No.3208

Farm Fresh Business Market in Japan: Key Research Findings 2022

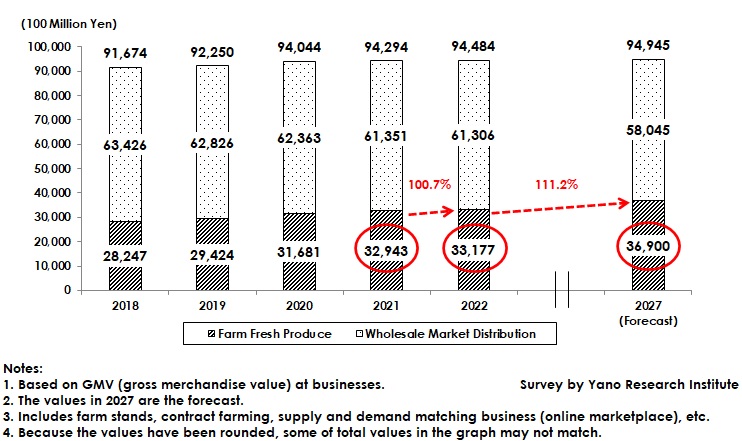

Robust Farm Fresh Business to Reach 3,317,700 Million Yen in 2022, 100.7% on YoY

Yano Research Institute (the President, Takashi Mizukoshi) has conducted research on the farm fresh business market in Japan, and has found out the market trends, the trends by market players, and the future perspectives.

Market Overview

Farm fresh business in this research refers to businesses operating off-market business that distributes farm produce directly from farms to retailers and consumers, disintermediating traditional wholesale market. The farm fresh produce indicates domestically produced fruits and vegetables that are distributed by these operators. In recent years, online marketplace of vegetables delivered from producers to consumers continues booming.

To prevent farmers from leaving their business due to being aged and labor shortage, the revision of Farm Land Act enforced in 2009 has relaxed the regulations for entering agricultural business, and the revision in 2015 has reviewed the corporate requirements for farmland ownership. Currently, as decline in production on account of leaving farms is compensated by agricultural production corporations and general corporations entering agriculture, the entire agricultural product market size, including the wholesale market, has been kept the status quo at 9,448,400 million yen for 2022, 100.2% of the previous year (based on BMV at businesses),. Of this, the estimated market size for farm fresh business has reached 3,177,000 million yen (based on BMV at businesses), 100.7% of the preceding year which exceeds the growth rate of the entire market.

Noteworthy Topics

Sales Channel Development Support for Agricultural, Forest and Fishery Products Contributes to Fueling Home Delivery business for Farm Fresh Produce

Online marketplace providing farm fresh produce geared to general consumers has substantially expanded in 2020. One of the backdrop factors against this is “the Emergency Measures to Diversify Sales Channels for Domestic Agricultural, Forest and Fishery Products” taken the initiative by MAFF, aiming to support the sales promotion by using online platform for agricultural, forestry and fishery businesses as well as processing companies that have lost their sales channels amid the corona crisis. Those businesses having met the conditions, such as sales decrease by 20% from pre-corona situations, are able to receive financial assistance for delivery fees on consumers (users) and advertisement expenses. This initiative, letting consumers to dispense with delivery fees, has succeeded in attracting consumers who were reluctant to use ecommerce and in obtaining repeat customers who experienced the convenience of home delivery and the attractiveness of farm fresh produce.

This sales channel development support ends as corona crisis dies down. Hereafter, the key is whether farm fresh home delivery businesses can keep on attracting consumers by appealing their products and convenience, even they charge delivery fees.

Future Outlook

Since domestic population decreases and meal externalization (use of food services and ready-to-eat meals) increases, consumption of fresh vegetable is on a decline. Those concerned are about to face the issue of who distributes and how to the limited demand.

Because price of farm fresh produce is decided by distributors (traders) and demanders (retailers, restaurant chains, and processed food manufacturers), it has an advantage of stable purchase price which is free from price fluctuation in the marketplace. In addition, sales operators are making marketing efforts to penetrate farm fresh produce by ensuring freshness, making rare products available that are not normally distributed, and proposing new recipes making the most of product features.

The farm fresh business market size has been expanded by obtaining the demands by demanders wanting to stabilize purchase cost, by consumers having particular interest in food, and by farmers trying to increase revenue. The market is projected to generate 3,690,000 million yen (based on BMV at businesses), by 2027, 111.2% of the size in 2022. The entire agricultural product market, including the wholesale market, is expected to be 9,494,500 million yen (based on BMV at businesses) by 2027, 100.5% of 2022.

Research Outline

2.Research Object: Agricultural production corporations (private farms, contracted farms, CSA), farm fresh produce distributors (organic farm produce distribution, farm fresh platform businesses), farm produce sales businesses (farm stands, food loss prevention businesses, agricultural theme park operators, farm produce home delivery service providers, supply and demand matching business).

3.Research Methogology: Face-to-face interviews by expert researchers, indirect interviews via telephone or questionnaires, and literature research

Farm Fresh Business Market

Farm fresh business in this research refers to businesses operating off-market business that distributes farm produce directly from farms to retailers and consumers, disintermediating traditional wholesale market. The farm fresh produce indicates domestically produced fruits and vegetables (including rice) that are distributed by these operators. Imported products are excluded.

The market size is calculated based on the gross merchandize value at businesses, which is a total of domestic fruits and vegetables sales at each end channel.

<Products and Services in the Market>

Private farms/contracted farms, CSA (Community Supported Agriculture), organic farm produce distribution, farm fresh platform businesses, farm stands, food loss prevention businesses, agricultural theme park, farm produce home delivery services, supply and demand matching businesses (online marketplace).

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.