No.3701

Credit Card Market in Japan: Key Research Findings 2024

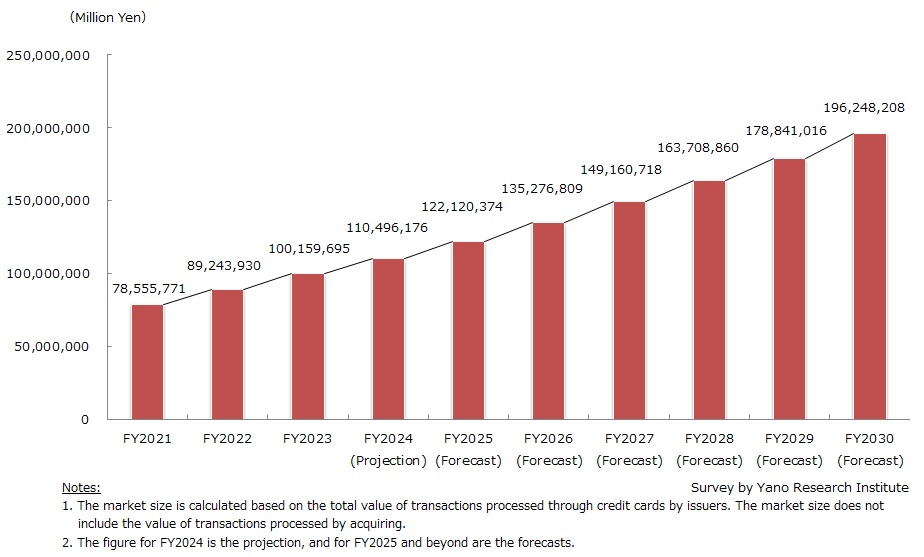

Backed by Penetration of Cashless Payment, Credit Card Market Size Forecasted to Reach 196 Trillion Yen for FY2030

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the credit card market in Japan, and found out the current status, the trends of market players, and future perspective.

Market Overview

The size of the domestic credit card market reached 100 trillion yen-level in FY2022 (based on the transaction value at credit card issuers).

The growth was driven by the increase in consumption in travel, dining and leisure, as well as to the spread of small-value payments and the expansion of merchants in various sectors. In addition, point campaigns implemented by credit card companies and strengthened partnership with banks, securities companies, insurance companies, and other financial institutions have also contributed significantly to market expansion.

Further growth is expected in FY2024 through such efforts, and the credit card market size (based on the transaction volume through credit card by issuers) is expected to reach 110 trillion yen. This growth trajectory is projected to persist.

Noteworthy Topics

Expansion of App Functions Associated with Increase of Cardless Payment

A “numberless card”, a credit card that have no 16-digit number embossed, and a “virtual credit card”, a digital credit card accessible through smartphone or online, are promoted. The benefit of numberless cards includes greater security (preventing number theft) as well as enabling creation of credit cards with a wider design option. The virtual card is promoted primarily for the convenience of users that do not wish to carry around physical credit cards, but also for the benefit of credit card issuers that wish to keep down the cost of card issuance.

Despite the drawback that having no physical card may cause difficult situations in verifying the card number, development of the apps that can indicate the card number on the smartphone has been prompting the issuance of numberless cards and virtual cards. Credit card companies are enhancing the app’s user interface/user experience (UI/UX) also from the standpoint of promoting the use of credit cards, since expansion of UI/UX functionality has proven effective in driving the use of credit cards.

Future Outlook

Transaction through credit cards continues to expand, thus the credit card market size (based on transaction volume of credit cards) is projected to reach 196 trillion yen by FY2030.

The continued adoption of cashless payments is driving market expansion not just through increased usage, but also by penetrating in areas like corporate cards, where the use of credit cards has been limited. Cashless payments are rapidly becoming a part of daily life, particularly for small transactions at convenience stores, cafes, and movie theaters, where high point redemption rates incentivize frequent use. At the same time, large-scale rewards programs targeted at premium cardholders, such as gold and platinum card users, are encouraging greater spending through cashless payments. This has sparked heightened competition among card issuers to attract younger consumers applying for their first premium cards.

As cashless payment adoption deepens, marketing strategies tied to cashless IDs are evolving rapidly. The integration of financial services with digital IDs, not just for payments but also across bank accounts, investment portfolios, and insurance products, is accelerating. This convergence is enabling richer data collection and significantly improving the precision of targeted marketing efforts.

Research Outline

2.Research Object: Major credit card issuers

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), surveys via telephone, mailed questionnaire, and literature research

What is the Credit Card Market?

In this research, the credit card market refers to the total value of transactions processed through credit cards by domestic card holders, the amount of shopping done online and offline. The market size is calculated based on the total value of transactions processed through credit cards by issuers. The credit card here includes corporate cards. The market size does not include the value of transactions processed by acquiring.

<Products and Services in the Market>

Credit card, corporate card, electronic money, contactless payment (a secure method of paying without physically swiping or inserting a card into a terminal including but not limited to touch to pay/tap to pay)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.