No.3950

Market for Consumer Goods and Services for Feminine-Care/Femtech in Japan: Key Research Findings 2025

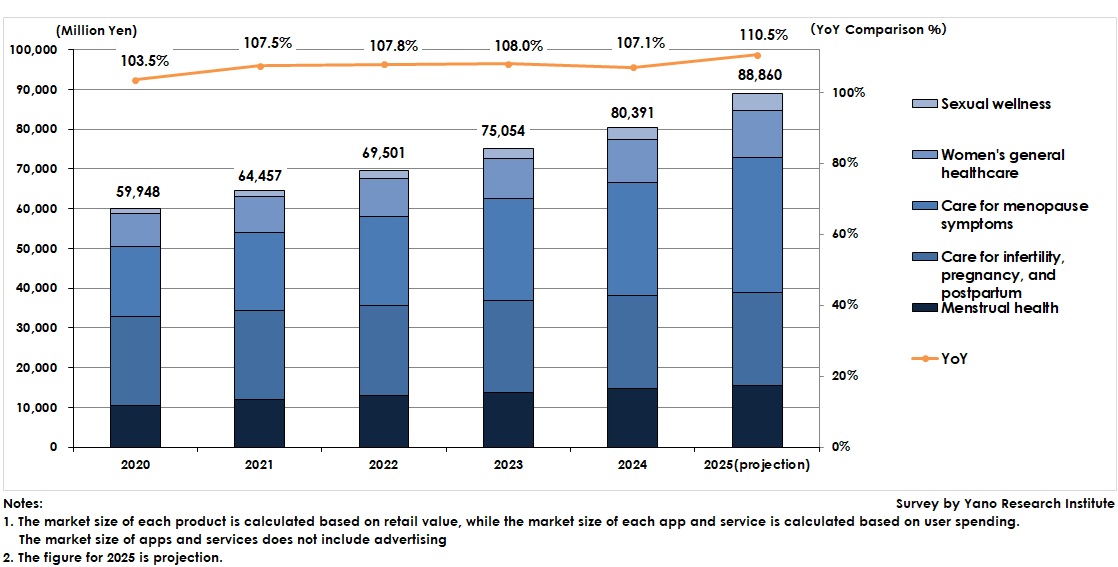

The Market Size for Consumer Goods and Services for Feminine Care/Femtech Grew to 80.3910 Billion Yen in 2024, 107.1% of Previous Year’s Size

Yano Research Institute (the President, Takashi Mizukoshi) studied the Japanese market for feminine care and femtech consumer goods and services. The study revealed the status and trends of market players, as well as the market's challenges and prospects.

Market Overview

The market for consumer goods and services in feminine care and femtech was estimated to reach 80.391 billion yen in 2024, 107.1% of the size of the previous year.

The menopause symptom care category has experienced continuous double-digit growth since 2021 due to increased awareness of menopause symptoms. This category surpassed the infertility, pregnancy, and postpartum care category in 2023, and reached 28.0 billion yen by 2024.

Though still small, the sexual wellness category — traditionally considered taboo in Japan — has recorded double-digit growth since 2021, as has the menopause symptom care category. These categories contributed to the expansion of the total feminine care and femtech market.

Noteworthy Topics

Accelerated Introduction of Employee Benefit Services in Companies

In February 2024, the Ministry of Economy, Trade and Industry (METI) announced that women’s health issues, including menstrual and menopausal symptoms, as well as gynecological cancers, accounted for 3.4 trillion yen of the country’s economic losses. This indication in numbers by the METI will significantly impact the feminine care and femtech market.

Since around 2013, the government has promoted health-focused corporate management nationwide, leading to the concept to become well-rooted concept today. In this context, the feminine care and femtech market has emerged to address women’s health issues in the workplace. Furthermore, labor shortages have led companies to recognize the importance of women in the workforce and enhance their support.

As the enormous losses associated with women’s health issues have become widely recognized, corporate support for women's health and femtech is expected to grow. These corporate efforts, as well as individual consumption, are expected to further increase the market size.

Future Outlook

The market for consumer goods and services in feminine care and femtech is projected to reach 88.86 billion yen, which is 110.5% of the previous year’s size.

The femtech boom appeared to be over due to negative factors, including the closure of specialty stores and the withdrawal of some businesses from the menstrual health sector. However, increased awareness of menopause symptom care and sexual wellness has contributed to total market expansion.

Additionally, as drugstores and variety stores have strengthened these items and services, the distribution channels have broadened nationwide. Drugstores' release of private brand products in the second half of 2024 has appealed to a wider range of customers. This expansion of distribution channels is expected to cause the market for consumer goods and services in feminine care and femtech to continue growing, instead of ending up as a temporary boom.

Research Outline

2.Research Object: Feminine care product manufacturers and distributors, the femtech market players, femtech product distributors, etc.

3.Research Methogology: Face-to-face interviews (including online) by specialized researchers, survey via telephone & email, questionnaire, and literature search.

What is the Market for Consumer Goods and Services in Feminine-Care/Femtech?

This research focuses on the domestic market for consumer goods and services related to feminine care and femtech. This market includes products and services in the following five fields: 1) menstrual health, 2) care for infertility, pregnancy, and postpartum, 3) care for menopause symptoms, 4) women's general healthcare, and 5) sexual wellness.

The market size of each product is calculated based on retail value, while the market size of each app and service is calculated based on user spending (the billing amount). The market size of apps and services does not include advertising revenues.

<Products and Services in the Market>

Menstrual-health products/services: Include period (absorbent) panties, menstrual cups, menstrual discs, non-polymer (cotton) sanitary napkins, cloth menstrual pads, detergent for menstrual stains, and period tracking apps. Infertility, pregnancy, and postpartum care products/services: Include supplements (e.g., folic acid, minerals, and vitamins), pregnancy and ovulation test kits, basal thermometers, self-syringe kits, pelvic support belts, postpartum shapewear girdles, postpartum shapewear, maternity clothing and dresses, maternity underwear, pregnancy-safe skincare products, apps and social media services for fertility care and prenatal care (e.g., ovulation management and in vitro fertilization support), search engines for fertility treatment information and clinics, fertility consultation services, endometrial flora check kits, ovarian age test kits, apps for pregnant women and for childbirth(e.g., nutritional management and health management and tracking), and online consultation services for pregnant, postpartum, and prospective mothers. Menopause symptom care products/services: Include supplements (e.g., soybean isoflavone, equol, black cohosh, and vitamins), Chinese medicines (e.g., dong quai, Poria cocos, Camellia japonica 'Kamiminoso’[cultivar of common camellia], and Shokukusho Tang), incontinence care products, skincare products for menopausal women, vaginal healthcare products, healthcare apps for menopause, online consultation services for menopausal women, and mailed equol test kits. Women's general healthcare products/services: Include supplements and Chinese medicines to relieve premenstrual syndrome (PMS) and hormone-related symptoms; delicate-zone care products; perioperative care products, such as compression socks and stockings and post-surgery bras and underwear, for surgeries involving gynecological cancers (e.g., breast and cervical cancer); underwear for women, including sleep bras and thermal underwear; mailed test kits for gynecological cancers; and hormone tests. Sexual wellness-related products/services: Include self-pleasure products, products for pelvic floor muscle exercises, and mailed test kits for venereal diseases.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.