No.3768

Global Automotive Lithium-ion Battery Market: Key Research Findings 2025

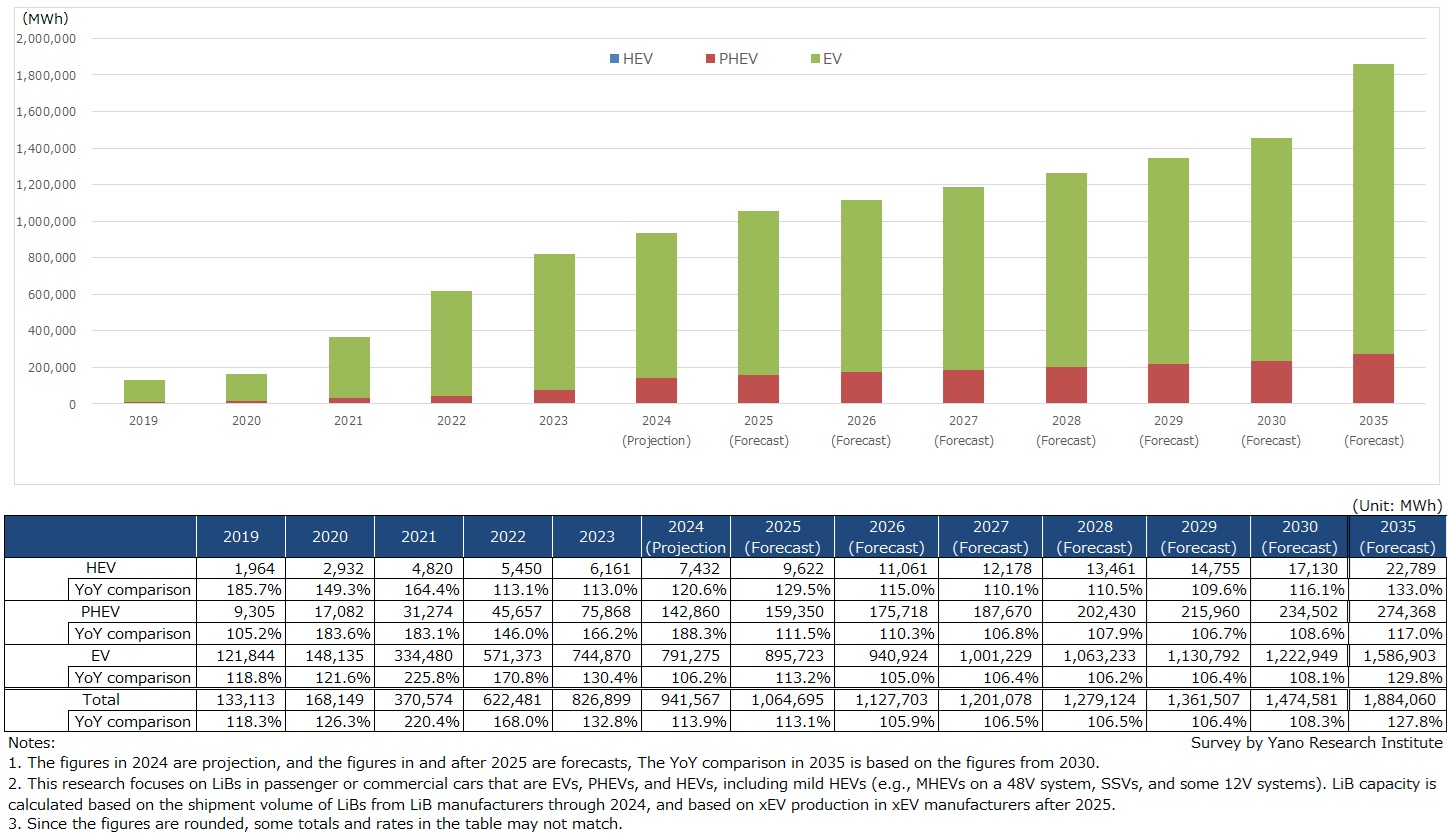

Global Automotive LiB Market Expected to Reach 941GWh in 2024 and 1TWh in 2025

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey on the global market of automotive lithium-ion batteries (LiBs) and found out the trends by product segment, the trend of market players, and the future perspectives. This press release discloses the market size forecasts for global automotive lithium- ion batteries.

Market Overview

The estimated global automotive lithium-ion battery (LiB) market size by capacity grew to 941.5 GWh in 2024, which is 113.9% larger than the previous year. This growth has been in tandem with the increase in global production of xEVs (i.e., electric vehicles [EVs], plug-in hybrid electric vehicles [PHEVs], and hybrid electric vehicles [HEVs.]) Specifically, the capacity of LiBs increased as follows: 7.4 GWh for HEVs (up 20.6% year over year), 142.8 GWh for PHEVs (up 88.3%), and 791.2 GWh for EVs (up 6.2%).

The continuous growth of the xEV market, even after the pandemic, has led to an estimated 28% share of global automobile production for EVs in 2024, with 30% coming into view in 2025. The market by region shows that the growth rates in Europe and North America subsided somewhat in 2024, while China maintained its 2023 level, and kept its position as the growth driver.

Noteworthy Topics

While Market Growth for PHEVs and EVs Continues to Rely on Government Policy, Changes in European and the U.S. Policies on Them will be Key

The market for EVs and PHEVs in Europe is expected to decline in 2024 compared to the previous year due to the reduced or suspended subsidies. The prohibition on selling new internal combustion engines (ICE) vehicles, which was set to begin in 2035, has essentially been retracted, as authorities have permitted the use of electrofuels (e-fuels). European automakers are transitioning to PHEVs, while the European Commission plans to implement stricter utility factors after 2025, aiming to close the gap between actual PHEV CO2 emissions and the standards set by the Worldwide Harmonized Light Vehicles Test Procedure (WLTP). Utility factors measure the rate at which PHEVs use electric charge versus gasoline as fuel. The European Commission's plans on the positioning of PHEVs in achieving carbon neutrality are garnering attention. Due to the declining growth rate of the EV market, the European Automobile Manufacturers' Association (ACEA) is calling for an earlier review of CO2 emission regulations, in 2025.

Although EV sales in North America have exceeded previous years' sales, the growth rate is sluggish, prompting automakers to review their EV strategies. The second term of the Trump administration has begun, which will likely be the headwind for the EV market. Depending on the subsidizing policy for the Inflation Reduction Act of 2022 (IRA), new launches or expansions in battery production are predicted, but the joint ventures between automakers and LiB manufacturers have retracted or postponed their initial operation plans. Conversely, some of the U.S. and Japanese automakers are focusing on HEV development in North America due to the recent, strong HEV market.

In 2024, China has added consumer replacement support to its extended tax exemption for neighborhood electric vehicle (NEV: PHEV and EV) purchases to encourage consumers’ EV purchases. In addition, the cost leadership strategy of Chinese EV manufacturers on PHEVs is gradually shifting the NEV market's focus from EVs to PHEVs, including range extender vehicles that carry an auxiliary power unit.

Japan’s “eco-car” or green vehicle market mainly consists of HEVs. Japan aims to ban ICE vehicles by 2035 and promote HEVs as one of the next-generation green vehicles.

Future Outlook

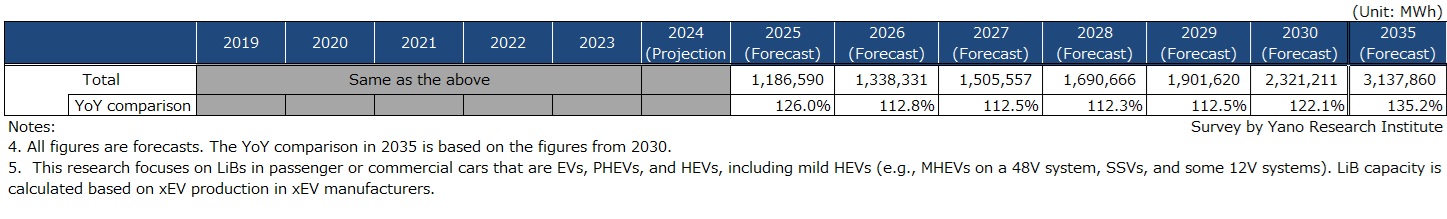

Yano Research Institute has forecasted the xEV market growth with two scenarios; one based on governmental policies (the aggressive forecast that tends to result in a higher growth rate), and the other based on the xEV market environment (the conservative forecast that tends to result in a lower growth rate).

The aggressive forecast expects higher growth rates, as it anticipates by and large achievements against the targeted xEV proliferations by each country, due to each automaker’s electrification efforts. In the aggressive forecast, the global automotive LiB market based on the capacity is projected to reach 1,186 GWh by 2025, 2,321 GWh by 2030, and 3,137GWh by 2035.

On the other hand, the conservative forecast anticipates a lower growth rate, because it expects needing more time to overcome various challenges to xEV proliferation, such as improving usability and affordability to meet consumer needs.

While there is a common view in the industry that the automotive LiB market forecasts need to be reviewed due to the recent sluggish growth rates, opinions differ on the time frame for doing so. Those opinions that emphasize short-term reviews anticipate that the EV market will improve again around 2026. This is because of new fuel regulations in Europe, and zero-emission vehicle (ZEV) regulations in California, as well as the launch of low-priced EVs by European and the U.S. automakers, with steady decreases in automotive LiB prices being the prerequisite for this.

Meanwhile, some are skeptical of the continuous profitability of low-priced EVs. Low-priced vehicles tend to be small in vehicle size class, and the smaller the vehicle size is, the higher the battery cost ratio. Lower EV prices stem from lower battery costs, assuming a declining trend in battery prices from 2023 to 2024, as well as the adoption of lithium iron phosphate (LFP) cells. However, caution is needed regarding the continuity of this trend. According to the conservative forecast, the global automotive LiB market size, based on the capacity, is projected to reach 1064 GWh by 2025, 1,474 GWh by 2030, and 1,884 GWh by 2035.

Research Outline

2.Research Object: Automakers, automotive lithium-ion battery manufacturers in Japan, Europe, China, and South Korea

3.Research Methogology: Face-to-face interviews (including online) by expert researchers and literature research

About the Automotive Lithium-ion Battery Market

Automotive lithium-ion batteries (LiBs) are those installed in electric vehicles (EVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs) to power their motors.

This research focuses on LiBs in passenger or commercial cars that are EVs, PHEVs, and HEVs, including mild HEVs (i.e., MHEVs on 48V system, SSVs, or partly on 12V systems). LiB capacity has been calculated based on LiB shipment volumes in LiB manufacturers through 2024, and based on xEV production by xEV manufacturers after 2025.

<Products and Services in the Market>

LiBs for EVs, LiBs for PHEVs, LiBs for HEVs, LiBs for Mild HEVs

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.