No.3543

Corporate Gift Market in Japan: Key Research Findings 2024

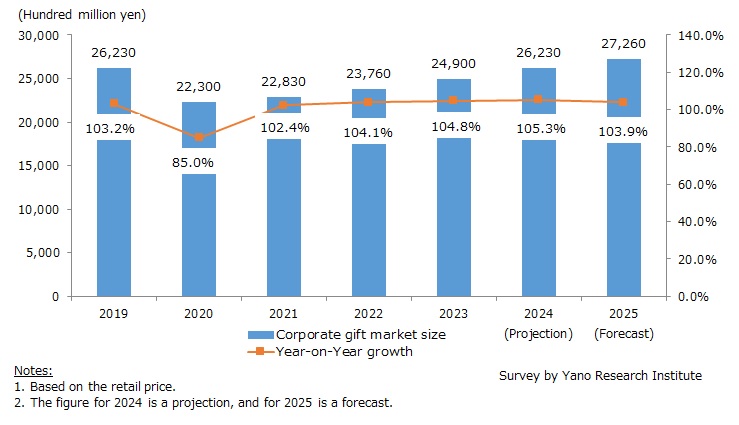

Size of Domestic Corporate Gift Market in 2023 Estimated at 2,490,000 Million Yen, Expected to Exceed Pre-pandemic Level by 2025

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the domestic corporate gift market, and found out the trends by occasion, by sales channel, by item, as well as the market player trends and future perspectives.

Market Overview

Size of the corporate gift market in 2023 was estimated at 2,490,000 Million Yen, 104.8% of the previous year, based on the retail price.

Demand for gifts associated with people getting tother diminished during COVID-19 crisis, including corporate gifts. The market size fell markedly as businesses called off events and sales promotions.

Meanwhile, as more companies started seeing gifting as a communication tool, new opportunities for corporate gifting, such as companies sending gifts to its employees (Business to Employee [B2E] gifts) uplifted the market growth. Moreover, as all kinds of business and social activities resumed in 2022, demand for gifts associated with deteriorated sales promotions has been recovering. Furthermore, a favorable wind is blowing for the corporate gift market since 2023, as seen in the moves of local governments changing a way of providing support to citizens (eligible for certain support programs such as childcare) from cash to physical gifts.

Noteworthy Topics

Enterprises and Local Governments Revaluing Significance of Corporate Gifts

The spread of the new coronavirus has given a chance for businesses and local authorities to reassess the significance of gifting.

Until recently, novelties (give aways) from businesses to consumers were viewed somewhat negatively as items symbolizing mass production/huge waste. However, when companies lost promotion opportunities, such as attracting potential customers to stores or organizing sales events, they seem to have concluded that distributing novelties blindly make no sense. The situation has given a chance for businesses to reevaluate the cost, effectiveness, and efficiency of sales promotion.

In addition, in light of the trends toward the elimination of empty formalities among major companies, the penetration of online meeting tools and the decline of face-to-face negotiations and business dining during the pandemic sank the demand for gifts further. However, although the number of gifting opportunities decreased, quality of gifts is increasing. As meeting business partners in-person become a rare occasion, gifting as a means to show sincere gratitude for accepting face-to-face meeting increased. Businesspersons are increasingly selecting corporate gifts in a meticulous manner, choosing newsworthy items and/or items that suit the tastes and preferences of their business partners increased popularity over standard items.

As observed, people's values and consumption behavior are changing due to the changing times and the situation and mindset caused by the COVID-19 pandemic. As gifting opportunities are lost, it has encouraged reevaluation of the fundamental value of gifting, which is to convey feelings. Providers of items for corporate gifts are required to deepen their understanding of what is needed in society today, and what issues have or have not been resolved through corporate gifts. They must work their way out to communicate the value of gifts effectively.

Future Outlook

Size of the corporate gift market is expected to attain 2,623,000 million yen in 2024 (105.3% of the preceding year) and 2,726,000 million yen in 2025 (103.9% on same basis), based on the retail price. Despite the slight decline of B2B gifts (gifts between businesses) stemming from the trend of eliminating empty formalities, the corporate gift market is projected to grow as a whole, as recovery of B2C gifts (gifts from business to consumer; novelties, etc.) and substantial increases of B2E gifts (gifts from business to employees) and G2C gifts (gifts provided by local government to citizens as a part of certain support programs) contribute to the market growth.

Research Outline

2.Research Object: Gift wholesalers, manufacturers, and retailers

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey via telephone, mailed questionnaire, and literature research

What is the Corporate Gift Market?

In this research, the corporate gift market includes gifts or offerings that business and local governments send to a range of stakeholders. In the case of businesses, it refers to: novelty, prize for promotional campaign, or stockholder benefits for consumers; client gifts to clients, vendors, or suppliers; and gifts sent from employer to employee based on employee benefit programs such as work anniversary gifts and birthday gifts. For local governments, it refers to gifts to be provided to citizens that are eligible for certain support programs (such as childcare).

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.