No.2237

ADAS/Autonomous Driving System Sensors Market in China: Key Research Findings 2019

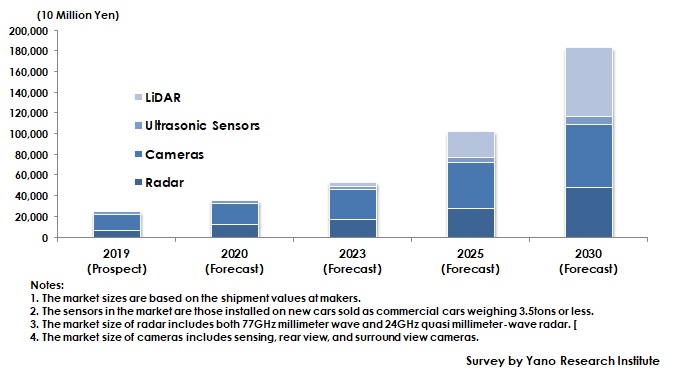

Market Size of ADAS and Autonomous Driving System Sensors in China Expands to 1,800,000 Million Yen by 2030

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the markets of sensors for ADAS (Advanced driver-assistance systems) and autonomous driving systems in China and has found out the overviews on the sensors installed in ADAS and autonomous driving systems, trends of the technologies, business strategies at each maker, and the forecast until 2030 by type.

Market Overview

The total market size of the sensors for ADAS and autonomous driving systems in China is projected to achieve 252,940 million yen in 2019. With regard to the market sizes by sensor type, radar reached 68,040 million yen; cameras achieved 156,100 million yen; and ultrasonic sensors 28,800 million yen. (Both 77GHz millimeter wave and 24GHz quasi millimeter-wave radars are included in the market size of radar-type sensors, while sensing, rear view, and surround view cameras are included in camera-type sensors.)

The demand for radars is increasing, not only that for 77GHz long range radar but also short range radar installed on the both rear sides of the vehicle (both 77GHz and 24GHz are used for short range radar). Short range radar is used for BSD (blind-spot detection system) and DOW (door open warning) systems. DOW systems are highly demanded in China, because the traffic accidents caused by motorbikes closing in from the rear without being noticed occur from time to time. The number of cameras used in ADAS for forward sensing, rear-view and surround view has been expanding. Those made by local Chinese makers are also increasing in number, primarily used as rear-view cameras. Supersonic sensors are increasingly used for collision warning as well as for parking support systems. Four to twelve supersonic sensors are installed per vehicle (private or commercial vehicle) depending on the use.

Noteworthy Topics

Chinese Government Fostering Connected Vehicle Development

According to the “Intelligent Vehicle Innovation & Development Strategy” in January 2018, China announced that it aimed to commercialize middle and high level ICVs (intelligent connected vehicles) by 2020, and to earn global reputation for its standard ICVs by 2035. Since autonomous driving brings about significant economic and social benefits, the country introduces a series of measures and regulations to encourage the development of its automotive industry.

In addition, in “the ICV Industrial Development Action Plan” in December 2018, China stipulated to adopt 5G cellular communications for V2X (communication from vehicle to vehicle, from road to vehicle) and indicated its target penetration rates of V2X on new vehicles. The country also intended to implement 5G-V2X in 2022 or beyond, and planned to demonstrate 5G-V2X at the 2022 Winter Olympics in Beijing.

Future Outlook

The market size of the sensors for ADAS and autonomous driving systems in China is expected to achieve 1,837,180 million yen by 2030. For the market size by sensor type, radar attains 484,350 million yen, cameras 615,410 million yen, supersonic sensors 75,920 million yen, and LiDAR 661,500 million yen. The largest market by sensor type is LiDAR, the demand of which expected to expand for the autonomous driving systems with level 3 and higher for 2025 and beyond. The Chinese government has announced in “China Manufacturing 2025” report that it intends to implement the development of ICVs (Intelligent Connected Vehicles) as its national strategy and aims to achieve level-4 or higher automated driving ICVs by attaining V2X (communication from vehicle to vehicle, from road to vehicle) by 2025. Therefore, the vehicles equipped with level 4 of autonomous driving systems are to increase in the urban areas such as Beijing and Shanghai specified as the ICV testing areas, which is likely to increase the shipment volume of LiDAR in China.

Research Outline

2.Research Object: Automakers, manufacturers of car electronics, semiconductors, and sensors

3.Research Methogology: Face-to-face interviews by our expert researchers, surveys via telephone/email, and literature research

What are ADAS/Autonomous Driving System Sensors?

Advanced Driver Assistance Systems (ADAS) aim to prevent road accidents and the associated casualties by monitoring the surrounding environment through the sensor devices installed at the front, sides, and rear parts of the vehicle. An autonomous driving system is the ADAS technologies being advanced. The system presides over driving of a vehicle on behalf of the driver by using the installed sensors, a high-precision map, and telecommunication functions according to the level specified out of the six levels of the automated driving system.

The sensors for ADAS and autonomous driving systems in this research indicate those sensor units (radar, cameras, infrared lasers, and ultrasonic sensors) installed at the front, sides and the rear of the vehicle. The sensors in the market size are those installed in new cars sold as commercial cars weighing 3.5tons or less.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.