No.3801

The eKYC/Public Personal Authentication/Identity Verification Solutions Market in Japan: Key Research Findings 2025

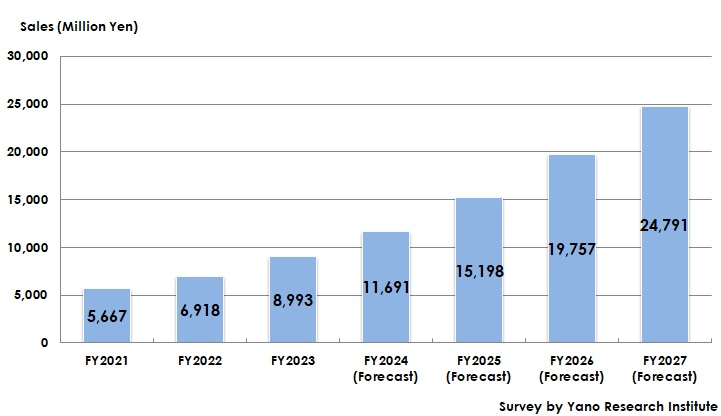

The eKYC/Public Personal Authentication/Identity Verification Solutions Market Expanded by 30% YoY in Fy2023 to 8,993 million yen

Yano Research Institute (the President, Takashi Mizukoshi) conducted research on the domestic eKYC (electronic Know Your Customer), public personal authentication, and identity verification solutions market. The research has examined the current state of the market, the trends among market players, and future prospects.

Market Overview

Traditionally, identity (ID) verification through a bank teller or mail has been mandatory under the Act on the Prevention of Transfer of Criminal Proceeds in financial institutions. Additionally, revisions to the Act allow for online ID verification, with all procedures completed digitally. An increasing number of financial institutions, including all city banks and some local banks (accounting for 60% of all banks), are implementing eKYC solutions.

As the next stage, the proliferation of ID verifications is underway among companies that are not necessarily required to perform them. Specifically, providers of services that connect people and things, such as flea market sites, matching apps, and skill-sharing services, are implementing these solutions. The backdrop behind it is stricter ID verification in business matching apps, which aim to ensure reliable business partners and to enhance service security.

As a result, the market size for eKYC (electronic Know Your Customer) solutions, public personal authentication solutions, and identity verification solutions in Japan increased to 8,993 million yen, which is 130% larger than the previous year.

Noteworthy Topics

Changes in ID Verification Methods

There are various methods of identity verification, and the methods in use are shifting. When eKYC was first introduced, My Number Cards were not widely used, and many people could not remember the code number that they had provided when obtaining their driver's license. Therefore, the most popular eKYC method was submitting a photo of an ID-verifying page of a document, such as a passport or driver's license, as well as a photo of the individual. This method remains the most common, but is expected to decrease over time, because it requires a visual inspection, which is inefficient. Additionally, this method of taking a photo of an ID document for submission makes it easy to falsify an ID, which leads to an increase in fraud.

Consequently, IC-chip reading methods are required. The market became excited when the Digital Agency announced at the 4th Council for the Promotion of a Digital Society that it would allow only public personal authentication for eKYC and revise the Act on the Prevention of Transfer of Criminal Proceeds and the Mobile Phone Improper Use Prevention Act accordingly. Although the agency has not disclosed a specific roadmap for integrating eKYC with public personal authentication, the revisions are final, prompting eKYC vendors to adapt. While integration is limited to industries that require ID verification under these acts, the significance of public personal authentication has increased.

Future Outlook

The domestic market for eKYC (electronic Know Your Customer) solutions, public personal authentication solutions, and identity verification solutions is expected to reach 24,791 million yen by FY2027.

The market is expected to grow steadily, as these solutions continue to be implemented in financial institutions and in the areas where these regulations are not applied, such as matching apps and sharing services.

Research Outline

2.Research Object: eKYC/identity verification solution vendors, and identity verification telecommunication businesses

3.Research Methogology: Face-to-face interviews by expert researchers (including online), survey via telephone, and literature research

The Market for eKYC and Public Personal Authentication and Identification Solutions

eKYC is the abbreviation of electronic Know Your Customer. The market size of eKYC, public personal authentication and identification solutions is the sum of sales of eKYC solutions, which are online procedures of identity verification, and sales of ID verification solutions, which utilize the verified identity information obtained through eKYC. Sales of “public personal authentication,” a service for secure and reliable identity verification using electronic certificates mounted on the IC chip of a My Number card, are included in eKYC sales.

<Products and Services in the Market>

eKYC, public personal authentication, and Identification Solutions

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.