No.3204

Credit Card Market in Japan: Key Research Findings 2022

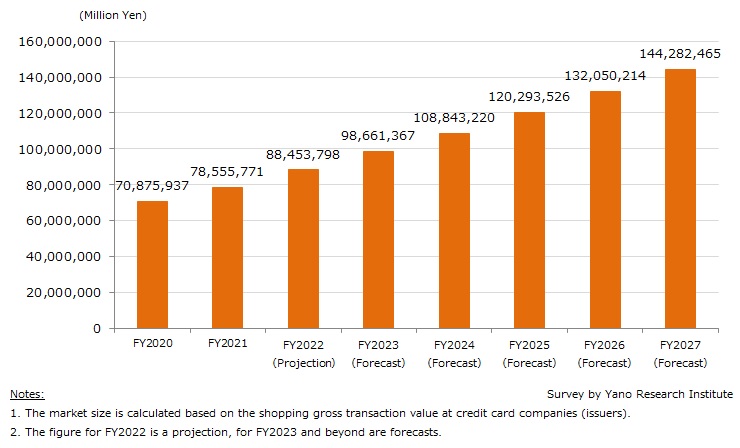

Credit Card Market Size Forecasted to Reach 144 Trillion Yen by FY2027

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the domestic credit card market and found out the current status, the trends of market players, and future perspectives.

Market Overview

The credit card market size expanded to around 78 trillion yen in FY2021 (based on the shopping gross transaction value at credit card companies [issuers]). The market size in FY2021 was spurred by the ease of pandemic restrictions (which increased occasions where credit cards are used, such as driving, travelling, leisure activities, etc.), along with the rise of online shopping and contactless payments, driven by the people’s preference for avoiding direct contact during the pandemic.

The credit card market is expected to grow continually for FY2022.

Noteworthy Topics

Expansion of Credit Card Use for B2B Payment

Use of corporate credit cards in B2B (business-to-business) transactions is expanding. Corporate credit cards had been mainly used for travel expenses and entertainment expenses associated with business trips. Since it become feasible to link the credit card data to corporate expense settlement system in the last few years, the demand for using corporate credit cards in B2B situation has been increasing, from the viewpoint of improving operational efficiency.

The corporate credit card market is expected to grow significantly hereafter, against the background of the sophistication of credit scoring methods and the rise of new payment solution like “Business Payment Solution Providers (BPSP)” *. Moreover, as it is assumed that sellers (those providing products and services) in hopes to enjoy the benefits of not going through credit scoring and no risk for bad-debt are likely to favor the use of corporate credit cards, expansion is expected for the corporate credit card market.

*“Business Payment Solution Providers” refers to financial agents that accept buyer’s (member merchant’s) payment by credit card and complete payment to suppliers on their behalf.

Future Outlook

Size of the credit card market is expected to grow steadily beyond FY2022, and it is forecasted to reach around 144 trillion yen by FY2027. The growth factor includes the further penetration of cashless payment that is driven by the governmental promotion for cashless society, and the expansion of credit card usage in the fields where credit cards had not been used, such as in corporate domain.

Research Outline

2.Research Object: Domestic leading credit card issuers

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), surveys via telephone, mailed questionnaire, and literature research

What is the credit card market?

The credit card market in this research is the market of transactions via credit cards by the domestic credit card holders who shopped at online shops as well as the real shops in and out of the country. The market size is calculated based on the shopping gross transaction value at credit card companies (issuers). Nonetheless, the acquiring transaction volume (transaction volume of other companies' cards at member stores) of each company is not included.

<Products and Services in the Market>

Credit card, corporate card, electronic money, contactless payment

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.