No.3847

Cosmetics OEM Market in Japan: Key Research Findings 2025

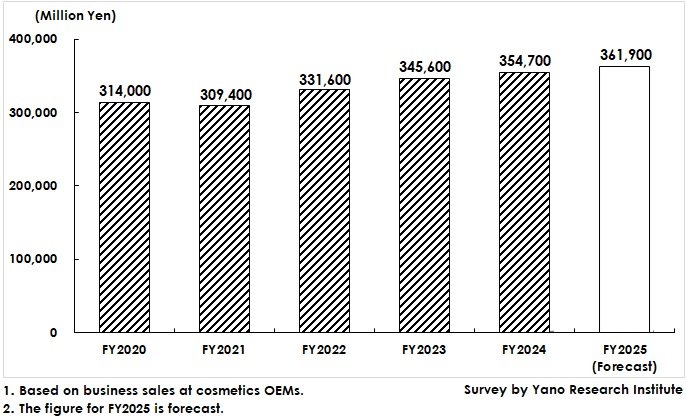

Cosmetics OEM Market Increased by 2.6% YoY to 354,700 Million Yen in FY2024

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey on the cosmetics original equipment manufacturer (OEM) market in Japan and found out the status, trend of market players, and prospects.

Market Overview

Based on business sales, the cosmetics original equipment manufacturer (OEM) market generated 354,700 million yen in FY2024, a rise by 2.6% from the previous fiscal year.

The market temporarily flourished as client companies, i.e., cosmetics brands or new market entrants from other industries, placed new or renewed orders in the hope that demand for cosmetics would recover once the pandemic ended and behavioral restrictions were lifted. However, cosmetics store sales have fallen short of expectations.

This is due to the diversification of consumer needs and preferences. Products and sales channels have also diversified with the emergence of mail order and ecommerce channels, as well as the increased distribution of overseas products, such as Korean cosmetics. To prevent stagnant inventory flows stemming from the gap between actual and expected demand, companies plan order placement forethoughtfully. In this context, the market has been soft, though a moderate recovery in order placement has been observed.

Meanwhile, price negotiations between cosmetics OEMs and clients since FY2022 have resulted in pass-through at each manufacturer, boosting the market size to exceed that of the previous years.

Noteworthy Topics

Diversification of Products and Sales Channels Led to Small-Lot Orders

The cosmetics market in Japan was previously supported by distribution channels consisting primarily of stores offering general cosmetics products. However, these channels have rapidly diversified due to the prevalence of mail order and online sales.

Impactful added-value products are now offered through mail order and online retail, developed primarily by fabless manufacturers (sometimes from other industries) that specialize in product planning and sales promotions.

Simultaneously, the market has diversified into small mass markets that cater to specific needs and interests. This contrasts with the previous mass market that uses general distribution channels. These small mass markets are represented by original brand products and businesses operated by TV celebrities, artists, and famous beauticians, leveraging social media. Changes in the distribution structure prevent client companies from placing large-scale orders for specific markets and channels. This tendency is likely to continue. Cosmetics brand manufacturers are expected to continue reconstructing their brand portfolios to adapt to these channels.

Future Outlook

The cosmetics OEM market is expected to reach 361,900 million yen in FY2025, 102.0% of the size of the previous fiscal year.

Despite the market's overall soft trend, stable demand is anticipated due to recovering makeup demand after the pandemic and invigorated market conditions stemming from robust consumption by inbound tourists. Well-selling haircare and skincare brands and products have emerged, which were developed by fabless manufacturers, offering products primarily through mail order and online channels. This momentum, including those new market entrants, is expected to continue.

Research Outline

2.Research Object: Original equipment manufacturers (OEMs) in cosmetics, companies in the business of cosmetics containers and ingredients, cosmetics manufacturers, and other related enterprises and organizations

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, survey via telephone, mailed questionnaire, and literature research

The Cosmetics OEM Market

In this research, the cosmetics original equipment manufacturer (OEM) market is defined as a market where contract manufacturers produce skincare, makeup, haircare, and other cosmetics products upon being ordered by clients who are often cosmetics brands or new market entrants from other industries. The cosmetics OEM market consists of three main submarkets: contract manufacturing (main players: OEMs), cosmetics containers (container manufacturers and dealers), and cosmetics ingredients (ingredient manufacturers and traders).

* Until 2024, the cosmetics OEM market was translated as the cosmetics contract manufacturing market. Since the term cosmetics OEM is more popular, we changed the title of the press release.

<Products and Services in the Market>

Cosmetics items (for skincare, makeup, haircare, others), containers for cosmetics merchandises, ingredients for cosmetics products.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.