No.3649

Environmental Value (Carbon Reduction Value= Carbon Offsets and Credits) Market in Japan: Key Research Findings 2024

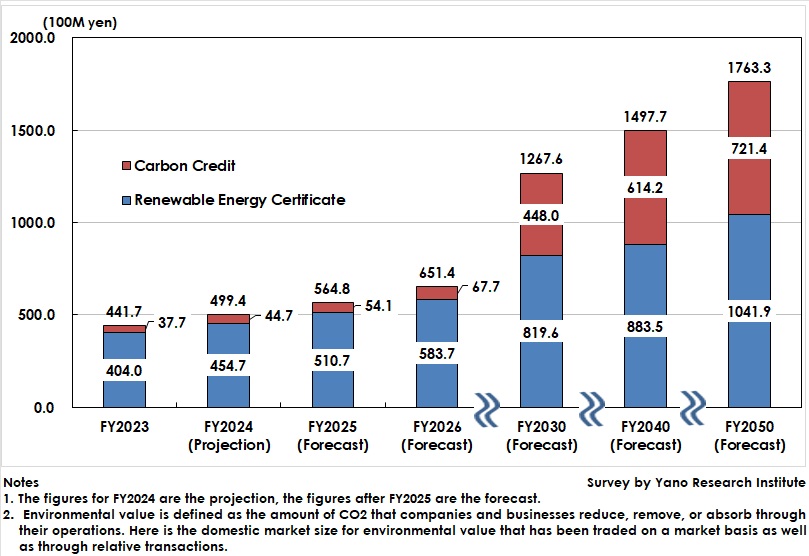

For Realization of Carbon Neutrality in 2050, the Environmental Value Market for FY2050 Expected to Quadruple the FY2023

Yano Research Institute (the President, Takashi Mizukoshi) has studied the environmental value (carbon reduction value) market in Japan, which works as part of the carbon pricing policy to efficiently reduce CO2 for realization of carbon neutrality. Here shows the carbon offset and renewable energy certificate market size forecast until FY2050.

Market Overview

To achieve carbon neutrality by 2050, many companies and businesses in Japan recognize the risk to their future viability if no efforts are made or successful results are attained in the fight against global warming. As a result, they continue to strive to reduce, eliminate, or absorb CO2 emissions and reinvest the results in their businesses. However, during the transition period, each company or business faces a shortfall or surplus against its emissions target settings. By converting the shortfall or surplus into Carbon Credits or Renewable Energy Certificates (RECs) (i.e., environmental value), the environmental value can be traded between companies and businesses, allowing them to offset emissions or use cap-and-trade programs, leading to nationwide (or global) decarbonization.

As the direction of carbon pricing policy in Japan, carbon credits, RECs, and cap-and-trade programs are used as the incentives for companies and businesses to invest in energy-saving or low-carbon projects, generating financial transfers and creating a domestic virtuous cycle between the economy and the environment. With the visualization of environmental value, necessary for decarbonization initiatives, the government policies are designed to increase the predictability of return on investment for companies and businesses by stimulating and expanding environmental value transactions in the carbon credit and REC markets.

In the future, when carbon neutrality is achieved by 2050, the CO2 emissions and removals will need to be balanced, which will require the expansion of CO2 absorption/removal (or negative emission) projects. While companies and businesses take steps to reduce emissions, there is still a need for carbon trading and offsetting through carbon credits, RECs, and cap-and-trade programs between the CO2 emitting entities and carbon absorbing and removing entities.

* “CCUS (Carbon Capture, Utilization, and Storage) Technologies in Japan: Key Research Findings 2024” (released on 27 May 2024)

https://www.yanoresearch.com/en/press-release/show/press_id/3539

Noteworthy Topics

PPA Schemes

The Power Purchase Agreement (PPA) has become a widely used method for electricity consumers such as companies and businesses to procure, purchase or use renewable energy or decarbonized electricity with environmental value (CO2 reduction effects). Under the PPA scheme, power purchasers can stably buy electricity with environmental value, generated from renewable energy sources including solar energy, from power plants or energy retailers through a long-term (fixed unit price) contract such as twenty years.

Recent renewable energy policy has encouraged a shift to the Feed-in Premium (FIP), which provides greater incentives to adjust supply and demand than the Feed-in Tariff (FIT) scheme for renewable energy. As a result, renewable energy power generation projects have become more FIP-compliant, making it easier for electricity purchasers to enter into new forms of PPA contracts. In other words, the FIP scheme allows power generators to have non-FIT non-fossil certificates and to directly supply electricity retailers through relative transactions other than the fulfillment market for the Act on Sophisticated Methods of Energy Supply Structures obligations.

* “Solar Power Market in Japan: Key Research Findings 2024” released on 6 September 2024

https://www.yanoresearch.com/en/press-release/show/press_id/3613

Future Outlook

The domestic environmental value (carbon reduction value) market is forecast to quadruple from 44.2 billion yen per year for FY2023 to 176.3 billion yen per year by FY2050. In Japan, the market size for RECs that certify the consumed electricity as decarbonized electricity or renewable energy is larger than that of carbon credits that offset CO2 emissions. On the other hand, the unit price for CO2 transactions is higher in carbon credits with limited generation and issuance than in RECs.

The transfer of environmental value (CO2 reduction value) is positioned as the last resort in the transition period for carbon neutrality achievement. It is considered as the method to be used only when CO2 emissions exceed the stipulation despite decarbonization efforts by companies and businesses. Therefore, the domestic environmental value market is projected to expand toward 2050, but as a secondary market* rather than a primary market for CO2 emission reduction efforts, the market is expected to expand with restraint.

* “Efforts to Transform Energy Flows for Achieving Carbon Neutrality in Japan: Key Research Findings 2023” released on 20 November 2023.

https://www.yanoresearch.com/en/press-release/show/press_id/3394

Research Outline

2.Research Object: Energy suppliers (electricity, gas, petroleum), demanders (companies, businesses), relevant government offices, and business groups

3.Research Methogology: Face-to-face interviews (online included) by our specialized researchers, interviews via telephone and email, and literature research

About Environmental Value (Carbon Reduction Value= Carbon Offsets and Credits) Market

In this research and analysis, environmental value is defined as the amount of CO2 that companies and businesses reduce, remove, or absorb through their operations. The environmental value of carbon credits (*1) and renewable energy certificates (RECs) (*2) is traded (bought and sold) on a market basis, which we refer to as the domestic carbon credit and certificate market.

In addition to market-based trading, carbon credits and certificates are also traded on a relative basis. The market for carbon credits and certificates and the market for relative trading are collectively referred to as the environmental value market.

This research predicts the market size of the environmental value (carbon reduction value) as a part of the carbon pricing policy (*3), which aims at efficient CO2 reduction.

*1) Carbon credit:

A carbon credit is the gap between baseline emissions (no action taken to reduce emissions) and the emissions after CO2 reduction projects are taken place, which is certified to be able to trade. In CO2 reduction projects, facility/equipment upgrades, deployment of renewable energy equipment, forest management are included.

Companies or businesses that bought carbon credits can offset the value of CO2 emissions caused by their operations. There are several types of carbon credits, such as the J-Credit Scheme, Joint Crediting Mechanism (bilateral crediting), the Cap-and-Trade Program, and various voluntary credits.

*2) Renewable Energy Certificate (REC)

A Renewable Energy Certificate (REC) is the attribute information (environmental value) on CO2 emission factors of renewable energy sources such as solar, wind, hydro, geothermal, etc. that is certified to be tradable.

A REC is the attribute information (power generation date, power plant, power generation method, etc.) and the company or business that has purchased the certificate can offset the power or heat used (or procured) by overwriting with the attribute information of the certificate, thereby reducing the CO2 emissions (carbon offsetting). There are several types of renewable energy certificates, such as green power certificates, FIT non-fossil (renewable) certificates, non-FIT non-fossil certificates (with or without renewable attributes).

*3) Carbon Pricing:

Carbon pricing is the policy method to reduce CO2 emissions to induce companies and businesses to act in an appropriate manner consistent with the market mechanism to reduce emissions by pricing the value of carbon and providing economic incentives.

<Products and Services in the Market>

Environmental value (carbon credits and renewable energy certificates) as a policy of carbon pricing

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.