No.2884

Home Centers/DIY Hardware Stores Market in Japan: Key Research Findings 2021

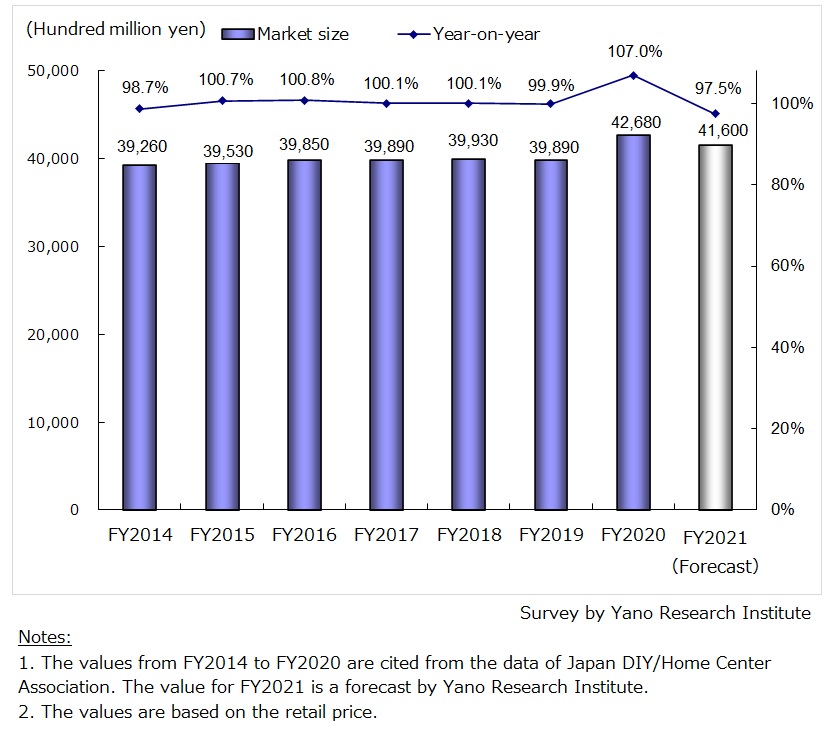

Home Center/DIY Hardware Stores Market for FY2021 Projected to Decline to 97.5% YoY to 4,160 Billion Yen

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a survey on the domestic home center/DIY hardware stores market, and found out the market trends, the trends of specialty hardware stores for professionals, and future perspectives.

Market Overview

According to Japan DIY/Home Center Association, in 2000s the domestic home center/DIY hardware stores industry decelerated, growing only at the level of 1%. The market experienced a downturn for the first time in FY2006.

While the home center/DIY hardware stores market barely grew in FY2018/2019, yielding only 100.1% and 99.9% of preceding fiscal year, respectively, due to the surge in demand led by COVID-19 crisis, the market for FY2020 attained 428 billion yen, recording the fastest growth of 7.0% year on year. Factors that underpinned the growth include 1) consumer preference for stores that make social distancing easier while they shop, 2) stable sales of anti-pandemic products such as facial masks, alcohol-based sanitizers, acrylic boards, and vinyl sheets, and 3) spike in sales of gardening and DIY, driven by a lengthy period of voluntary lockdown.

Sales of the home center business of majority of the 25 enterprises surveyed exceeded that of the previous fiscal year; except for one company, they topped the sales of the preceding year. Demand grew especially for DIY, gardening, and storage items that are needed by people who had to tidy up their homes to create a workspace at home, in connection with the increase of remote working. Moreover, rise in demand for pet items was also notable as people looked for pets to deliver healing while they spend longer hours at home.

Meanwhile, a growing number of home center companies are eying on business alliance, expanding business by mergers and acquisitions. Nevertheless, since the M&A trend and pandemic-driven demands are both transient, from the medium to long term viewpoint, environment surrounding the market is challenging.

Noteworthy Topics

Specialty Hardware Stores for Professionals Growing Steadily

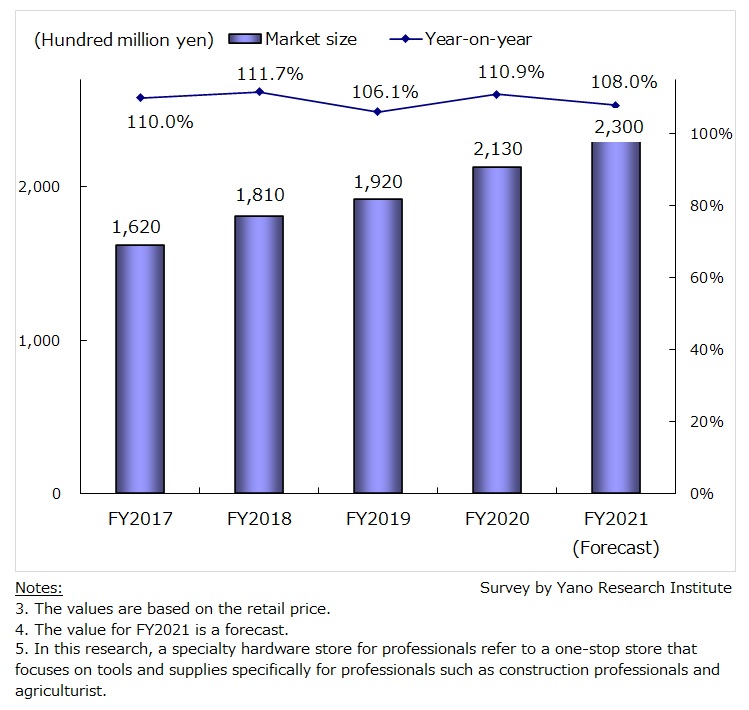

In this research, a specialty hardware store for professionals refer to a one-stop shop that focuses on tools and supplies specifically for professionals such as construction professionals and agriculturists. Conventional stores focusing on a single product category, such as timber merchant, hardware stores, and metalware stores, are not included.

Because management of specialty hardware stores for professionals require multiple sourcing and wide variety of products, companies that are well-capitalized and capable of operating large-scale home center/DIY hardware stores play the central role in the industry. Other market players include “PROSTOCK” (owned by Koizumi Co., Ltd., the housing equipment trading company), “Denzai Kaitori Center” (whose primary business is a contractor of air conditioner installation), “Shima Corporation” (owned by Shima Bukuro, K.K.), and “Best Material Corporation” (owned by BEST BKM, K.K. in Niigata).

The market of specialty hardware stores for professionals is estimated to have yielded 213 billion yen for FY2020, making a double-digit growth of 10.9% from the previous fiscal year. The growth in FY2020 attributes to the rise in demand for remodeling of detached houses as well as for air conditioners and ventilators. Most of the companies continued to roll out new stores even amidst the COVID-19 crisis, and the sales of those new stores together with stable sales at existing stores contributed to the business performance. In particular, “Kohnan PRO”, the specialty hardware store that boasts the number of outlets, has been accelerating new store opening. It is leading the market of specialty hardware stores for professionals by opening an average of 10 stores per year in the last few years.

Based on the outlook of more store openings and continuance of healthy sales at existing stores, the market size of specialty hardware stores for professionals is projected to reach 230 billion yen for FY2021, 108.0% of the preceding fiscal year. The specialty hardware stores for professionals are the game changers, rapidly grabbing the market share of conventional market players like timber merchants and metalware stores. The market of specialty hardware stores for professionals expects further expansion hereafter.

Future Outlook

Considering the store roll out plans and sales outlook by companies operating home centers/DIY hardware stores, size of the home center/DIY hardware stores market is projected to attain 4,160 billion yen for FY2021, 97.5% of the previous fiscal year.

In the medium to long term, decline in population is likely to shrink the size of home center/DIY hardware stores market, while competition intensifies with other types of retailers. Against the background of decrease in the total number of stores, the market size will stay at almost the same level or diminish slightly.

Meanwhile, it should be noted that each company promotes digital marketing. If they succeed in customer acquisition strategies, such as marketing online membership programs to prospective members and increasing frequency of visits to physical stores, the companies may retain customers acquired during the COVID-19 calamity.

Research Outline

2.Research Object: Retailers, manufacturers, and wholesalers in home centers and DIY hardware stores business

3.Research Methogology: Face-to-face interviews by the expert researchers, survey by telephone/email, and mailed questionnaire

What is the Home Center/DIY Hardware Stores Market?

Regarding size of the domestic home center/DIY Hardware stores market, the values from FY2014 to FY2020 is cited from the data by Japan DIY/Home Center Association, and the value for FY2021 is a forecast estimated by Yano Research Institute.

<Products and Services in the Market>

DIY goods and materials, electric products, interior products, household necessities, gardening and exterior products, pet products, automobiles and outdoor, hobbies, services, etc.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.