No.3937

Nighttime Economy Market in Japan: Key Research Findings 2025

Size of the Nighttime Economy Market Reached 9.8459 Trillion Yen in FY2024

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey of the nighttime economy market in Japan. The survey revealed the market structure, trends among market players, trends in number of users or participants, and future perspectives.

Market Overview

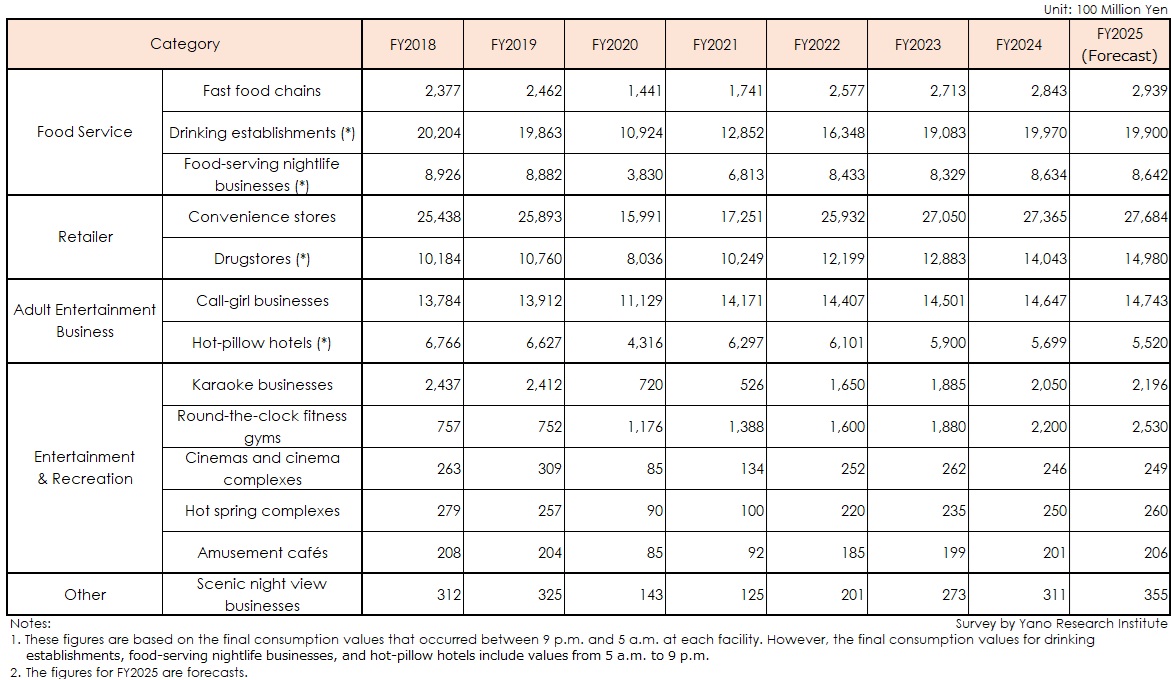

Based on final consumption values, the nighttime economy market (*) reached 9.8459 trillion yen in FY2024, marking a 3.4% increase from the previous fiscal year.

*) In this research, the nighttime economy market refers to the market size of economic activities occurring from 9 p.m. to 5 a.m. Market size is based on the total final consumption value of the following categories: fast food chains, drinking establishments (e.g., pubs and bars), food-serving nightlife businesses (e.g., cabaret clubs and small-scale hostess bars), convenience stores, drugstores, call-girl businesses, hot-pillow hotels, karaoke businesses, round-the-clock fitness gyms, cinemas and cinema complexes, hot spring complexes, amusement cafés (e.g., manga cafés and internet cafes), and scenic night view businesses. The size of drinking establishments, food-serving nightlife businesses and hot-pillow hotels is calculated based on final consumption values for full hours.

Due to the enormous scale of nighttime consumption, the following categories—drinking establishments, convenience stores, drugstores, and call-girl businesses—respectively exceed one trillion yen. Since the recovery period from the pandemic, these categories have experienced stable consumption, which continued in FY2024 and contributed to the expansion of the nighttime economy market. Drugstores, in particular, have significantly increased their sales after 9 p.m., which represented their acceptance of an influx of consumers and foreign tourists' nighttime spending, as well as their contribution to market expansion.

Noteworthy Topics

Number of Nighttime Visits in Three Major Convenience Store Brands

From 9 p.m. to 5 a.m. in FY2024, a total of 3.74286 billion visits were made to three major convenience stores: Seven-Eleven, Family Mart, and Lawson (*). This number was five times higher than that of fast food chains, nine times higher than drugstores, and 65 times higher than karaoke businesses. These figures demonstrate that convenience stores have indeed become the primary infrastructure supporting massive nighttime spending.

*) The survey was conducted by Yano Research Institute.

Future Outlook

Since the start of FY2025, a further increase in commodity prices, particularly food prices, has affected visits to drinking establishments, resulting in a modest decline in the size of this category. Despite an increase in unit price spending per customer, it was not enough to offset the loss from declining visits. Other categories have remained prosperous, experiencing an influx of nighttime visits, especially by inbound customers, as well as increased customer spending due to higher product and service prices. Because of the growth of these booming markets, the nighttime economy market is expected to grow further.

Yano Research Institute estimates that the nighttime economy market will reach 10.0204 trillion yen in FY2025, marking a 1.8% increase from the previous fiscal year.

In the medium to long term, an increase in nighttime visits by both domestic consumers and foreign tourists, as well as increased customer spending due to higher prices for products and services will contribute to the nighttime economy for the time being.

Additionally, Japan’s nighttime safety has high potential for nighttime economy to thrive, even compared to other major countries worldwide. However, labor shortages and overly biased administrative measures are preventing the full utilization of this potential. Market growth is expected to remain limited, as long as the current market environment continues.

Research Outline

2.Research Object: Food service providers, retailers, entertainment businesses, railway companies, and local governments.

3.Research Methogology: Face-to-face interviews by specialized researchers, combined with publicly available information and literature research

What is the Nighttime Economy Market?

In general, the nighttime economy encompasses economic activities conducted from after sunset until sunrise. In this research, however, the term is redefined as economic activities conducted from 9 p.m. to 5 a.m. The nighttime economy market is also defined as the market formed by these activities or the consumption of products and services provided during this time.

Please note that this definition of the nighttime economy market assumes the start time of the offerings but not the end time.

Market size and number of visits were calculated by collecting and measuring data from market players (including hourly pricing information, customer count data, and store information) as well as statistical information from various government agencies and industry associations.

<Products and Services in the Market>

Product and services that were offered from 9 p.m. to 5 a.m. by companies in the food services, retail, adult entertainment, entertainment facilities, scenic night view-related businesses, railways, and local governments.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.