No.2855

Lending Service Market in Japan: Key Research Findings 2021

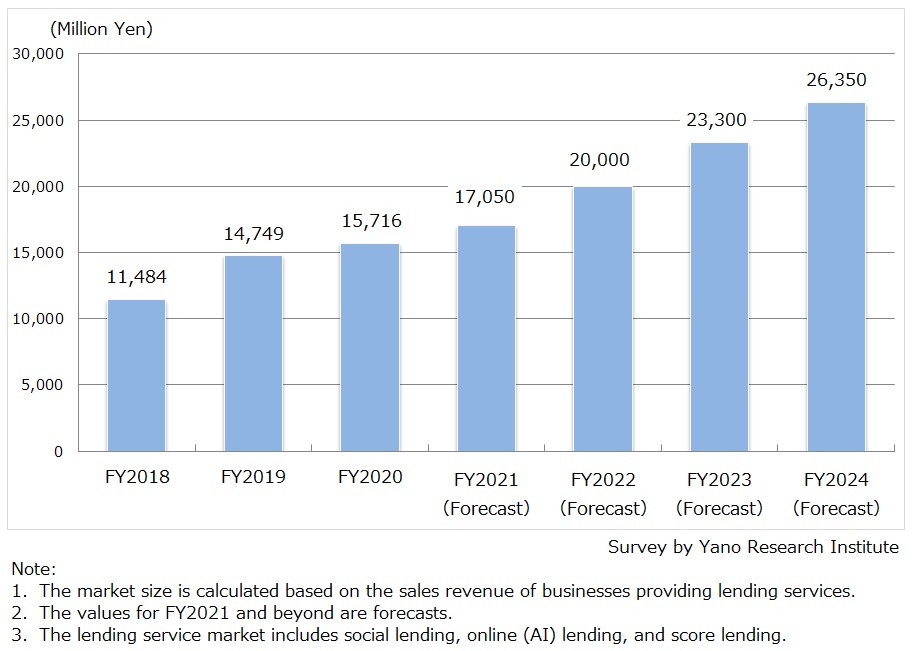

Growing Popularity of Social Lending Augmented Lending Service Market to 15,716 Million Yen in FY2020, Up 6.6% from Preceding Fiscal Year

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic lending service market and has found out the current status, the trend at market players, and future perspectives.

Market Overview

FinTech is a coined term of “Finance” and “Technology”, which refers to various innovations combining financial services with information technologies. Lending service is the FinTech-related financing service that differs from borrowing conventional bank loans, which includes various types of services such as lending services provided completely (only) online and services that enable individuals to obtain loans under rate and terms based on ‘scores’ of each borrower.

Along with the development of FinTech, the lending service market has been invigorated and is expecting expansion. In this survey, the lending service market includes social lending, online (AI) lending, and score lending, and the market size is calculated based on the sales revenue of lending service providers. Size of the lending service market for FY2020 was valued at 15,716 million yen, reaching 106.6% of the previous fiscal year. While social lending augmented the market growth in particular, score lending also expanded.

Noteworthy Topics

Enforcement of Financial Services Intermediary Business Act

Against the background of development in the information and telecommunication technology, and an introduction of “Financial Services Intermediary Business Act” in November 2021, financial services became available online.

While the market environment sees it important for financial services to make it easier for users to choose the right service from various offerings, the Act established a new business category of “financial services intermediary business operator”. Under the Act, instead of obtaining license respectively for banking, securities brokerage, and insurance business, a service provider can cover all three fields with a single license. By expanding the range of financial services, it is expected to revitalize the entire financial industry and boost the lending service market.

Future Outlook

Size of the lending service market is projected to reach 26,350 million yen by FY2024.

Online (AI) lending was not utilized in FY2020 because public funds and low-interest loans were widely available in the Covid-19 crisis. Nonetheless, as public funds are mostly emergency-oriented, when it runs out, another funding will become necessary. At present, users prefer non-contact transaction to in-person transaction, and their interest in online (AI) funding is growing. Since its time to funding is short, online (AI) lending is in great demand as a working capital loan, and for that reason, the market anticipates growth hereafter.

Research Outline

2.Research Object: Financial institutions and lending service providers

3.Research Methogology: Face-to-face interviews by the expert researchers (including online interviews) and literature research

Lending Service Market

FinTech is a coined term of “Finance” and “Technology”, which refers to various innovations combining financial services with information technologies. Lending service is the FinTech-related financing service that differs from borrowing conventional bank loans, which includes various types of services such as lending services provided completely (only) online and services that enable individuals to obtain loans under rate and terms based on ‘scores’ of each borrower.

In this survey, the lending service market refers to social lending (also known as peer-to-peer lending or crowd lending), online (AI) lending, and score lending. The market size is calculated based on the sales revenue of businesses that provide lending services.

<Products and Services in the Market>

Social lending, online (AI) lending, score lending

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.