No.3301

eKYC & Identity Verification Solution Market in Japan: Key Research Findings 2023

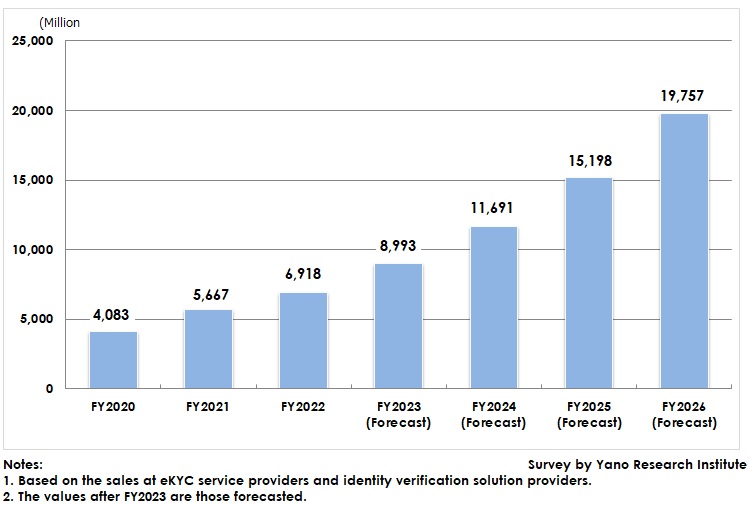

eKYC & Identity Verification Solution Market for FY2022 Generated 6,918 Million Yen, 122.1% on YoY

Yano Research Institute (the President, Takashi Mizukoshi) carried out research on the domestic eKYC (electronic Know Your Customer) & identity verification solution market, and found out the status, the trends of market players, and future perspectives.

Market Overview

eKYC (electronic Know Your Customer) is a digitized online solution for confirming the identification of clients in a non-face-to-face manner. Triggered by the amendment to the Act on Prevention of Transfer of Criminal Proceeds in November 2018, deployment of the service has been considered mainly at financial institutions, and now the introduction has spread to almost half of all banks.

The identity verification solution is the means to confirm identity by utilizing eKYC verified identity information under the laws and regulations such as the Act on Prevention of Transfer of Criminal Proceeds and the Mobile Phone Improper Use Prevention Act, enabling to simplify the identity verification procedures and to verify the customer continuously. The solution, therefore, is regarded as a promising area to expand the eKYC market, attracting increasing numbers of eKYC businesses to try handling it.

The domestic eKYC & identity verification solution market for FY2022 has generated 6,918 million yen (based on the sales at businesses), 122.1 percent of the size in the previous fiscal year.

Noteworthy Topics

Expanded Use of Public Identity Verification and Influence on eKYC Market

In online identity verification, use of public identity verification that is stipulated in Act on Prevention of Transfer of Criminal Proceeds has been increasing. The number of My Number Card issued is 87 million as of the end of April 2023, which applies to 69.8% of the population.

Public identity verification is the method that utilize the electronic authentication function of My Number Card, which can be done by reading the IC chip of My Number Card by a smartphone. As the IC chip is difficult to counterfeit, the method is expected also from the fraud prevention aspect.

Health insurance cards and driver’s licenses that have been conventionally used for identity confirmation are announced to be integrated into My Number Card hereafter. As public identity verification is assumed to become the center of eKYC for the future, the policies at eKYC businesses and how companies introducing eKYC solutions respond to public identity verification are attracting attention.

Future Outlook

The eKYC & identity verification solution market size for FY2026 is expected to reach 19,757 million yen.

Financial institutions are expected to continue deploying and utilizing eKYC services: All the city banks have finished or have determined the deployment; 36 of total 62 regional banks, and 18 of total 37 member banks of the Second Association of Regional Banks have already deployed eKYC (both as of end of May 2023), and the rest of the banks is expected to deploy the service one after another.

At financial institutions, use of eKYC can expand in various procedures. While identity verification is currently used for initiation of transactions at opening of an account, there are moves to expand using of this function to other areas. As banks tend to shift their face-to-face transactions to online, increasing number of banks is considering the use of eKYC for online procedures to modify addresses, telephone numbers, etc.

Research Outline

2.Research Object: eKYC service vendors, telecommunication businesses

3.Research Methogology: Face-to-face interviews by expert researchers (including online), survey via telephone, and literature research

The eKYC & Identity Verification Solution Market

eKYC is the abbreviation of electronic Know Your Customer which is digitized online procedures to legitimately confirm the client identification in a non-face-to-face manner. It is to conform to the amended Act on Prevention of Transfer of Criminal Proceeds (the amendment effective since November 2018), allowing the identity confirmation method to be completely online without the need of mailing and other procedures.

By referring to and confirming the eKYC verified identity information in accordance with laws and regulations such as the Act on Prevention of Transfer of Criminal Proceeds and the Mobile Phone Improper Use Prevention Act, it is possible to simplify identity verification procedures when using the identity confirmation service at another location or can continuously verify the client identity. The identity verification solution in this research refers to the solution that verifies identity by utilizing the eKYC verified identity information.

The size of the eKYC & identity verification solution market in this research is calculated based on the sales of the business in question at eKYC service providers and identity verification solution providers.

<Products and Services in the Market>

eKYC, public identity verification, identity verification

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.