Domestic IT Investment in Japan: Key Research Findings 2016

Research Outline

- Research period: From July to October, 2016

- Research targets: Domestic private companies, organizations and public institutions

- Research methodologies: Mail-in survey to private companies, organizations, and public institutions, and literature research

What is the IT Investment Market Size at Domestic Private Enterprises?

The market size of investment in information technologies, or IT, at the domestic private enterprises in this research is calculated based on the data from the Ministry of Economy, Trade and Industry, and Ministry of Finance, added with the results of the questionnaire to the domestic companies regarding the IT investment conducted by Yano Research Institute.

*Period of Questionnaire Conducted: July to August 2016; Targets of the Questionnaire: 551 domestic private companies and public institutions; Methodologies: Mail-in Questionnaire.

Summary of Research Findings

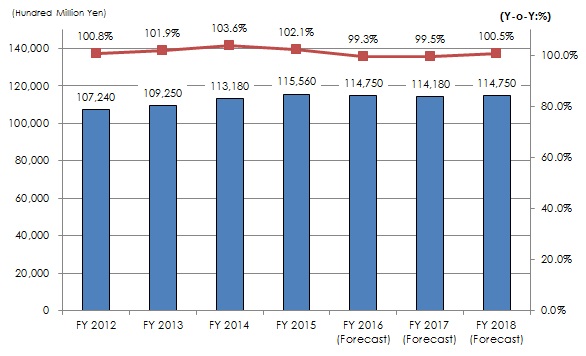

- IT Investment Market Size at Domestic Private Enterprises in FY2016 Expected to Scale Down to 11,475 Billion Yen, Decline by 0.7% on a Y-o-Y Basis

The market size of investment in IT, or Information Technologies (including both hardware and software) at the domestic enterprises in FY2016 is expected to end up with 11,475 billion yen, down by 0.7% from the previous fiscal year.

Because the large-scale system upgrading at financial institutions is likely to peak out and quieten down by FY2016, IT investment at domestic enterprises is regarded to decrease slightly.

- Concerns over Security Issues Raised Both Attention and Investment to Security Software

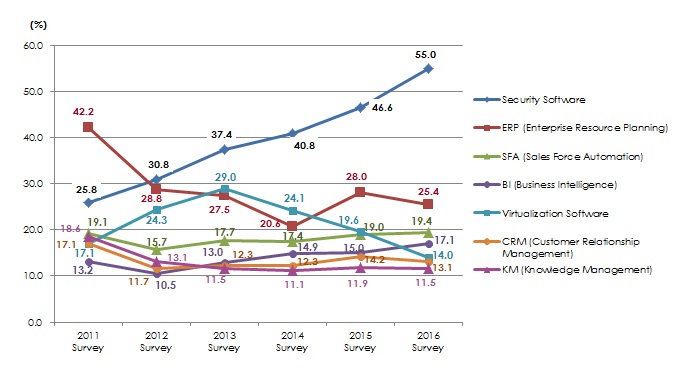

To the question “in which of the IT categories or items that your company increase investment within the coming three years” in the mail-in questionnaire conducted as a part of this research, the largest number of responses concentrated on “security software” which have been occupied the number-one position for 5 years in a row ever since it exceeded “ERP” in 2012, the then number one software to invest in the 2011 survey. The ratio of response to “security software” had been 29.2% in 2011 and rose to 55.0% in the latest 2016 survey.

2015 was the year that faced full of information security issues such as personal information leakage, zero-day vulnerability, and increase of ransomware. Furthermore, DDoS attacks using IoT systems, smartphones, and other devices are assumed to increase for the future. Attention to these troubles and concerns seem to have driven enterprises to invest in IT.

- Figure 1:Transition and Forecast of Domestic Private IT Market Size

- Figure 2: Top 7 IT Categories Expecting More Investment during the Next 3 Years (Questionnaire Results)