No.2615

Contactless Payment Market in Japan: Key Research Findings 2020

Increasing Demand for Touchless Interface Expands Contactless Payment Market

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the global market of contactless payment, and has found out the current condition, the trends at market players, and the future perspectives. Here, an analysis on contactless payment market in Japan is announced.

Market Overview

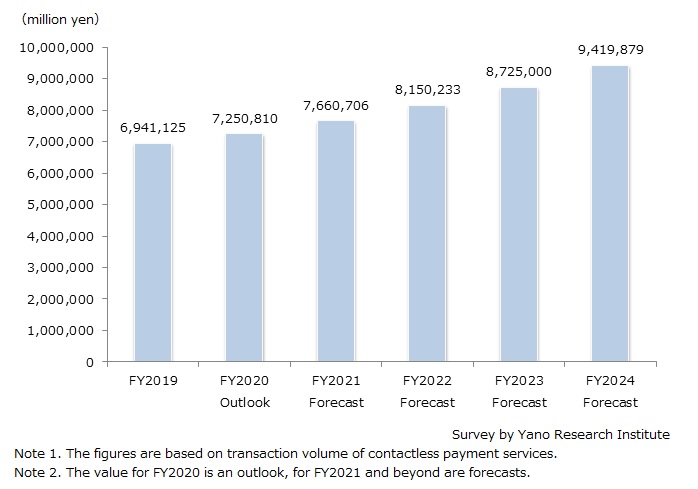

The domestic contactless payment market size (based on the transactions by contactless payments) is valued at 6.9 trillion yen in FY2019 and is expected to exceed 7.2 trillion yen in FY2020. Supported by the increasing use of post-pay IC-type electronic money and contactless mobile payment (payment with smartphone such as QR Code*), the market is likely to continue on an expanding trend.

*QR Code is a registered trademark of DENSO WAVE INCORPORATED.

Noteworthy Topics

Growth of Contactless Payment Provided by Global Financial Services Brands

Since global financial service brands including Visa are promoting issuance of contactless-enabled credit cards, post-pay IC-type contactless payment is on the rise. Although contactless payments have accounted mostly for small amount payments in the past, it is also being used for relatively high spending in recent years, due to increased adoption of post-pay IC-type contactless payment. Accordingly, installation of contactless payment terminals has been accelerated at participating merchants, expanding locations and opportunities that accept contactless payments. Furthermore, an environment conducive for seamless payments is in place for users, since contactless payment does not require them to hand over one’s card to merchant as in traditional credit card payment.

Future Outlook

Driven by the consumer preference in making non-contact payment for pandemic purchases, all in all, demand is growing for contactless payments.

As contactless payment technology is equipped as a standard function in newly issued credit cards, international financial brands are promoting contactless payment further. Moreover, against the backdrop of increasing usage of electronic money, it is assumed that the pervasion of contactless payment continues hereafter.

Based on these factors, size of the domestic market of contactless payment (based on the transactions of contactless payment) is projected to exceed 9 trillion yen by FY2024.

Research Outline

2.Research Object: Domestic leading contactless payment service providers

3.Research Methogology: Face-to-face interviews with our expert researchers, survey via telephone and email, and literature research

Contactless Payment

In this research, contactless payment indicates the payment service using near field communication via NFC-installed medium such as cards and smartphones, which enables completion of payment simply by waving/tapping the device against a payment terminal. Main methods of contactless payments are pre-paid non-contact IC-type electronic money and post-pay non-contact IC–type electronic money. The market size is calculated as a total of transactions (amount of billing) by non-contact IC-type electronic money and contactless payment services of international financial brands.

<Products and Services in the Market>

Credit cards, electronic money, etc.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.