No.3290

Cosmetics OEM Market in Japan: Key Research Findings 2023

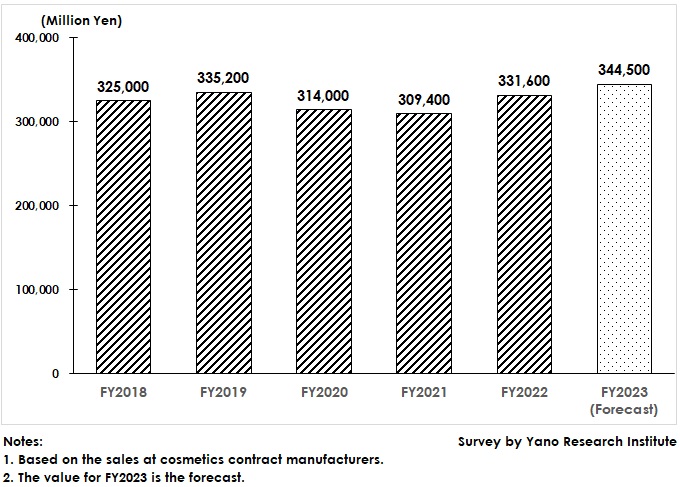

Cosmetics Contract Manufacturing Market for FY2022 Rose to 331,600 Million Yen, 107.2% on YoY

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic cosmetics contract manufacturing market and found out the status, trend of market players, and future outlook.

Market Overview

The FY2022 domestic cosmetics contract manufacturing market, based on the sales at businesses, grew for the first time in two years since affected by the pandemic in FY2020, reaching 331,600 million yen, 107.2% of the previous year.

FY2022 saw obvious increase in opportunities to go out and in flow of people in the city, due to eased behavioral restrictions. Furthermore, the progress in the moves to encourage inbound demand through acceptance of travelers from overseas after October triggered the domestic cosmetics market to recover.

Noteworthy Topics

Recovery from Fallen Consumption Caused by Lockdown Expected for Chinese Cosmetics Market

The Chinese government locked down cities in March 2022 as the coronavirus infections expanded. This diminished local consumption, which, in tandem with the revisions in regulations for cosmetics management in China, substantially impacted the product sales at foreign cosmetics manufacturers as well as Japanese.

Lift of zero-COVID policy in 2023 has improved local consumption to go on the gradual recovery. Continuous growth of local brand manufacturers (local Chinese companies) is encouraging Japanese cosmetics contract manufacturers to do the sales activities.

Future Outlook

The domestic cosmetics contract manufacturing market for FY2023 is projected to increase to 103.9% on a YoY basis to reach 344,500 million yen, exceeding the pre-corona level.

The cosmetic market is expected to show a full-scale recovery, due to reviving flow of people stemming from eased behavioral restrictions, expanding demand for makeup as masks not required anymore, and resurge of inbound tourism demand. Backed by such market statuses, the business size for new and renewed orders to contract manufacturers by brand manufacturers and the frequency of such orders are expected to increase. On the other hand, however, cosmetics contract manufacturers, after having made efforts not to raise prices, seem to embark on price revisions due to soaring costs for raw materials, materials for containers and packaging, fuel and light, and logistics. The cosmetics contract manufacturing market is projected to expand to 368,800 million yen by FY2027, 111.2% of the size in FY2022.

Research Outline

2.Research Object: Contract manufacturers of cosmetics, companies in the business of cosmetics containers and raw materials, cosmetics products manufacturers, and other related enterprises and organizations

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, survey via telephone, mailed questionnaire, and literature research

The Cosmetics Contract Manufacturing Market

The cosmetics contract manufacturing market in this research refers to the market where contract manufacturers produce items for skincare, makeup, haircare, and other cosmetics products based on the requests from clients i.e. cosmetics brands and those new market entrants from other industries. The market mainly consists of contract manufacturing, cosmetics containers market (container manufacturers and dealers), and cosmetics raw materials market (raw material manufacturers and traders).

<Products and Services in the Market>

Cosmetics products (for skincare, make up, haircare, others), containers for cosmetics items, raw materials for cosmetics products.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.