No.3842

Global Market of Four Key Lithium-ion Battery Components: Key Research Findings 2025

In 2024, Global Market for Four Key LiB Components Decreased Due to Oversupply in 2023 Caused by Accelerated Chinese Capital Investments, Generating Price Competition in LiB Components in Around 2021

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey on the global market of four major lithium-ion battery components and found out the trends of applications (small consumer equipment and vehicles) and the shipment, and of country-based capital investment and component prices, etc.

Market Overview

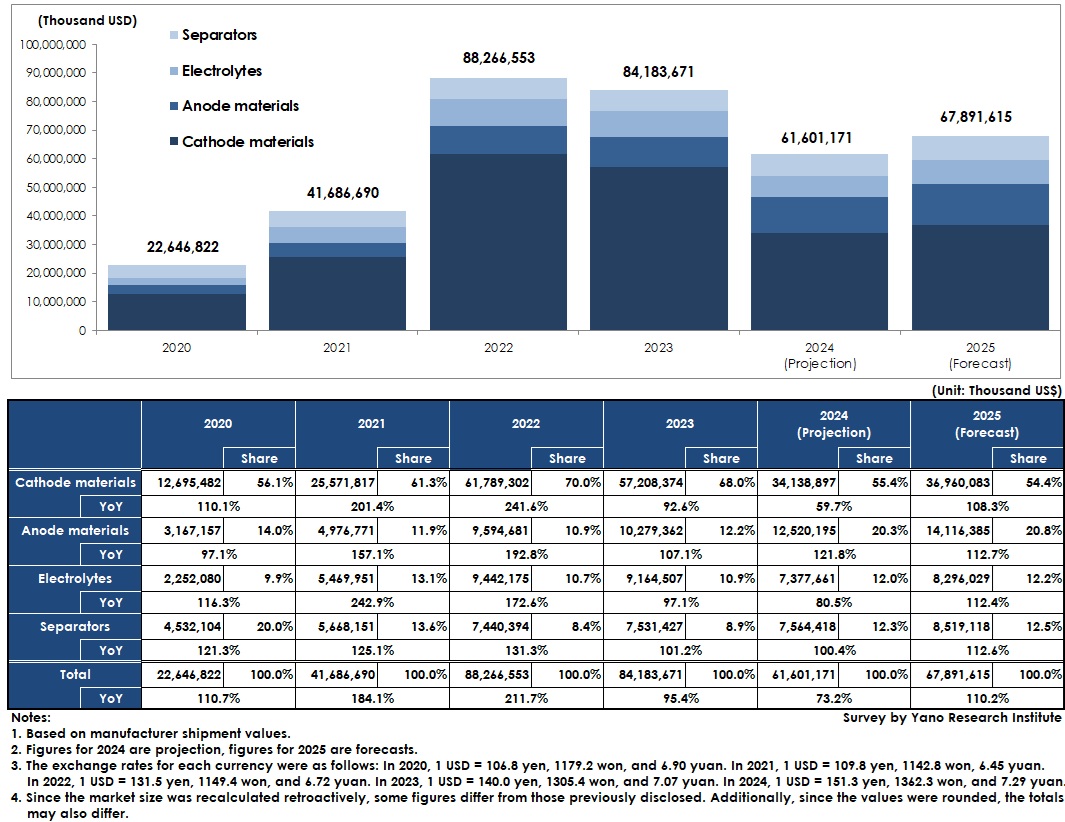

The global market of four key lithium-ion battery (LiB) components is projected to decline to US$61,601,171 thousand in 2024, which is 73.2% of the size in the previous year, based on manufacturer shipment values.

The growth rate of the global automotive LiB market slowed during 2023 and 2024. Regarding the regional markets for EVs and PHEVs (i.e., the demanders of automotive LiBs), China maintained the same growth level as the previous year, while the markets in Europe and the United States declined. Although EV sales growth decreased in China from the previous year, the Chinese EV market was supported by PHEV growth. Due to these factors, the growth rate of automotive LiBs based on shipment volume is also expected to decline.

Meanwhile, the global small consumer LiB market declined in 2023, but is expected to rebound in 2024, due to the recovery in demand for LiBs in notebook PCs and smartphones.

As in 2023, the prices of the four key LiB components declined in 2024, due to lower material prices (such as lithium prices), an oversupply from slower automotive LiB growth, and fiercer price competition. Although the shipment volume of the four key components is projected to exceed the previous year’s level, the global LiB market size is expected to decline for the second consecutive year. The price decline has been particularly significant for cathode materials and electrolytes. Despite no price-rising factors identified for 2025, prices may increase in 2026 or beyond, depending on the supply and demand balance and material price trends.

Noteworthy Topics

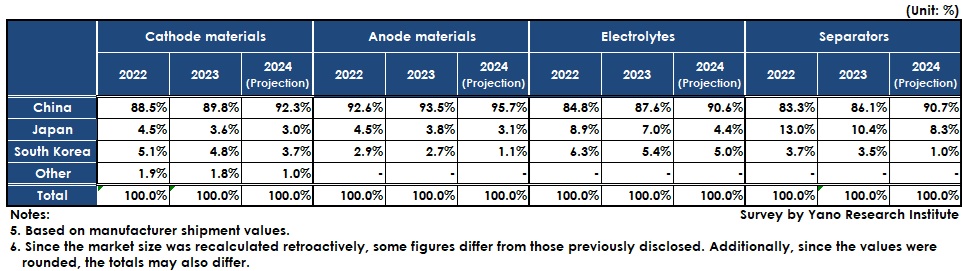

In 2024, China Dominated the Share of All Four Key LiB Components by Shipment Volume by Over 90%

The global market share of the four key lithium-ion battery (LiB) components by country (based on manufacturer shipment volume) showed that Chinese LiB component manufacturers dominated the market for all four components, accounting for over 90%.

While several of these Chinese LiB component manufacturers showed growth in shipment volume in 2024, their growth rates are expected to slow compared to the high-growth period from 2021 to 2022. An imbalance between supply and demand has led to an oversupply. Excessive price competition has also occurred in an attempt to maintain capacity utilization. Most companies expect negative growth in sales values.

Since around 2022, these factors have created a gap between the volume of Chinese automotive LiBs produced by manufacturers and the volume installed in xEVs. According to some of Chinese LiB component manufacturers, this gap has widened by 2024. The growth rate of Chinese LiB component shipment volume may be lower than the estimated figures of this research when the shipment volume of materials is closer to actual demand (i.e., the volume installed in xEVs).

Meanwhile, the shipment volume of many Japanese and South Korean LiB component manufacturers is projected to level off or decrease in 2024 compared to the previous year. This is because they will be embroiled in China’s declining material prices and because of their efforts to regulate component shipment volume to secure profits. Additionally, it is because of the growth-stalled EV market in Europe, reducing the automotive LiB production there and diminishing LiB component demand.

Future Outlook

Accelerated capital investments among Chinese LiB component manufacturers during 2021 and 2022 led to an imbalance between suppliers and demanders. This caused an oversupply in the global four key LiB components market since around 2023. In the future, some of these Chinese companies will likely withdraw from the market or be absorbed by larger companies. A reduction in LiB component production capacity is expected to rebalance between supply and demand, increasing LiB component prices once again.

Currently, it must be difficult for LiB component manufacturers to invest in facilities due to decreased LiB component prices causing low profitability (or possible deficits). However, the xEV market is growing moderately in the long term, and automotive LiB demand is expected to catch up with supply.

In the Chinese market, neighborhood electric vehicles (NEVs), i.e., plug-in hybrid electric vehicles (PHEVs) and electric vehicles (EVs), are beginning to account for 50% of new car sales, exceeding the government's target (announced in 2020) ahead of schedule. However, further market expansion cannot be expected from domestic NEV demand, because the market requires lower prices and the government has not set a goal of 100% NEVs. Therefore, the market growth will likely depend on the momentum and timing of the growing demand for Chinese LiBs and LiB components targeting the European market.

Meanwhile, Japanese and South Korean LiB component manufacturers are looking to the U.S. market because the U.S. is likely to maintain the tax credit (Section 45x) for battery production in the clean energy sector under the Inflation Reduction Act. In addition, the deliberations are ongoing regarding the conditions for the non- Foreign Entity of Concern non-FEOC) (*) to be included in Section 45x. The trend of excluding China from the U.S. battery supply chain remains unchanged, since Japanese and South Korean LiB component manufacturers are receiving requests from U.S. battery manufacturers and OEMs (automakers) to use materials other than China.

Consequently, Chinese LiB component manufacturers are targeting the European market as growth target, while Japanese and South Korean manufacturers to look to the US market to focus.

*) A Foreign Entity of Concern (FEOC) includes entities “owned by, controlled by, or subject to the jurisdiction or direction of” the governments of China, Russia, Iran, or North Korea).

Research Outline

2.Research Object: Manufacturers of lithium ion battery components (in Japan, South Korea, and China)

3.Research Methogology: Face-to-face interviews (including online) by expert researchers, and literature research

About Four Key Lithium Ion Battery Components

Lithium ion batteries are used as power supply for smartphones and other communication devices and power sources for electric vehicles (EVs), plug-in HEVs (PHEV), etc. This research highlights the following four key components among more than ten that make up lithium-ion batteries: Cathode materials, Anode materials, Electrolyte, and Separator.

The market size has been calculated based on the shipment values, on the US-Dollar basis. The exchange rates for each currency were as follows: In 2020, 1 USD = 106.8 yen, 1179.2 won, and 6.90 yuan. In 2021, 1 USD = 109.8 yen, 1142.8 won, 6.45 yuan. In 2022, 1 USD = 131.5 yen, 1149.4 won, and 6.72 yuan. In 2023, 1 USD = 140.0 yen, 1305.4 won, and 7.07 yuan. In 2024, 1 USD = 151.3 yen, 1362.3 won, and 7.29 yuan.

<Products and Services in the Market>

Cathode materials, Anode materials, Electrolyte, and Separator.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.