No.3990

Pachinko Equipment Market in Japan: Key Research Findings 2025

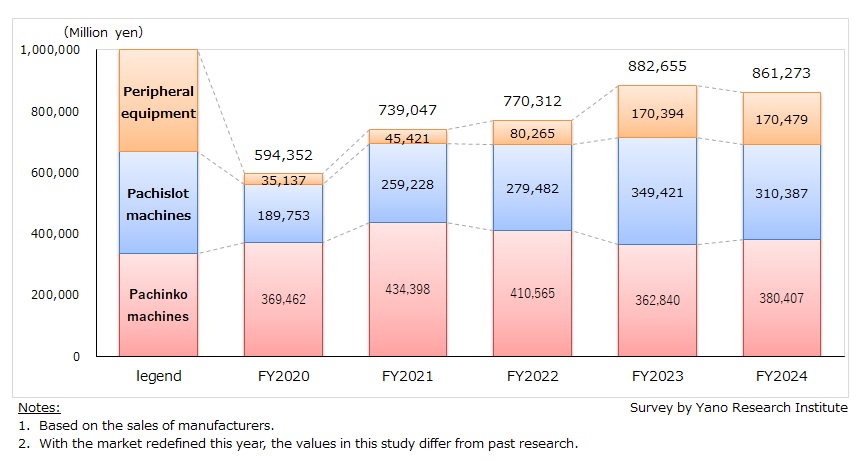

Pachinko Equipment Market Diminished to 97.6% of Preceding Fiscal Year to 861,273 Million yen in FY2024

Yano Research Institute (the President, Takashi Mizukoshi) surveyed the domestic pachinko equipment market, and found out the current status, the market size by product segment, the manufacturer trends, and future perspectives.

Market Overview

The pachinko equipment market size (the total market size of pachinko machines, pachislot machines, and peripheral equipment) in FY2024 dropped to 861,273 million yen (97.6% of the previous fiscal year), based on the sales of manufacturers.

By segment, while pachinko machine market grew to 830,407 million yen (104.8% on year-over-year basis), pachislot market declined to 310,387 million yen (88.8%) and peripheral equipment stayed almost flat at 170,479 million yen (100.1%).

After years of decline due to stronger popularity of pachislot, the market size of pachinko machines exceeded the previous year's results in FY2024. While unit sales declined, price rise of gaming machines underpinned the market growth.

Propelled by the softening of industry’s voluntary restriction, adoption of Lucky Trigger—which the game players’ chance of winning significantly—started from March 2024. Followed by further phasal relaxations, pachinko machines with diverse specifications were released. However, machine utilization rates are still falling. Gaming machine manufacturers are expected to enhance the overall gameplay with the Lucky Trigger, instead of emphasizing solely on creating more chance of wins.

On the other hand, the pachislot machine market—whose growth had been driven by the emergence of Unit 6.5 machines in FY2022 and robust sales of smart pachislot machines—turned for the worse in FY2024. Still, the interest in pachislot machines remains robust among pachinko parlors, as the utilization rate for these machines exceeds that of pachinko machines. Although there has been a drop in the number of units sold per machine model, pachislot machines have outperformed pachinko machines in sales.

Meanwhile, the peripheral equipment market saw the emergence of new product genre (reset-unit for smart gaming machines) along with the introduction of smart pachislot machines in FY2022. This led to three consecutive years of year-over-year market growth since FY2021. Nonetheless, the growth leveled off for FY2024.

Noteworthy Topics

Sales of Gaming Machines in Smaller Quantities / Demand Still Chiefly Driven by Pachi-Slot Machines

Although the pachinko machine market expanded in FY2024, unit sales declined, with demand increasingly concentrated on smaller production runs. Total sales of the top 10 models in FY2024 are estimated at approximately 260,000 units, or about 26,000 units per model on average. This marks a further decrease from FY2023, when total sales were estimated at 290,000 units, averaging roughly 29,000 units per model. Considering the strong machine utilization rates of pachislot machines, pachinko parlor operators continue to favor pachislot machines over pachinko machines. As a result, annual sale of 30,000 units are now regarded as a significant success for pachinko machines, while even reaching 10,000 units remains challenging. Pachinko machine sales are expected to remain sluggish in FY2025.

For pachislot machines, total sales of the top 10 models reached approximately 215,000 units in FY2024, with an average of around 21,000 units per model. Although average sales per model increased notably in FY2023 due to the strong performance of specific models, the figure dropped in FY2024 compared to the previous year. Despite this slight downturn, pachinko parlor operators continue to show a strong appetite for newly launched pachislot models, largely because the number of new releases is limited by stringent machine type testing requirements. As a result, demand for pachislot machines is expected to remain firm.

Future Outlook

Two leading industry associations—Nikkoso and Nichidenkyo—are currently reviewing industry’s voluntary regulations on gaming machines within the framework of the compulsory Gaming Rules. In response, gaming machine manufacturers are launching new models that comply with these rules as well as the newly issued “Basis for Interpretation of Technical Standards” notified by administrative authorities.

A representative example of a regulation-compliant feature is the Lucky Trigger (LT), introduced in March 2024. In July 2025, “LT3.0 Plus”—machines with gameplay enhanced by Lucky Trigger—were also released. As pachinko machines incorporating these features gain popularity, further advancements in machine development are anticipated.

Meanwhile, the rollout of pachislot machines equipped with Bonus Trigger (“BT machines”) began in June 2025. As the share of smart pachi-slot with Assist Time (“AT machines”) installed in parlors has increased, polarization has emerged between new machines and standard machines in terms of payout performance and gameplay. BT machines are positioned as an intermediate model between AT machines and non-AT (normal) machines by gameplay style, and are expected to attract both pachislot fans dissatisfied with non-AT machines and those fatigued by the high gambling nature of AT machines. To re-engage dormant fans and attract new players, Nichidenkyo aims to raise the share of BT machines to 10% of the total pachislot machines within two years.

While the newly introduced LT3.0 Plus and BT machines have yet to demonstrate a significant market impact, there is considerable potential for these new models to gain traction, depending on the direction of further machine development.

Because switching between smart pachi-slot and smart pachinko does not require replacing reset-units, pachinko parlors can respond quickly even if market trends shift due to new machine specifications. The spread of smart gaming machines may therefore accelerate changes in pachinko parlor operations at an unprecedented pace.

Research Outline

2.Research Object: Manufacturers of pachinko machines, pachislot machines, and peripheral equipment

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), surveys via telephone and email, and literature research

What is the Pachinko Equipment Market?

In this research, pachinko equipment market encompasses the markets for pachinko machines, pachislot machines, and peripheral equipment.

The peripheral equipment includes equipment and systems installed at pachinko parlors, such as central management systems (so-called ‘hall computer’), machine-side ball/token vending machines, smart gaming machines, and ball/token hoppers.

<Products and Services in the Market>

Pachinko machines, pachislot machines, gaming machine components, hall computers (central management systems), prize POS (system used in pachinko parlors to manage inventory and process sales of prizes exchanged for tokens or balls won by players), ball/token counter machines, automatic prize dispensers, customer management systems, signal lights (signaling to floor staff which specific machine needs attention), ball/token hoppers, “CR units” (machine-side ball/token vending machines), reset-unit for smart gaming machines

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.