No.3428

Cold Chain Logistics Market in Japan: Key Research Findings 2023

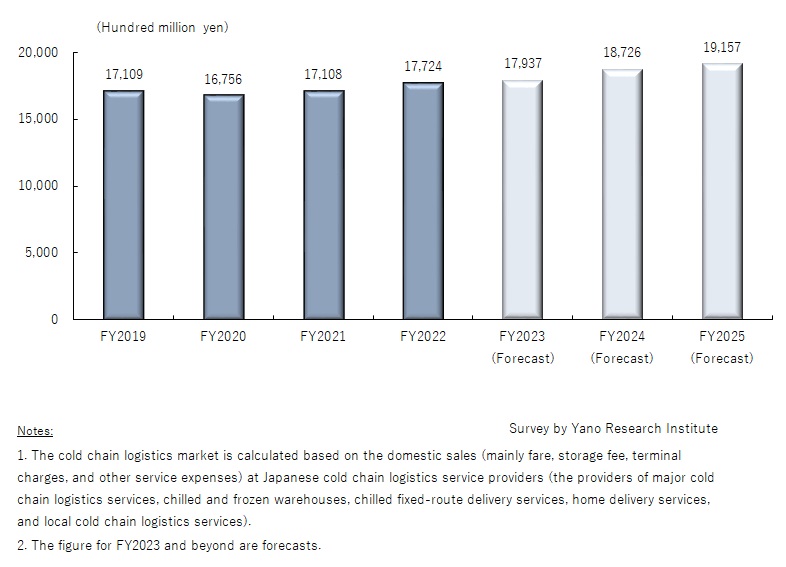

Cold Chain Logistics Market for FY2022 Grew by 3.6% from Preceding Fiscal Year to 1,772,400 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the cold chain logistics market in Japan and has found out the market size, the trends of market players, and future perspectives.

Market Overview

The cold chain logistics market size for FY2022, calculated based on the domestic sales at Japanese cold chain logistics service providers, grew by 3.6% from the previous fiscal year to 1,772,400 million yen. As seen in a 3.6% rise from the market size of FY2019 (1,710,900 million yen), the market is demonstrating a strong growth even compared to the levels prior to the outbreak of the COVID-19 crisis.

The market growth in FY2022 was driven by the recovery of business activities in many industries, which underpinned the demand for chilled/frozen foods, as well as to a rise in logistic costs stemming from the soaring labor cost, electricity charge, and fuel prices.

Noteworthy Topics

Factors Influencing Cold Chain Logistics Market Sie Fluctuation

One of the factors that contributes to the expansion of the cold chain logistics market is the trend of increasing cold storage warehouse capacity (including freezer warehouses). While frozen foods require roughly 2.5 times the space required to store livestock products, and their long shelf life tends to cause long-term storage, cold storage logistics companies are rebuilding (expanding) or constructing new cold storage warehouses to meet rising demand for frozen foods. In addition, there is a growing need for chilled warehouses equipped with functions suitable for food distribution in areas close to consumption areas, such as retail warehouse and multi-functional warehouse. These warehouses are often capable of adapting to frequent warehousing and providing additional processing for food products. It is assumed that these factors will grow the cold storage logistics business, and eventually expand the whole market.

Future Outlook

The cold chain logistics market size for FY2023, calculated based on the domestic sales at Japanese cold chain logistics service providers, is forecasted to grow by 1.2% from the previous fiscal year to 1,793,700 million yen.

Although the reclassification of COVID-19 to Category 5 under the Infectious Disease Control Law is favorable for retailers, the main consigner of the cold chain logistics, considering the sluggish consumption due to soaring prices, a slow recovery of food service industry, and inbound tourist demand not returning its heyday, the volume of goods to be handled by cold logistics will remain flat to slightly increase. Meanwhile, as the 2024 logistics problem approaches, labor cost associated with securing drivers is poised to rise. For this reason, the market size is forecasted to grow continually.

Research Outline

2.Research Object: Logistics companies, wholesalers, and makers involved in cold chain logistics, and the competent authorities

3.Research Methogology: Face-to-face interviews by the expert researchers (including online interviews), surveys via telephone and letters, as well as literature research

What is the Cold Chain Logistics Market?

The cold chain logistics market in this research refers to a logistics system with the temperature controlled throughout the supply chain from production to consumption, mainly for foods. In the system, the temperature must not deviate either from the following fixed ranges, i.e., constant temperature (5°C to 18°C), chilled (-18°C to 10°C), or frozen (-18°C or below).

The cold chain logistics market in this research is calculated based on the domestic sales (chiefly fare, storage fee, terminal charges, and other service expenses) at Japanese cold chain logistics service providers (the providers of major cold chain logistics services, chilled and frozen warehouses, chilled fixed-route delivery services, home delivery services, and local cold chain logistics services). However, the sales of major trading companies, wholesalers specific to perishable foods, major food wholesalers, and other wholesalers are not included. Those mid-and-small size and individual service providers that mainly receive transportation/delivery orders are also excluded.

<Products and Services in the Market>

Cold chain logistics of food (and some chemicals)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.