No.3404

Life Insurance Distribution Channels in Japan: Key Research Findings 2023

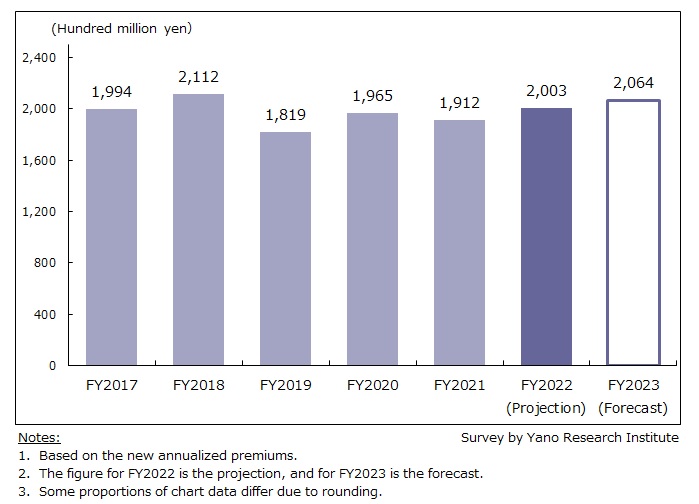

Insurance Shops Market Size in FY2022 Expected to Grow by 4.8% from Preceding Fiscal Year to 200, 300 Million Yen

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the distribution channel strategy of domestic insurance companies and business strategies of independent insurance agents. This press release announces the market size of insurance shops (based on the annualized premiums).

Market Overview

The severe economic environment, marked by the prolonged COVID-19 crisis, rising prices, and stealth tax raise, heightened the need for reviewing life insurance policies and reconsidering the purchase of new ones. In FY2022, consumers focused on saving money and reassessing their approach to asset building by revisiting their insurance policies.Independent insurance agents are seeing an increase in inquiries for medical insurance with broader coverage at lower premiums, single-payment whole life insurance, and foreign currency-denominated life insurance, which is gaining attention due to the interest rate hike in the United States. As demand for these types of insurance grows, the insurance brokerage market for FY2022 is projected to grow by 4.8% compared to the previous fiscal year, reaching 200,300 million yen.Although foot traffic has returned to pre-pandemic levels, the growing demand for the convenience of online quotations makes it unlikely that insurance shops will experience significant growth in FY2023. Additionally, the time-consuming nature of in-person interactions at insurance shops could have a negative impact on their performance.On the other hand, the government's "Asset Income Doubling Plan" may increase the number of customers interested in asset building with insurance products.Considering both factors, the market size for FY2023 is expected to grow by 3.1% from the prior fiscal year to 206,400 million yen, and the number of new insurance policies to be sold will reach 2.04 million. The market foresees recovery to pre-pandemic level.

Noteworthy Topics

Expansion of Online Customer Engagements

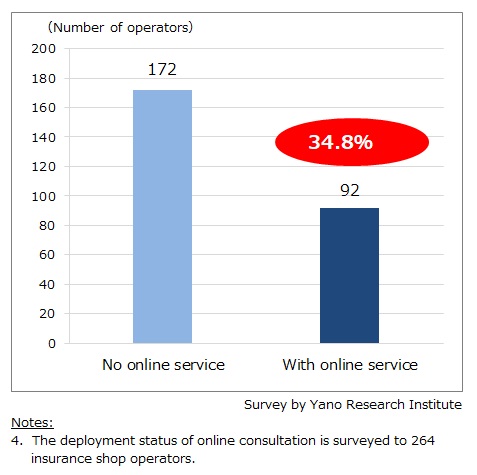

The COVID-19 crisis prompted independent insurance agents operating insurance shops to expand their online services. As of August 2023, 92 out of 264 independent agents (34.8%) had introduced online consultation services. This marks an increase of approximately 5 percentage points from the 2022 survey, where the adoption rate was around 30%.

At the same time, traditional life insurance companies are also shifting toward a hybrid sales model, combining online services with in-person interactions. Historically, direct sales were solely focused on face-to-face engagements. However, the push for digitalization and the impact of the pandemic have driven these companies to enhance customer engagement through a more flexible, hybrid approach.

Future Outlook

The domestic insurance market is increasingly seen as a shrinking industry, driven by a range of socioeconomic challenges, including low birthrates, an aging population, and overall population decline.

However, the environment surrounding the industry has become chaotic. On one hand, there is an increase in the number of customers interested in asset building with insurance stemming from the government's "Asset Income Doubling Plan" and in preparing financially for “the risk of extended longevity”. On the other hand, there is a major trend of tightening household expenses including insurance due to a rise of uncertainties, such as soaring product prices and tax hikes.

There is potential for growth for both insurers and independent insurance agents, provided they address customer needs related to "the risk of extended longevity and increasing health consciousness" as well as "asset building." Additionally, engaging new customer segments, such as tech-savvy seniors, Gen Z, and those previously indifferent to insurance, presents further opportunities. Although life insurance coverage in Japan is already high and nearing saturation, the market could still expand if these "Blue Ocean" opportunities are effectively tapped into.

Research Outline

2.Research Object: Companies that sell insurance policies including conventional life-insurance companies, online life insurers, and independent insurance agents (insurance shops, online services, door-to-door sales)

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews) and literature research

About Insurance Shops

Insurance shops in this research refer to independent insurance agents that sell insurance policies at physical retail location, which work with multiple insurance companies to offer a variety of life insurance policies. The market size is calculated based on the annualized premiums at operating companies.

<Products and Services in the Market>

Consumer insurance and commercial insurance, life insurance and non-life insurance (general insurance)

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.