No.3987

Life Insurance Distribution Channels in Japan: Key Research Findings 2025

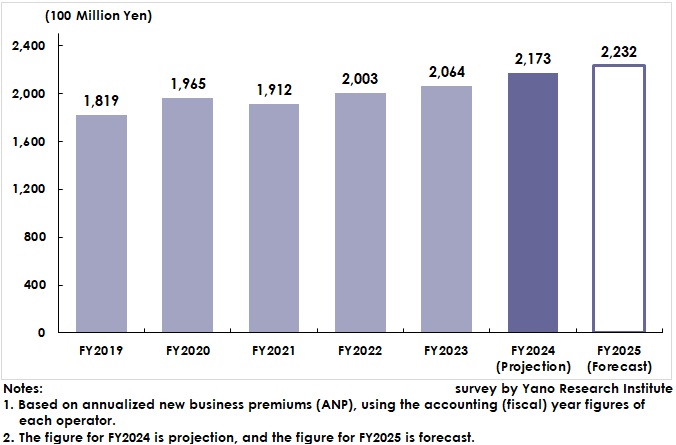

Insurance Shop Market Size Grew by 5.2% YoY to Reach 217.3 Billion Yen in FY2024

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the distribution channel strategy of domestic insurance companies and business strategies of independent insurance agents. This press release announces the market size of insurance shops (based on the annualized premiums).

Market Overview

In FY2024, the launch of the new NISA program continued to influence the demand for building assets through life insurance products. This has led to robust sales of single-premium life insurance, foreign currency-denominated insurance, and savings insurance, including variable life insurance. Based on annualized new business premiums (ANP), the market size for insurance shops is expected to grow 5.2% year over year, reaching 217.3 billion yen in FY2024. However, despite signs of improved profitability stemming from the consolidation of unprofitable shops, some insurance shop operators experienced decreased foot traffic and sluggish new customer visits.

The market size for insurance shops is forecast to reach 223.2 billion yen in FY2025, a 2.7% increase from the previous fiscal year. While the demand for asset building remains high, foreign currency-denominated insurance products are likely to become less attractive due to the shrinking interest rate difference between the United States and Japan. After Japan ended its negative interest rate policy and maintained it at around 0.5%, the Federal Reserve Board lowered its policy interest rate.

In this context, affordable health insurance with comprehensive coverage is garnering attention, which is slowing new life insurance contracts. Additionally, insurers are compelled to concentrate their resources on reorganization in response to the Amendment to the Insurance Business Act, which also slows their growth. For the insurance agent industry, improving its image and appealing to healthier operations are key to leaping forward in the future.

Noteworthy Topics

Insurance Agents’ New Challenges Provided by Amendment to the Insurance Business Act

In response to the amendment to the Insurance Business Act, insurance agencies are required to address the following challenges: 1) providing advanced comparative recommendations, 2) rectifying excessive favoritism, and 3) strengthening the compliance framework.

To provide comparative recommendations, more agents are adopting systems capable of securities analysis and product comparison based on objective criteria, including the number of insurance policy applications. Therefore, system vendors that supply these systems to insurance agents view the regulatory reform as favorable, given the increased demand it generates.

To address the issue of excessive favoritism, some insurance agents have stopped holding events and seminars. Meanwhile, some other agents engaged in advertising have started ensuring business transparency by guaranteeing fair transactions with insurance companies. However, the sudden end of back-office support by insurance company employees has left insurance agents lacking knowledge, which may cause them to withdraw from partnerships with insurance companies.

Appointing a compliance officer to strengthen the compliance framework appears challenging, because, in many cases, this position must be served concurrently within the existing system due to the number of shops, limited human resources, and unspecified qualification requirements.

In the meantime, some companies have started developing in-house systems to digitize written and oral records and automate workflows. Consequently, regulatory reform is impacting competitiveness among insurance agencies.

Future Outlook

The insurance industry must transition from a product-sales-based business model to an advanced service-based model, due to proliferation of generative AI and the need to respond to customer demands.

While industrial reform is underway, the life insurance market is trending downward in the medium to long term due to fewer children and declining population. However, the younger population and the “new rich” who have a higher demand for asset building, and the indifferent population who should review their insurance, are expected to create new market opportunities. Growing demand for asset succession will also increase the importance of insurance products.

Ongoing mergers and acquisitions, as well as the entry of foreign-affiliated companies, are widening the gap among insurance agents. Non-face-to-face sales and digital responses are inevitable. Agents who cannot adapt to these changes may become obsolete. Due to the generalization of financial planning consultations and fiercer competition in financial education, insurance agents who only offer insurance policies will not survive. The key is to have comprehensive consulting abilities, including asset building and succession planning.

Research Outline

2.Research Object: Companies that sell insurance policies including conventional life-insurance companies, online life insurers, and independent insurance agents (insurance shops, online services, door-to-door sales)

3.Research Methogology: Face-to-face interviews (including online interviews) by specialized researchers, and literature research

About Insurance Shops

In this research, insurance shops refer to independent insurance agents that sell insurance policies at physical retail locations, which partner with multiple insurance companies to offer a variety of insurance products. The market size is calculated based on annualized new business premiums (ANP), using the accounting (fiscal) year figures of each operator.

<Products and Services in the Market>

Consumer insurance and commercial insurance, life insurance and non-life insurance

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.