Trends of Local Banks toward Regional Revitalization in Japan: Key Research Findings 2016

Research Outline

- Research period: From June to August, 2016

- Research targets: Megabanks, local banks, public and private funds, large SIers, IT ventures, etc.

- Research methodologies: Face-to-face interviews, survey via email and telephone in combination with literature research

Summary of Research Findings

- Feasibility-Based Financing Expected to Gradually Increase at Local Banks

Wider adoption of “Local Benchmark,” a corporate health-check tool by METI, is likely to bring about growing number of financing cases based on feasibility including ABL (Asset Based Lending) and privately-placed bonds, among local banks. This is expected to raise the ratio of feasibility-based financing to the same level as or exceed that of conventional mortgage-based financing, although the entire loan amount may not differ much.

- Loose Integration Among Local Banks Developed from Regional Cooperation may Lead Further to Restructuring

Broader acceptance of DMO (Destination Management Organization) and sharing of conventional information systems among local banks are likely to trigger regional cooperation among them. Then, such regional cooperation may trigger establishing of holding companies, which may eventually lead to loose integration of local banks. Furthermore, there is possibility that local banks to be purchased and integrated into megabanks, or that a leading local bank that became larger by loose integration through establishment of holdings may progressively acquire other banks.

- Cooperation with Large SIers and Ventures, and Acceleration in Utilization of Fin Tech at Local Banks Expected to Increase

Mainly those local banks that refer themselves to act “relationship banking” cooperate with large SIers in extensive ICT-related areas, such as DMO, agricultural forestry and fishery industry becoming the sixth sector, medical and long-term care, and etc. In addition, more ventures are considered to enter the industries which encourage regional revitalization, as many local governments have announced to support venture companies in their local versions of “Total Strategy for Revitalizing Towns, People, and Jobs strategies.” These actions are likely to drive cooperation between venture companies and local banks. Fin Tech is the most typical area that connects such cooperation, which helps to further accelerate utilization of crowdfunding, settlement, cloud accounting.

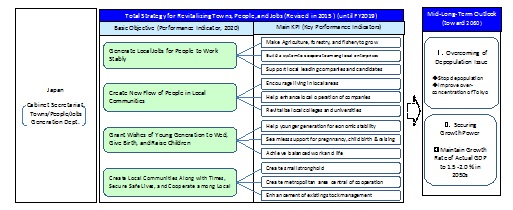

- Figure 1: About Total Strategies for Regional Revitalization

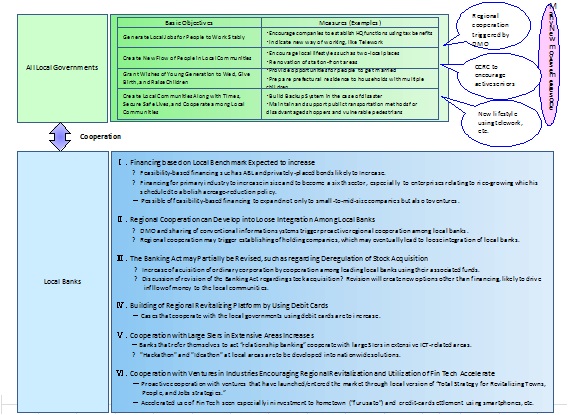

- Figure 2: Trends of Local Banks for Regional Revitalization (until FY2019)