No.3974

IT Investments by Domestic Enterprises in Japan: Key Research Findings 2025

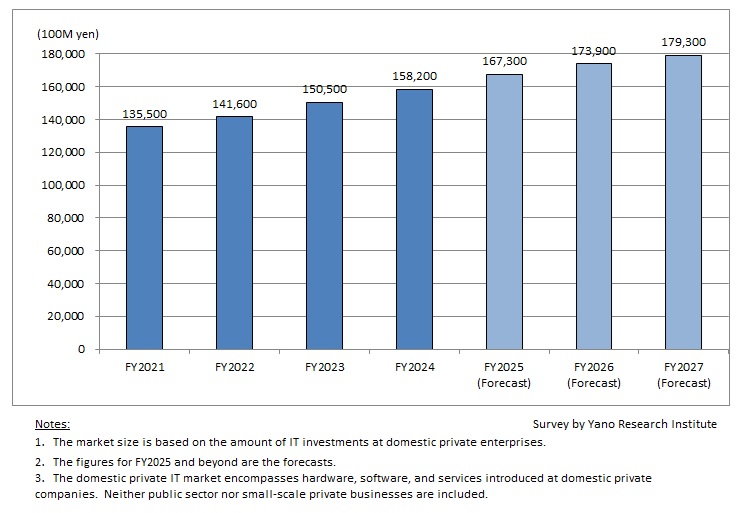

IT Investments by Domestic Private Enterprises in FY2024 Amounts to 15.82 Trillion Yen, Up 5.1% YoY

Yano Research Institute (the President, Takashi Mizukoshi) carried out a survey on the current status and future trends of IT investments by domestic private enterprises in FY2025.

Market Overview

The domestic private IT market in FY2024 is valued at 15.82 trillion yen, up 5.1% from the previous fiscal year. Replacement of mission-critical systems accelerated in FY2024, chiefly among large enterprises. Market growth was driven further by growing momentum for cybersecurity to protect against escalating cyber threats like ransomware attacks.

Noteworthy Topics

Cybersecurity at Overseas Bases

Out of the 500 respondents to the FY2025 Survey (questionnaire to domestic private companies), 164 enterprises have overseas bases. These 164 companies were asked to identify the key areas in which they have increased IT spending for their overseas bases (multiple responses allowed). While 39.0% reported no budget expansion in any area, 31.1% increased spending on cybersecurity, and 18.9% increased spending on production management systems.

When compared with the results of FY2011 Survey*, notable differences emerge in investment priorities. In FY2011 Survey, production management system ranked as the top priority (57.7%), followed by accounting systems (40.4%) and sales management systems (32.7%), with cybersecurity ranking fourth (20.2%). This shift reflects the global intensification of cyber threats. As a result, groupwide cybersecurity measures have become increasingly crucial, particularly for enterprises with overseas bases.

*FY2011 Survey: Based on Global IT Strategy of Japanese Enterprises 2011 (published in September 2011, Yano Research Institute), retabulated. (n=104, multiple responses allowed) The FY2011 Survey was re-tabulated excluding "unknown" and "no response" cases. FY2025 Survey's "no expansion in any area" is not shown in the chart. The results of FY2011 Survey and FY2025 Survey were reviewed side by side, though differences in survey conditions should be considered when interpreting the comparison.

Future Outlook

The domestic private IT market is projected to grow by 5.8% year-on-year to 16.73 trillion yen in FY2025, 17.39 trillion yen by FY2026 (3.9%), and 17.93 trillion yen by FY2027 (3.1%).

Associated with the termination of Windows 10 in FY2025 that necessitates OS migration and PC replacements, spending on hardware is on the rise. Coupled with the legacy system renewal, security strengthening, and business operation systems’ cloud migration, IT investments are expected to expand steadily. Spending on utilization of AI like generative AI is also brisk. This includes user fees for AI-related services and cost for building foundation to maximize AI usage, such as database generation, which are forecasted to expand considerably.

Spending on OS migration and PC replacements is expected to continue into FY2026, though at a lower level than anticipated for FY2025. Market growth will be supported by the renewal of mission-critical systems, the cloud migration of business operation systems, and the utilization of AI.

However, the weak yen, inflation, and rising costs resulting from persistent labor shortages are placing pressure on domestic enterprises, which may lead to delays in, or a scaling back of, their IT investments.

Under these circumstances, enterprises need to reassess investment priorities, focus on securing and developing in-house IT talent, and promote standardization and automation to achieve long-term cost reductions and accelerate system development.

Research Outline

2.Research Object: Domestic private companies

3.Research Methogology: Questionnaire to private companies and literature research

In this research, the domestic private IT market encompasses hardware, software, services (maintenance, managed services, and outsourcing), and online services (ASP and cloud services) introduced by domestic private companies as a crucial investment supporting the long-term stability and growth of the company. The total market size is calculated based on the IT investments at the domestic private companies. Note that public sector (government agencies and local governments) and small-scale private businesses are excluded.

Alongside the research, a questionnaire was conducted to assess the current status and future trends of IT investment by domestic private companies (“FY2025 Survey”).

*[Survey period] June to August 2025 [Target audience] 500 domestic private companies [Survey methodology] Questionnaire distributed via mail or email, with responses collected through mail or online platform.

<Products and Services in the Market>

IT investment by domestic private enterprises on hardware, on software [including customization], managed service/outsourcing services for maintenance and operations, online services like ASP/cloud, access charges, consulting, etc.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.