No.4002

Credit Card Market in Japan: Key Research Findings 2025

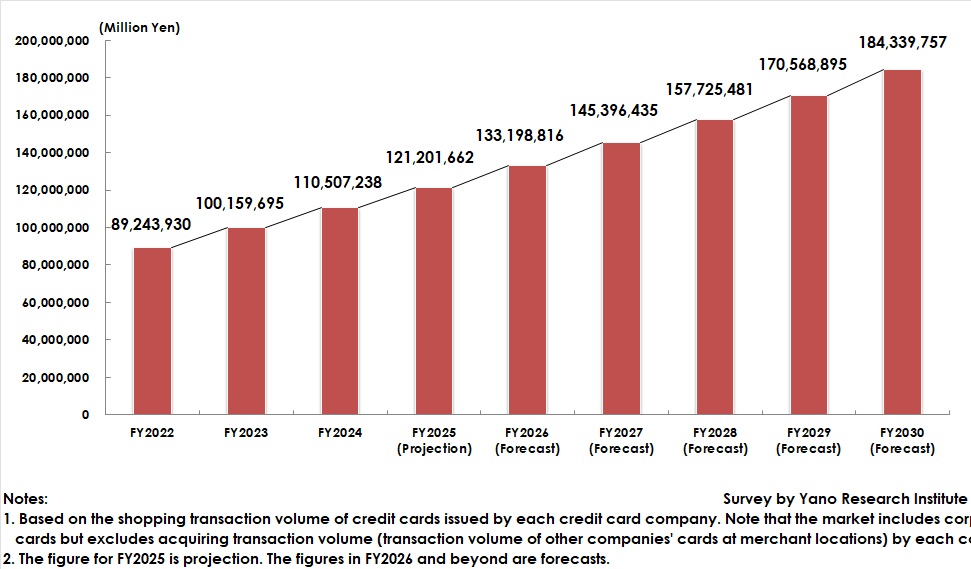

Credit Card Market Expected to Reach 184 Trillion Yen by FY2030

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey of the credit card market in Japan. The survey revealed the current status, trends of market players, and future perspective.

Market Overview

The volume of credit card shopping transactions issued by card companies exceeded 110 trillion yen, one of the factors to drive the growth of Japan's cashless market. This increase was fueled by advanced reward point programs implemented by credit card companies. These programs offer personalized incentives based on customer data to encourage increased transaction volume and frequency. They have effectively expanded usage opportunities by promoting cross-usage across their integrated ecosystems, which include financial services.

Other marketing promotions also contributed to the increase in transaction volume. These promotions include enhancing premium card tiers, including platinum cards; expanding corporate card offerings focused on digital payment solutions; and developing cards designed for younger consumers. Additionally, the market growth was boosted by the natural increase in usage driven by credit card partnerships with prepaid settlements and QR code payments.

These efforts are expected to expand the market beyond 121 trillion yen. Consequently, growth is expected to continue.

Noteworthy Topics

Credit card companies have changed their marketing approach. Rather than promoting credit cards as standalone products, they have positioned them as part of a broader financial services ecosystem since 2023. These services include bank accounts, securities, insurance, and loans through mobile apps.

This approach also benefits banks by strengthening customer relationships. For banks, integrating credit cards increases account utilization rates, directs salary deposits, boosts investment trust and insurance adoption, and improves daily active app users (DAUs).

Consequently, future competition will lie in algorithms that enable seamless customer migration across financial services rather than in reward point redemption rates or campaigns.

From 2025 to 2027, the focus of bank partnership ecosystem is expected to shift from acquiring members to optimizing the share of customer usage. Ultimately, credit card companies' KPIs may become key indicators for tracking customer migration, bundling rates, and churn predictions within the financial ecosystem.

In an environment of rising interest rates, aligning with banking services is indispensable. The future development of credit card companies is garnering attention, as they now have the potential to offer banking as a service (BaaS).

Future Outlook

The volume of credit card transactions is experiencing robust growth. It is expected to reach 184 trillion yen by FY2030. The following factors are driving this growth:

1) Credit card companies are successfully increasing customer usage by offering advanced reward point programs and personalized incentives that provide companies with precise insights into customer behavior.

2) The shift from reward point-exclusive campaigns to behavior-based campaigns optimized for profits has boosted both usage frequency and unit purchasing price, transforming the profit structure to a lifetime value (LTV) basis. By FY2030, the LTV-based model is expected to be the primary business operating indicator.

3) In the realm of high-end credit cards, premium cards offering curated luxury lifestyle benefits are expected to emerge alongside traditional gold and platinum offerings.

Due to these efforts, the credit card market is expected to transform from a traditional transaction volume-driven business model to a customer value-driven model by 2030. This transformation will be driven by three pillars, i.e., expansion of cashless infrastructure, maximization of customer value, and advancement of merchant networks.

This structural transformation will unlock significant long-term growth potential and ensure sustained market expansion.

Research Outline

2.Research Object: Leading credit card issuers

3.Research Methogology: Face-to-face interviews (including online interviews) by expert researchers, surveys via telephone, mailed questionnaire, and literature search

What is the Credit Card Market?

In this survey, the credit card market refers to shopping transactions using credit cards by Japanese credit card holders at stores and online shops both in Japan and abroad. Market size is calculated based on the shopping transaction volume (usage amount) of credit cards issued by each credit card company. Note that the market includes corporate cards but excludes acquiring transaction volume (transaction volume of other companies' cards at merchant locations) by each company.

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.