No.3923

Outdoor Gear, Facility, and Rental Market in Japan: Key Research Findings 2025

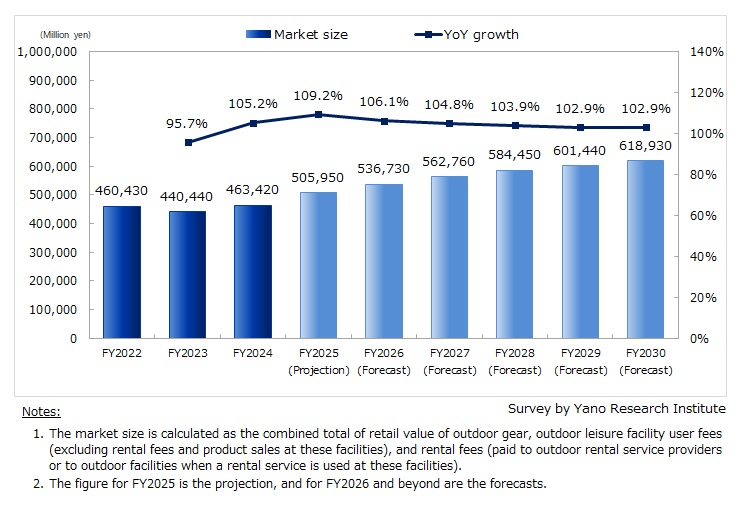

Domestic Outdoor Gear, Facility, and Rental Market Sized at 464,420 Million Yen in FY2024, Projected to Grow by 9.2% YoY in FY2025

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the outdoor gear, facility, and rental market in Japan and found out the trends by segment and market players.

Market Overview

The market size of the outdoor gear, facility, and rental in FY2024 was estimated at 463,420 million yen, up 5.2% year on year. Following the reclassification of COVID-19 to a Class 5 disease under the revision of Infectious Disease Act in May 2023, consumer spending on leisure—including travel and sightseeing—generally rebounded. However, this shift also contributed to a cooling of the camping boom, as entry-level and bandwagon campers appeared to move on to other leisure options.

Looking into detail, sales of outdoor gear (mountain climbing/mountaineering gear, tents, tarps, sleeping bags, lights, cooking tools, dishes, cooking stoves, fuels, tables, chairs, coolers, and jugs) declined in conjunction with the slowdown in camping demand, while outdoor apparel (clothing, footwear, and backpacks) continued to post growth. Outdoor apparel has gained broader acceptance as streetwear, supported by its high functionality, design appeal, and versatility. As a result, growth in the outdoor apparel category helped offset the slowdown in equipment sales, leading to an overall improvement in the outdoor gear segment. In addition, rebounding inbound tourism, further amplified by the weak yen, is driving particularly strong demand for Japanese brands’ highly functional outdoor apparel.

The outdoor gear, facility, and rental market is projected to grow by 9.2% year-on-year to 505,950 million yen in FY2025. The outdoor gear market is expected to recover as sales of camping equipment bottom out. Outdoor activity–related services, including facilities and rentals, are also projected to improve. Supported by steady growth in the outdoor apparel segment, expansion is anticipated across the outdoor gear, facility, and rental markets.

Noteworthy Topics

Lifestyle-Oriented Apparel Drives Market Growth

The outdoor gear, facility, and rental market is expected to record steady growth.

In particular, lifestyle-oriented products are positioned as the primary growth driver. The increasing acceptance of outdoor apparel (clothing, footwear, and backpacks) as streetwear is central to this trend. Outdoor clothing has gained broad appeal across age groups and user cases, supported by its high functionality (such as wind resistance, water repellency, and lightweight performance) combined with refined design. Moreover, inbound demand, further boosted by the weak yen, is providing a strong tailwind for the outdoor apparel segment.

Although the outdoor gear segment lost momentum as the camping boom cooled, outdoor rental segment is expected to generate new demand linked to hiking, trekking, and mountain climbing, supported by municipality-led promotion of slow tourism*. Despite challenges such as overtourism—exemplified by visitor restrictions at Mount Fuji—and the aging of climbers, trekking tours have the potential to invigorate local economies by attracting visitors year-round, rather than only on weekends or during peak seasons.

The ability of businesses to adapt to evolving consumer needs will be critical to the future growth of the outdoor gear, facility, and rental market.

*Translator’s note: “Slow tourism” refers to a travel style in which visitors stay in a single destination and engage deeply with local culture, nature, and daily life. The term is often used in contrast with “multi-destination (itinerary-driven) tourism,” which involves visiting multiple attractions or regions within a limited timeframe.

Future Outlook

The domestic market for outdoor gear, facility, and rental services is forecasted to expand at a CAGR of 4.9% from FY2024 to FY2030, reaching 618,930 million yen by FY2030. Outdoor industry is poised to grow further by responding to varying consumer needs.

Research Outline

2.Research Object: Domestic manufacturers, wholesalers, and retailers of outdoor gear, companies that operate outdoor facilities, companies providing related services, organizations related to outdoor recreation and adventure activities, and industry associations

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), questionnaire survey, and literature research

What is the Outdoor Gear, Facility, and Rental Market?

In this research, the outdoor gear, facility, and rental market encompass outdoor gear (apparel and gear), outdoor leisure facilities (campsites, barbecue sites, cabins, cottages, and other outdoor lodging facilities like glamping sites), and services renting outdoor gear. The market size is calculated as the combined total of retail value of outdoor gear, outdoor leisure facility user fees (excluding rental fees and product sales at these facilities), and rental fees (paid to outdoor rental service providers or to outdoor facilities when a rental service is used at these facilities).

In this research, the outdoor activities mainly refer to outdoor leisure activities, excluding sports of competitive nature and activities alike (such as competitive trail running, sport climbing, and climbing gym), fishing (fishing gear, managed fishing sites), professional outdoor guides (mountain guides, nature guides), and outdoor music festivals.

<Products and Services in the Market>

Outdoor apparel (clothing, footwear, and backpacks), outdoor gear (mountain climbing/mountaineering gear, tents/camp tarps, sleeping bags, lighting fixture, cooking tools/dishes, cooking stoves/fuels, tables/chairs, coolers/jugs, etc.), outdoor facilities (campsites, barbecue sites, cabins, cottages, glamping sites), outdoor gear rental services (mountain climbing/mountaineering gear, camping gear)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.