No.3849

Character Business in Japan: Key Research Findings 2025

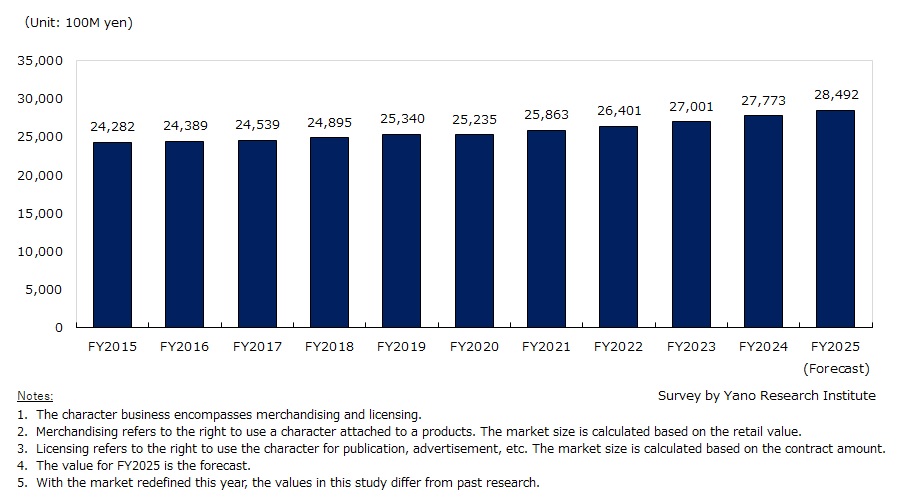

Character Business Market Forecasted to Expand to 2,849,200 Million Yen in FY2025, 102.6% from Preceding Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the character business market in Japan, and found out the market size transition by segment, the character trends, and future perspectives.

Market Overview

The character business market size (merchandising, licensing) in FY2024 was estimated at 2,777,300 million yen, up 2.9 percent from the preceding fiscal year. The business of merchandising and licensing characters was driven by the popularity of adorable little characters (referred to as “fancy” characters in Japan) such as "Chiikawa" and Sanrio characters (“Hello Kitty,” “My Melody,” and “Cinnamoroll”), as well as by the success of media-mix approach* for manga characters of “Dragon Ball,” “Jujutsu Kaisen,” and “Haikyuu!!”.

*In this survey, the “media-mix approach” indicates the utilization of fictional characters protected by intellectual property rights ("IP content") through multiple forms of media, such as anime, games, manga, and novel, for the purpose of increasing character recognition.

Noteworthy Topics

Reimagining Store Format and Expanding Sales Channels

In recent years, character specialty stores have increasingly reimagined their store formats, offering the same characters but within new concepts and themes. This new store format strategy enables broader product ranges, and develop merchandise more deeply tailored to the store’s unique theme. Moreover, the trend of combining product sales with experiential services is gaining traction across the market. For example, karaoke chains are actively launching character-collaboration rooms while selling related merchandise. Against this backdrop, sales channels for character goods are expected to continue expanding.

Future Outlook

The market size of character business (merchandising and licensing) in FY2025 is projected to reach 2,849,200 million yen, representing 102.6% of the previous fiscal year. Ongoing efforts by rights holders (IP holders/licensors) to deepen customer engagement and build touchpoints between consumers and characters are expected to drive both product development and character recognition. In terms of media-mix initiatives, airing short animations of “adorable” characters within television programs is increasing. This is likely to further boost character visibility and stimulate product development.

Research Outline

2.Research Object: Businesses related to character business; manufacturers and wholesalers (IP holders, licensors, agents, licensees), retailers, distributors, etc.

3.Research Methogology: Face-to-face interviews (including online) by our expert researchers, surveys via telephone & email, questionnaire, and literature research

Character Business in Japan

Character business in this research refers to merchandising and licensing of “characters”. Licensors allow licensees to use their copyrighted characters to make character merchandises, use them for advertising and promotion, as well as to develop into movies, television programs, and manga.

“Characters” in this research consist of fictional characters in anime titles, manga, games and illustrations. Celebrities and entertainers (non-fictional characters) are not included.

<Products and Services in the Market>

Character merchandises, character licensing

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.