Retail FX (Foreign Exchange) Trading Market in Japan: Key Research Findings 2017

Research Outline

- Research period: From October to December, 2017

- Research target: Commodity futures dealers, dedicated retail FX trading companies, securities companies, Internet banking corporations, etc.

- Research methodologies: Face-to-face interviews by the expert researchers, supplemented by interviews via telephone and e-mail

< What is Retail FX (Foreign Exchange) Trading? >

Retail FX (Foreign Exchange) trading in this research indicates the first financial product in Japan to handle foreign exchange transactions for private investors. It emerged after the revision to the Foreign Exchange Control Law in April 1998. The trading is executed based on notional principal, the leveraged margin deposit that works as collateral, and settle the account for only the difference caused between the period of position opening and closing. This report deals with OTC FX transactions market.

Summary of Research Findings

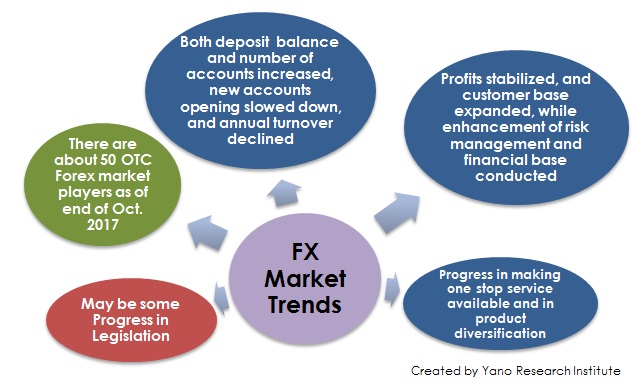

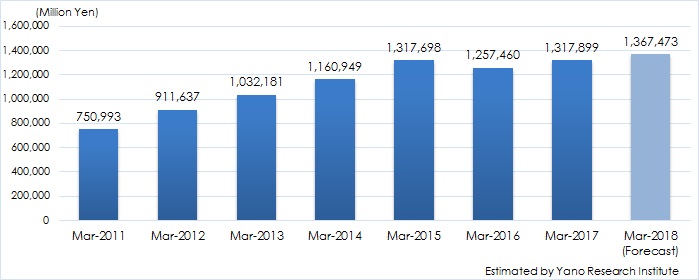

- FX Trading Market Size (Balance of Deposit Margin) for Fiscal Year Ending in March 2017 Attained \1,317.8 Billion, Up by 4.8 % on Y-o-Y Basis

The market size of retail FX (Foreign Exchange) trading (the balance of deposit margin) for the fiscal year ending in March 2017 rose by 4.8% from the previous fiscal year to achieve 1,317.899 billion yen. There were times when the assets of investors have decreased due to large fluctuations in foreign exchange rates, but after the yen has weakened and stabilized as it is in the latter half of the fiscal year, it has encouraged investment to change the market to an increase.

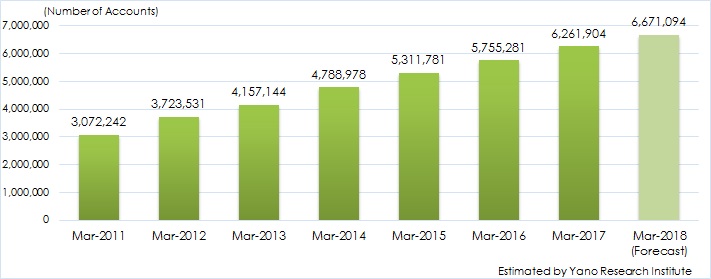

- Number of Accounts for Fiscal Year Ending in March 2017 Rose by 8.8% on Y-o-Y Basis to Achieve 6,260 Thousand

As a result of some efforts to drive investment, such as providing proactive seminars, adding the currencies of emerging countries, and narrowing the spreads, new account opening has continued increasing, but the increment has started slowing down. Consequently, the number of accounts for the fiscal year ending in March 2017 attained 6,261 thousand, a rise by 8.8% from the same period of the previous fiscal year.

- Annual Turnover of Fiscal Year Ending in March 2017 Achieved \4,835 Trillion

(1 Million Currency Units Converted to \100 Million), Down by 3.4 % on Y-o-Y Basis

Obscurity in future prospect in spite of large fluctuation in foreign exchange rates has brought about wait-and-see attitude by investors, which led the annual turnover of the fiscal year ending in March 2017 to decrease by 3.4% from the same period of the previous fiscal year to attain 4,835.7124 trillion yen (1 million currency units converted to 100 million yen).

- Figure 1: Market Trends

- Market Size for Fiscal Year Ending in March 2018 Projected to Attain \1,367.4 Billion, Number of Accounts to Achieve 6,671 Thousand, and Annual Turnover \4,293 Trillion

Because Yen-US-dollar trading is too large compared with that of other currencies, there has been an attempt of narrowing the spreads of the currencies of emerging countries aiming to encourage diversified investment. In addition, in order to attract new investors, the efforts such as diversification of products and development of useful trading tools available by smartphones have been made. Because of these company attitudes, improved trading environment, and occurrence of phenomenon bringing about fluctuation of foreign exchange rates, the market size of retail FX trading (the balance of margin deposits) for the fiscal year ending in March 2018 is projected to attain 1,367.4 billion yen, with the number of accounts to reach 6,671 thousand, and the annual turnover to achieve 4,293 trillion yen (1 million currency units converted to \100 million).

- Figure 2: Transition of Estimated Market Size of Retail FX Trading (Balance of Deposited Margin)

- Figure 3: Transition of Number of Accounts