No.3858

Food Retail Market in Japan: Key Research Findings 2025

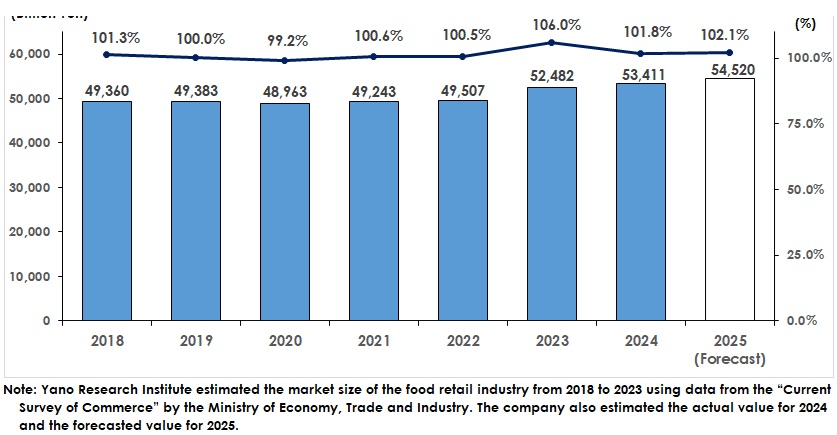

Food Retail Market Estimated at 53,411.3 Billion yen in 2024, 101.8% of Size of Previous Year

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey of the domestic food retail industry, focusing on supermarkets and mass merchandisers. The survey revealed trends in the industry and company trends, and the future outlook.

Market Overview

According to the “Current Survey of Commerce” by the Ministry of Economy, Trade and Industry, the food retail market in Japan was valued at 52,482.0 billion yen in 2023. Based on the market trends by segment, Yano Research Institute estimated the market size for 2024 to be 53,411.3 billion yen, 101.8% of the previous year’s size. The market has grown for four consecutive years since 2021.

Of the market segments, department stores (for food and beverage sales) were the only ones to decline, decreasing to 98.9% of the previous year’s size. Meanwhile, mass merchandisers & large-scale supermarkets increased to 103.3% of the previous year’s size, and small- and medium-sized supermarkets & food and beverage retailers increased to 101.4% of the previous year’s size. Convenience stores, a subset of these small and medium-sized supermarkets & food and beverage retailers, grew to 101.9% of the size of the previous year.

Noteworthy Topics

Overall Industrial Trend in Supermarkets

Despite structural changes in the society, including an aging population with fewer children, the Japanese supermarket industry has maintained steady growth, backed by stable demand for food, which is a daily necessity. However, overall supermarket sales have leveled off between 2022 and 2023, due to increased opportunities to go out resulting from the resumption of economic activity after the pandemic ended and the subsequent decline in at-home demand.

In recent years, the growth of dual-income and single-elderly households has increased the demand for bento boxes and ready-to-eat food. Despite competition from convenience stores, sales of these highly profitable items have remained stable. Unlike processed foods, which are experiencing fierce price competition, this category has established itself as a promising merchandise domain, enabling supermarkets to expand their offerings. Soaring commodity prices have caused consumers to tighten their budgets to maintain their standard of living, resulting in sluggish sales for well-known food brands. Conversely, private brands, which are often low-priced, are showing favorable sales.

Future Outlook

The food retail market is forecast to continue its good performance in 2025, reaching 54,520.0 billion yen, 102.1% of the previous year’s size. Although the domestic economy is expected to maintain path on the recovery, rising commodity prices are reducing consumers’ willingness to purchase. Their desire to maintain their current standard of living may cause them to spend more cautiously and continue to prioritize low prices.

Supermarkets, facing ever-severe competition, must not solely rely on price appeals to attract customers. It is imperative that they receive stable support from the local community. To respond to consumer needs and behavioral changes, supermarkets must differentiate themselves from competitors through product development, operate stores that focus on customer experiences, and use digital technologies to increase work efficiency and offer new services.

Research Outline

2.Research Object: Food retail industry centered on supermarkets and mass merchandisers, other related companies and organizations

3.Research Methogology: Market research data compilation by our specialized researchers, and literature research

About Food Retail Industry Market

Yano Research Institute estimated the market size of the food retail industry from 2018 to 2023 using data from the “Current Survey of Commerce” by the Ministry of Economy, Trade and Industry. The company also estimated the actual value for 2024 and the forecasted value for 2025.

<Products and Services in the Market>

The environment surrounding the food retail industry (changes in markets, commercial distribution, shifts in anchor tenants within commercial facilities, consumption environment), trends by business format (department stores, mass merchandisers, convenience stores, small-to-medium-sized food supermarkets, other food and beverage retailers), profitability of food supermarkets, and the current state of supermarkets.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.