No.3936

Commercial Vehicle Telematics Market in Japan: Key Research Findings 2025

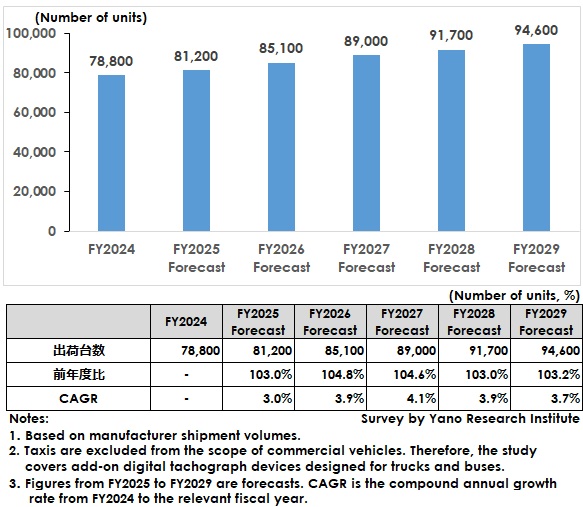

Digital Tachograph Shipment Volume for Trucks and Buses Estimated at 78,800 Units in FY2024

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey of commercial vehicle telematics market and revealed the trend of market players and the market outlook. In here discloses the digital tachograph market size forecast for trucks and buses.

Market Overview

Based on manufacturer shipment volumes, the market for digital tachographs for trucks and buses is estimated at 78,800 units in FY2024.

A digital tachograph is a device that records vehicle travel data, including distance, driving time, and speed, in digital format. Owing to its higher accuracy and tamper-resistant features compared to traditional analog models, it plays an important role in managing and tracking drivers’ working hours. Market expansion in fiscal year 2024 (FY2024) was driven by a surge in last-minute demand ahead of the new regulation taking effect in April 2025. The regulation mandates digital tachographs for existing charter buses. Installations for charter buses were therefore concentrated in FY2024, as mandatory installations began in April 2024 for new charter buses and in April 2025 for existing ones.

Beyond this one-time surge, voluntary installations — beyond the compulsory ones — have also supported ongoing market growth. Large charter bus operators have adopted digital tachographs equipped with wireless communication capabilities to streamline fleet management, which has generated replacement demand.

Noteworthy Topics

Enhancing Digital Tachographs: Transitioning from Mere Recording Devices to a Work Support Infrastructure

Digital tachographs have evolved from traditional recording devices into comprehensive work support infrastructures that enhance fleet management and operational efficiency.

Through the use of AI technologies and data analytics, digital tachographs have expanded their capabilities to detect signs that could lead to accidents as well as to provide educational support and business judgment. Consequently, the perception of these devices has shifted—they are now viewed as tools that directly impact corporate competitiveness.

These advancements have led major transportation companies to prioritize more than mere regulatory compliance. Many are shifting to adopt digital tachographs with telecommunication features to optimize fleet management. This trend is expected to expand across the industry, further increasing demand for digital tachographs with connectivity capabilities.

Future Outlook

Based on manufacturer shipment volumes, the market for digital tachographs for trucks and buses is projected to reach 81,200 units in FY2025, representing 103.0% of the previous year’s size.

Although the growth rate has slowed due to the subdued surge in demand following the new regulation mandating installation on existing charter buses, the implementation of two transportation- and logistics-related regulations is expected to encourage shippers to optimize their logistics and achieve greater objectivity in fleet management. These changes in mindset are anticipated to spread throughout the industry, shifting the focus toward digital records and connectivity-enabled digital tachographs.

Deployment of these digital tachographs is expected to increase between FY2026 and FY2027. Installations may expand beyond mandated businesses due to awareness campaigns and subsidy policies by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) and industry organizations. The enforcement of the two transportation- and logistics-related regulations mandates installation in certain transportation companies and urges shipper businesses to strengthen contractor management, while also leading to increased adoption in non-mandated businesses as an indirect effect.

Since FY2027 is expected to be a milestone year for the MLIT’s progress in achieving its installation rate targets, the market for digital tachographs for trucks and buses is forecasted to continue steady growth, reaching 89,000 units in FY2027, or 104.6% of the previous year’s size. The deployment of digital tachographs with connectivity capabilities will extend beyond regulatory compliance to support more sophisticated transport operational management, improved work processes, and safer road operations. These high value-added solutions are likely to increase adoption, accelerating the shift to higher-performance digital tachographs, primarily among major transportation operators.

Research Outline

2.Research Object: Providers of digital tachographs, drive recorders, and fleet management solutions

3.Research Methogology: Face-to-face interviews with our specialized researchers (including online interviews), and literature research

What is the Digital Tachograph Market?

A tachograph is a device that records vehicle travel information, which include distance, driving time, and speed. These devices are categorized as either analog or digital, depending on their recording method.

This research focuses solely on digital tachographs and excludes analog ones.

Additionally, taxis are excluded from the scope of commercial vehicles. Therefore, the study covers add-on digital tachograph devices designed for trucks and buses. The market size is based on shipment volumes of manufacturers that develop and produce these devices.

<Products and Services in the Market>

Digital Tachographs

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.