2019/05/09

Management Integration Issues Between Renault and Nissan; Nissan Should Not Turn Its Back from the Negotiations

Renault once again approached Nissan about integrating the management of the two companies. Since the announcement last November of the sudden leave of the “charismatic” figure Carlos Ghosn, who had kept the balance between the two companies, the battle on who will take new leadership between the two companies surfaced. On April 12, a new management body (Alliance operating board) formed by the top executives of Renault, Nissan, and Mitsubishi Motors met, and announced that this body would hold the right to make all top level management decisions. Renault’s Chairman, Jean-Dominique Senard, supported the transition of the management of the groups to the new body and the issue regarding management integration was shelved. Or so it seemed.

Prior to and following the meeting by the new management body, management integration had been proposed again by Renault. Nissan’s management group rejected this, their wishes to continue its management as an independent company while maintaining partnership with Renault.

For Renault, on the other hand, management integration with Nissan is basically a request out of desperation. In September 2018, Renault had suggested management integration to Nissan through ex-chairman, Carlos Ghosn. Also this past January, as a major shareholder of Renault, the French Government once again approached the Japanese Government regarding the integration of the two companies. And this timing of the suggestion again in April to Nissan, who held their Extraordinary Shareholders Meeting on April 8, was a form of “constraint”, to say the least.

At this point in time, Nissan is above Renault both in performance and technological capabilities. However, it could be said that because of that, Renault invested in the future of Nissan who once faced management crisis. Renault’s capital and 43.4% voting rights should not be taken lightly.

By FY2030, the Ministry of Foreign Affairs and the Ministry of Economy is targeting to mandate the improvement of fuel efficiency by 30% above the target set for FY2020, as well as to raise the popularization target of next generation fuel efficient vehicles, both means to catch up to Europe and China, who are the global leaders in environmental regulations and next-generation vehicles. Nissan and Renault are still far behind, their investments for research and development for FY2018 495.8 billion yen and 380 billion yen respectively, not even reaching Toyota’s investment amount combined. And to compare, the investment for research and development by Volkswagen exceeded 1.5 trillion yen.

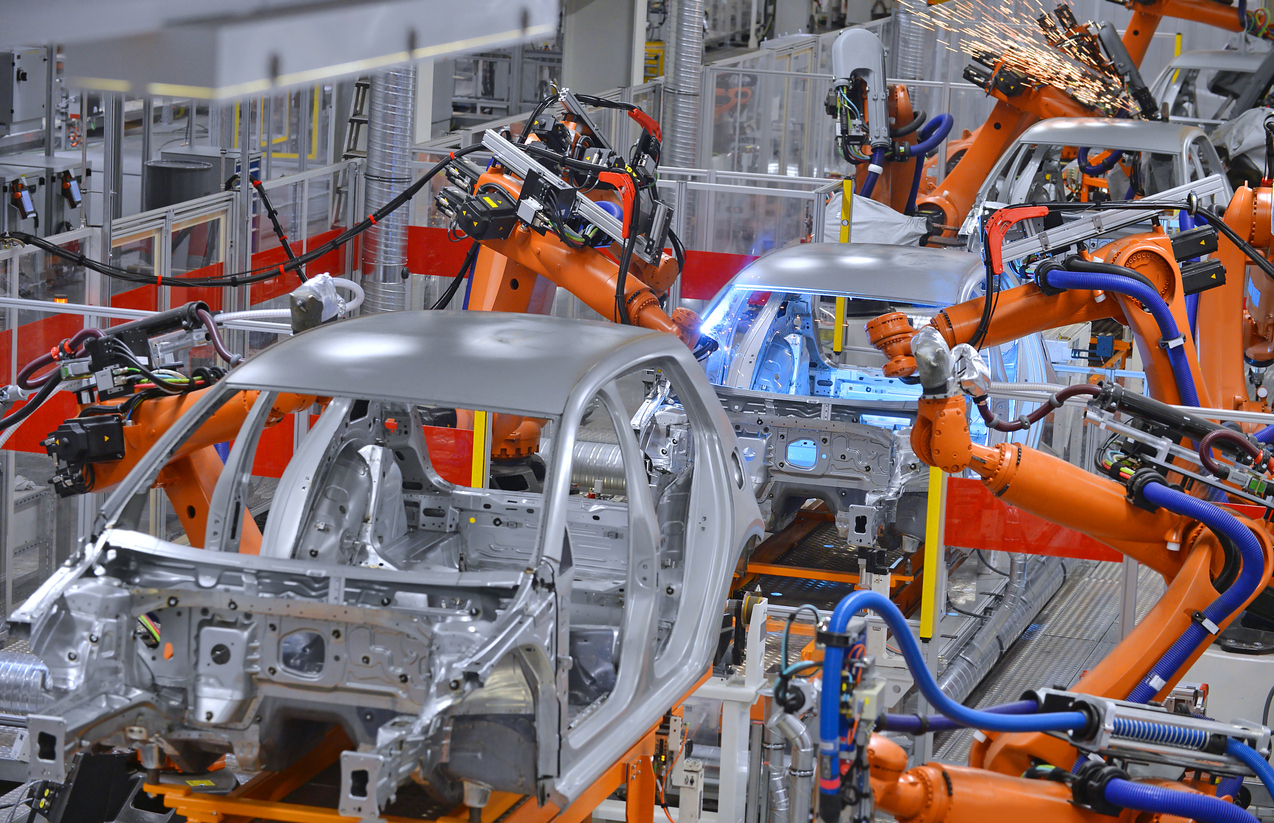

The automobile market is currently in the waves of reconstruction and forming new partnerships to establish their competitive advantage in the market for the future. The main players in the market are major IT companies and new ventures who are the driving forces behind CASE (Connected Autonomous Shared Electric). Within such environment, the argument of “the national interests of Japan and France” does not benefit either company, and when left behind this competition in the market, the next acquirer most likely will not be an automobile manufacturer. If there is something Nissan needs to do, it is to “accelerate” its integration structure in order to survive the forthcoming future. By taking leadership of the integration strategy and showing results, the issues with capitals can be resolved.

Takashi Mizukoshi, the President