No.3915

Automotive Aftermarket in Japan: Key Research Findings 2025

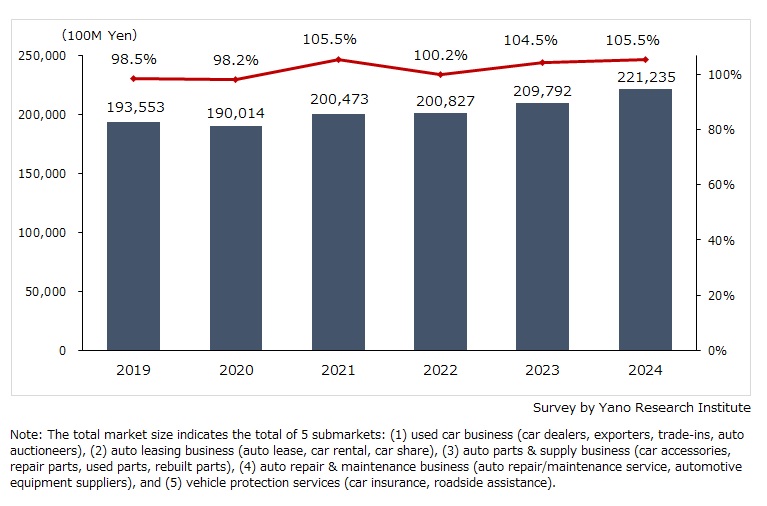

Automotive Aftermarket in 2024 Valued at 22,123,500 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey on the automotive aftermarket industry in 2024, and found out the trend by segment, the trends of market players, and future perspectives.

Market Overview

In 2024, the automotive aftermarket market was valued at 22,123,500 million yen, marking a 5.5% increase over the previous year.The decline in the number of new car sales in Japan—due to the safety test scandals involving multiple automakers—has negatively impacted every segment of the automotive aftermarket. (Source: Japan Automobile Dealers Association, Zenkeijikyo)Meanwhile, soaring retail price of used cars, as well as car supplies/parts and fees for peripheral services including auto lease and car repair have expanded the automotive aftermarket. Moreover, the increasing average age of vehicles, the inclination to retain cars for extended periods, and the growing need for transportation options like auto lease, car rentals, and car sharing—stemming from shifts in consumer perceptions—have fueled market expansion.As of the end of 2024, the number of vehicles owned in Japan was 78,970,000 units, showing slight decline from the previous year (Source: Ministry of Land, Infrastructure, Transportation, and Tourism [MLIT], Transportation Statistics Annual Report). Owing to the extension of vehicle lifespan and fewer older drivers voluntarily giving up driving, the number of vehicles owned has been static in the last few years. However, in the medium to long term, the number of vehicles owned is forecasted to decrease due to factors such as population decline, urbanization, shifts in the vehicle usage environment, and structural changes.

Noteworthy Topics

Domestic Used Car Retail Sales Grew to 4,449,200 Million Yen

Used car retail sales slumped in 2024 due to persistent inventory crunch (stock shortage at used car dealerships) due to recent annual lows in new-vehicle sales. Additionally, escalating global demand for used cars tightened the supply situation further, rising the used car prices. The domestic used car sales in 2024 amounted to 4,449,200 million yen.

In anticipation of a medium- to long-term decline in new-car sales volumes, auto makers and their franchise dealerships are making their way into aftermarket domain, including used-car sales.

On the other hand, independent car dealers are reinforcing used car sales and peripheral services at new large-scale dealerships.

Competition in used car sales is intensifying with different market participants involved, including Service Station (SS) businesses and car supply retailers. Small and medium-sized used car dealerships that do not have significant financial resources are experiencing difficulties in obtaining vehicle inventory and hiring employees.

Meanwhile, the popularity of “Used in Japan” vehicles as well as the weak yen that has eased overseas buyers to procure such vehicles have fueled used car exports. The number of used cars exported from Japan in 2024 was 1,573,000, up by 1.9% from the previous year. (Source: Ministry of Finance [MOF], Trade Statistics)

Future Outlook

The automotive aftermarket is influenced by major shifts in the global automobile industry, most notably the transition toward electric and smart vehicles, alongside growing geopolitical tensions and conflicts. In Japan, the market also faces distinct societal changes, including a shift from ownership to usership, a shrinking driver population driven by low birthrates and aging society, and persistent labor shortages in vehicle maintenance and dealership sectors.

Looking ahead, car ownership is expected to continue declining over the medium to long term. As these shifts unfold, companies in the automotive aftermarket will need to adapt their business models and strategies to stay competitive in an evolving market environment.

Research Outline

2.Research Object: Companies and groups in automotive aftermarket business and competent authorities

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey via telephone and email, and literature research

What is the Automotive Aftermarket Industry?

Automotive aftermarket in this research indicates the following five segments: (1) Used car business (car dealers, exporters, trade-ins, auto auctioneers), (2) auto leasing business (auto lease, car rental, car share), (3)auto parts & supply business (car accessories, repair parts, used parts, rebuilt parts), (4) auto repair & maintenance business (auto repair/maintenance service, automotive equipment suppliers), and (5) vehicle protection services (car insurance, roadside assistance).

The automotive aftermarket size is estimated by Yano Research Institute based on the publicized data.

<Products and Services in the Market>

New cars, used cars, used car export, auto auction, one-off bidding (“nyu-satsu kai”), auto lease, auto lease for individuals, lease maintenance, car financing, car rental, care share, car subscription, car supplies, tires, aluminum wheels, car stereos, GPS navigation systems, drive recorders (dashcams), car interior accessories, oils/solvents, genuine parts, JAPA recommended parts (JAPA: Japan Automotive Parts Association), repair parts, recycled parts, reused parts, rebuilt parts, car repair, vehicle inspection, periodic maintenance, collision repair, prepaid maintenance plans, car inspection equipment, car insurance, compulsory automobile liability insurance, voluntary insurance, direct non-life insurance, roadside assistance, gasoline, self-service fueling

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.