and plant-based seafood initially took off in Europe and the United States. In Japan, “alternative meat” began gaining attention in the late 2010s. As product taste improved, distribution broadened across major retailers and restaurant chains worldwide. Increased media exposure, new product launches, and expanding product lines further boosted consumer awareness.

Growing concerns over environmental issues, climate change, and animal welfare have also accelerated adoption. In particular, younger consumers are driving diversification in dietary patterns, including vegan and vegetarian lifestyles. In response to these trends, plant-based protein applications now span a wide range, including alternative meat, seafood, eggs, and dairy.

While the market environment is stabilizing in 2025, worsening climate issues have further heightened interest in sustainable food production. At the same time, companies are advancing technologies to improve the taste and texture of plant-based meat, including masking technologies that replicate meat-like flavor by reducing the characteristic aroma of soybeans. In Japan, manufacturers are enhancing flavor and mouthfeel by pairing plant-based meat with plant-based dashi and seasonings, and are also developing new taste profiles and recipes for alternative proteins to improve overall consumer satisfaction.

Future Outlook

The sharp rise in livestock product prices has triggered dramatic increases in the prices of meat and eggs—phenomena widely referred to as the “meat shock” and “egg shock.” The meat shock was driven by multiple factors, including soaring feed costs, the spread of infectious diseases, yen depreciation, rising logistics expenses, and labor shortages in food processing and distribution. Meanwhile, the egg shock stemmed from outbreaks of avian influenza, elevated feed prices, and heat among hens during extreme heat in summer.

These supply-driven price surges are significantly affecting both consumers and business users such as restaurants. Although protein shortages relative to global population growth have long been a concern, the added strain of climate-related disruptions to livestock production presents a new challenge for ensuring stable food supply.

Furthermore, declining fish catches—due to changes in fish habitats caused by ocean warming—are creating further supply pressures. To supplement traditional livestock production and fisheries, alternative protein sources like plant-based foods (plant-based meat, plant-based seafood, and plant-derived eggs), cultured meat, cultured seafood, coffee and cacao made with cultured plant cell, and insect protein are gaining attention as potential contributors to a more sustainable and resilient food system.

The global market size for alternative proteins (including plant-based meat, plant-based seafood, plant-based eggs, cultured meat, cultured seafood, plant cell-cultured foods, and insect protein) is projected to reach 1,065,251 million yen by 2030, based on the shipment value of manufacturers.* Going forward, the market is expected to continue expanding to reach 5,471,620 million yen by 2035 and 43,249,767 million yen by 2040.

*The market size does not include insect protein for animal feed applications.

Research Outline

2.Research Object: Enterprises pertaining to business of alternative proteins (plant-based meat, plant-based seafood, plant-based egg, cultured meat, cultured seafood, plant cell culture, and insect proteins) and related associations

3.Research Methogology: Face-to-face interviews by our expert researchers, survey via telephone and email, and literature research

In this survey, the alternative protein market includes plant-based meat, plant-based seafood, plant-based egg, cultured meat, cultured seafood, plant cell-culture foods, and insect proteins.

Plant-based meat and plant-based seafood are produced with proteins extracted from legumes, vegetables, and other plant resources, which are then processed (e.g., heating, cooling, pressurizing) to replicate the taste and texture of conventional meat or seafood.

Plant-based egg products similarly use plant-derived ingredients to mimic the taste, texture, and appearance of hen-laid eggs.

Cultured meat and cultured seafood are made from animal cells grown in controlled environments. Since the first commercial launch in Singapore in December 2020, cultured meat has been approved also in the United States, Israel, and Hong Kong, while other countries remain in the R&D stage. (In the UK, cultured meat is approved as pet food but not yet for human consumption.) Cultured seafood entered in the U.S. market in June 2025, while it remains under development elsewhere.

Plant cell-cultured foods refer to products such as coffee and cacao produced from cultured plant cells.

Insect-protein products in the scope of market size is limited to foods for human consumption; applications in animal feed, fertilizers, and pet foods are excluded.

<Products and Services in the Market>

Alternative protein products (plant-based meat, plant-based seafood, plant-based egg, cultured meat, cultured seafood, plant cell-cultured foods, and insect proteins)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.