No.3880

Rice Business in Japan: Key Research Findings 2025

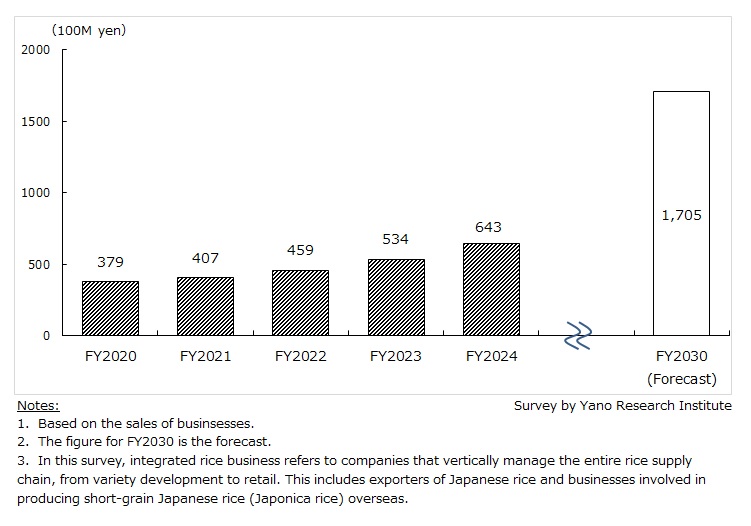

Japanese Rice (Short Grain Variety) Demand Expands with Popularity of Japanese Cuisine: Integrated Rice Business Market Forecasted to Reach 170,500 Million Yen by FY2030

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the market of integrated rice business (companies that vertically manage the entire rice business, from variety development and production to processing, distribution, and retail), and product and services related to rice (beverages, condiments, healthy functional rice, rice-based materials, processed rice, non-food rice, etc.) and found out the trends by segment and market player, as well as future perspectives. This press release denotes the transition and forecasts on the integrated rice business market size.

Market Overview

Today, Japan’s rice market is at a transitional stage from both supply and demand perspectives. Concerns over production shortages are becoming a reality, as the reduction in cultivated area and global warming are leading to more frequent crop failures. Rice production now faces an urgent need for technological innovation and climate change countermeasures.

On demand side, efforts are underway to develop heat-tolerant and pest-resistant varieties. At the same time, other initiatives are drawing attention. From an environmental perspective, Direct Air Capture (DAC) technology is being applied to paddy fields to capture more carbon dioxide. From the standpoint of labor shortages, direct seeding—a method of sowing rice seeds directly in the field rather than transplanting seedlings from a nursery—is being adopted.

On the other hand, demand is growing, with Japanese rice consumption increasing overseas. Innovations are also emerging in rice-based products, not only in food sector (such as healthy functional rice, cooked and dry packed rice, rice oil, and rice flour), but also in non-food applications, including skincare products, biomass plastics, and rice bran oil inks.

Japanese cuisine (washoku) has gained worldwide recognition, even being designated as an Intangible Cultural Heritage for its exquisite presentation and attention to detail. The growing popularity of Japanese food is a major driver of overseas demand for Japanese rice. According to a survey by the Ministry of Agriculture, Forestry and Fisheries, the number of Japanese restaurants overseas reached around 187,000 in 2023, with numbers still on the rise.

According to the Ministry of Finance’s Trade Statistics, the top three export destinations for Japanese rice in 2024, by both value and volume, were Hong Kong, the United States, and Singapore. Demand is particularly increasing in Asian countries, in line with increasing income levels.

Against this backdrop, the integrated rice business market (based on the sales of businesses) is projected to grow 20.4% year-on-year, reaching 64,300 million yen in FY2024.

Noteworthy Topics

Milling Technology and Expanding Applications Boost Demand for Rice Flour

Although rice flour has seen cycles of boom and decline, demand has steadily grown in recent years, driven by its diversifying applications.

This growth has been supported by advances in milling technology. Techniques that enhance particle size control and stabilize quality (reducing starch damage, etc.) have been introduced, including pneumatic grinding, which uses high-velocity air and particle collisions, and roller milling, which crushes grains with rollers in a controlled manner.

These innovations have expanded the use of rice flour into new applications, such as bread and Western-style confectionery. Today, rice flour is available in a wide variety of products tailored to specific applications, such as bread mix blended with wheat gluten and flours made from glutinous rice.

Future Outlook

Rice’s versatility is expected to sustain its role as a core ingredient in Japanese agriculture and food culture. Demand for Japanese short-grain rice is expected to expand not only across Asia but also in Western markets such as the United States, Canada, Australia, Germany, and the United Kingdom, where Japanese cuisine continues to gain popularity. The integrated rice business market is forecasted to grow to 170,500 million yen by FY2030, reaching 265.2% of its size in FY2024.

Research Outline

2.Research Object: Rice wholesalers, manufacturers (of processed rice, rice oil, rice flour, rice gel, healthy functional rice, beverages, and functional food), governing authorities, industry associations, etc.

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey via telephone, questionnaire, and literature research

What is the Integrated Rice Business?

In this survey, integrated rice business refers to companies that vertically manage the entire rice supply chain, from variety development and production to processing, distribution, and retail. This includes exporters of Japanese rice and businesses involved in producing short-grain Japanese rice (Japonica rice) overseas.

<Products and Services in the Market>

[Integrated rice business] companies that vertically manage the entire rice business, from variety development and production to processing, distribution, and retail; [Products and services related to rice] Beverages, condiments (Amazake, Sake, Mirin), healthy functional rice, rice-based materials (cooked and dry packed rice, rice oil, rice flour), processed rice (frozen rice dishes, aseptically packaged rice, retort rice dishes, rice snacks/sweets, packed mochi [rice cake]), non-food rice (for skincare products, rice resins)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.