No.3868

Online Retailing Market in Japan: Key Research Findings 2025

Majority of B2C Online Retailers Focused on “Email marketing (Including Email Newsletter)” as Their CRM Strategy in FY2024

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic online retailing (primarily B2C product sales), and found out the trends by product, service segment, and market player. This press release announces our findings from corporate questionnaire to domestic B2C online retailing businesses, highlighting their key focus areas in marketing (specifically, customer acquisition strategy, customer relationship management, consumer convenience improvements [website usability], and AI utilization).

Summary of Research Findings

According to the "Market Survey on E-commerce for FY2023" by the Ministry of Economy, Trade, and Industry, the size of the B2C e-commerce market for merchandise sales, services, and digital services reached 24,843,500 million yen in 2023 (109.2% of preceding year), of which product sales represented 14,676,000 million yen (104.8% on the same basis). The product sales segment, with EC ratio of 9.38% (an increase of 0.25 percentage points from the previous year), showed steady growth, though at a slower pace than in 2020 and 2021, when demand surged due to the spread of COVID-19.

The online retailing market has continued to perform well, with companies offering food subscription services and those operating online supermarkets seeing strong sales growth. According to the data from the Ministry of Economy, Trade, and Industry (METI)*, the EC ratio for "food and beverages (including alcoholic beverages)" was 4.29% in 2023 (an increase of 0.13 percentage points year-on-year), which is relatively low compared to other product categories. However, the B2C e-commerce market size for this sector reached 2,929,900 million yen in 2023 (106.5% year-on-year), showing steady expansion and nearing the 3 trillion-yen mark. The food sector in e-commerce continues to grow, particularly through online supermarkets. The use of subscription services tailored to consumer lifestyles is also on the rise. Given these circumstances, this area still holds significant potential and is expected to continue expanding.

*Source: "Market Survey on E-commerce for Fiscal Year 2023", METI

Noteworthy Topics

Corporate Questionnaire to Domestic Online Retailers on Key Focus Areas

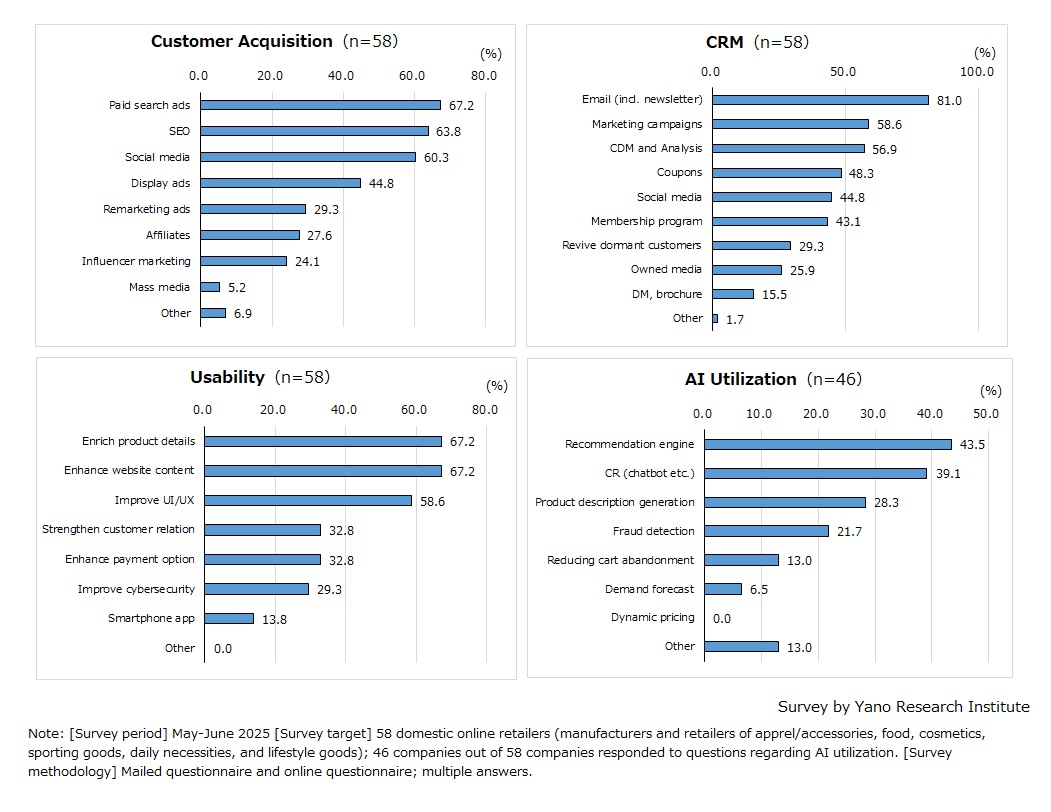

In relation to the main survey, we conducted a corporate questionnaire to 58 domestic e-commerce site operators (manufacturers and retailers in categories such as apparel, accessories, food, cosmetics, sporting goods, daily necessities, and lifestyle goods) from May to June 2025, to find out their key focus areas for online retail operations in FY2024 (with multiple responses allowed). The focus areas include customer acquisition strategy and customer relationship management, consumer convenience (website usability), and the use of AI. Below we share some of our analyses. Note that regarding the use of AI, the survey includes responses from 46 of the 58 companies that responded.

<Customer Acquisition>

When asked about their customer acquisition strategy (multiple answers allowed), 67.2% said they opt for "Paid search ads", followed by "SEO" (63.8%) and "Social media" (60.3%). As to “Other” which followed a free-text response, one company mentioned "Taxi TV ads".

<Customer Relationship Management>

In response to the questions about customer relationship management (multiple answers allowed), strikingly high percentage of respondents chose "retention emails (including email newsletters)" (81%), followed by more than half choosing "marketing campaigns" (58.6%) and "customer data management and analysis" (56.9%). "Utilize social media" ranked fifth, while it ranked third for customer acquisition. The result indicates that whereas social media is used for attracting potential customers, conventional measures such as email newsletters are preferred in customer relationship management.

<Website Usability>

For user convenience (website usability; multiple answers allowed), nearly 70% of respondents selected "Enrich product details" (67.2%) and "Enhance website content" (67.2%), followed by "Improve User Interface (UI) /User Experience (UX)"* (58.6%). By contrast, only 13.8% of respondents indicated initiatives involving the development or utilization of smartphone apps. These results suggest that, as of FY2024, content enhancements (including product details) and UI/UX improvements remain the primary focus areas for online retailers.

<Use of AI>

In terms of AI utilization (multiple responses allowed), “Recommendation engine” was most selected by respondents (43.5%), followed by “Customer relations (such as chatbots)” (39.1%). Additionally, almost 3 out of 10 chose “Product description generation” (28.3%). These results suggest that, as of FY2024, use of AI in demand forecasting remains limited among online retailers, reflecting ongoing concerns over accuracy.

*User interface (UI) refers to visual elements (e.g., buttons, layouts) of a website, while user experience (UX) encompasses user interaction and overall satisfaction.

Research Outline

2.Research Object: Online retailing businesses

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), surveys via telephone, questionnaire, and literature research

In this research, the online retailing market encompasses B2C business in the form of e-commerce, mainly selling merchandises, services, and digital services.

We have conducted a corporate questionnaire from May to June 2025, to 58 online retailers (manufacturers and retailers of apparel, accessories, food, cosmetics, sporting goods, daily necessities, and lifestyle goods) to get a clear picture of key marketing initiatives they have taken in FY2024. This press release shares some of our findings, specifically focusing on their strategies for customer acquisition, customer relationship management, e-commerce site improvements, and the use of AI. It is worth noting that while 58 companies participated in the overall survey, only 46 provided responses on questions about AI utilization.

<Products and Services in the Market>

【Product sales 】 1) GMS (mail order, catalog order, shopping channel, department store, GMS, CVS) 2) Home Appliances, Personal Computers, Peripheral Products 3) Books, Films, Music Products 4) Food, Beverages, Alcoholic Beverages, Health foods, 5) Pharmaceutical, Cosmetics Products 6) Furniture, Interior, Miscellaneous Goods, Daily Necessities 7) Apparel, Accessories 8) Sporting Goods 9) Automobiles, Motorbikes, Parts 【Services】 10) Accommodations, Travel Services, Transportation 11) Food Services, 12) Entertainment-Tickets Reservation Services 13) Financial Services (Online Banking and Electronic Securities) 14) Online-Only Life Insurance, 15) Hair Salon, Barber, Aesthetics-related Services 16) Food Delivery Services 【Digital Services】 17) Electronic Books (Books and Magazines) 18) Paid Music Streaming 19) Paid Video Streaming 20) Online Games

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.