No.3675

Decarbonization Changes Global Automotive Industry: Key Research Findings 2024

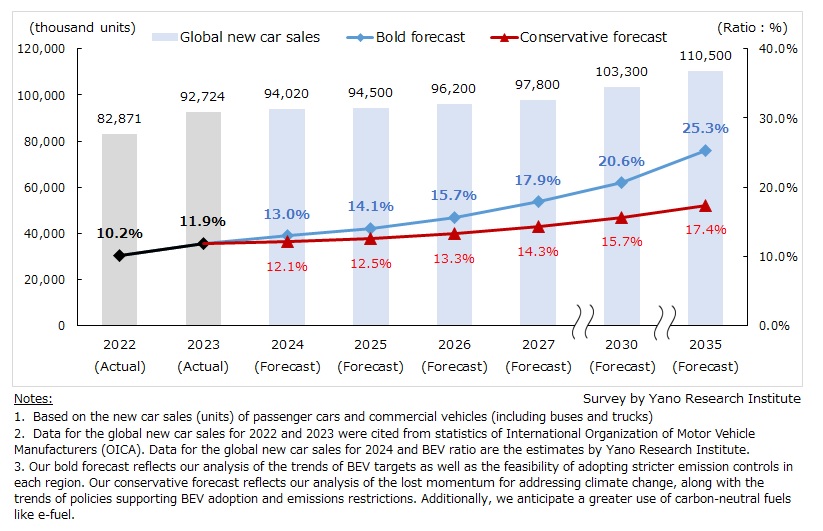

BEV to Account for 25.3% of Global New Car Sales by 2035 (Bold Forecast)

Yano Research Institute (the President, Takashi Mizukoshi) has conducted a survey on the state of automotive industry that has been impacted by the global movement toward decarbonization. The report highlights the market overview and decarbonization strategies of major manufacturers. This press release denotes our forecasts on BEV ratio and FFV ratio up to 2035.

Market Overview

During the Covid crisis, countries around the world have strongly promoted decarbonization through “green recovery” policies, integrating economic growth with measures against global warming. However, the situation has changed dramatically since product prices is inflating due to high energy prices. In 2023, COP28 ended with a call to “phase down”, a structured reduction in the use of fossil fuels, instead of long-demanded “phase out” (complete cessation). As seen in some fuel companies upgrading long-term fossil fuel demand forecast and steering toward large-scale investments to power plant/refinery, the path to decarbonization looks uncertain.

Although the automotive industry has been promoting the shift to BEVs, sluggish demand for BEV has required OEMs (automobile manufacturers) to redraft their electrification strategies. In addition, they are starting to question if BEVs really contribute to decarbonization, given the slumping of manufacturing/recycling of lithium-ion batteries (LiBs) that have a high environmental impact, as well as the low mix of renewable energy as the power supply.

Noteworthy Topics

2023 BEV Ratio & FFV Ratio

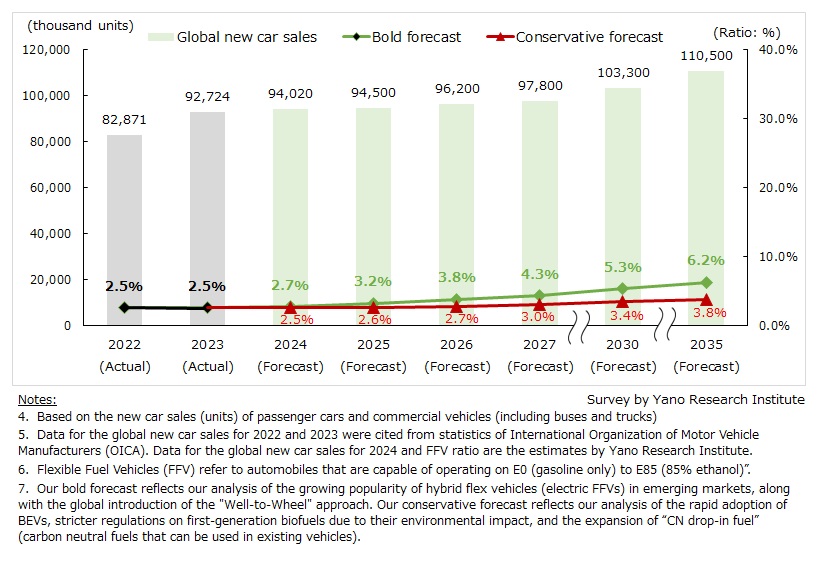

According to the statistics of International Organization of Motor Vehicle Manufacturers (OICA), global new car sales in 2023 was 92,720 thousand units. Using this number, we estimated BEV ratio at 11.9% (11,010 thousand units) and FFV ratio at 2.5% (2,310 thousand units).

To achieve decarbonization, the automotive industry has been actively promoting the development of BEV. China is the largest market of BEV, accounting for approximately 60 percent of BEVs sold. Competitive price has enabled Chinese BEV to dominate Europe and emerging markets. However, associated with the end of BEV subsidies, the demand for PHEV is rising even in the Chinese market.

Meanwhile, BEV sales have been stagnant in Europe and U.S. markets as economic and practical issues of BEVs become evident. Consumer interest is shifting toward hybrid electric vehicles (HEVs). Trends are changing in each region: In the U.S., the share of HEVs overtook that of BEVs in 2023; In Germany, the termination of purchase subsidies has triggered a slowdown in BEV sales.

Against these backgrounds, Mercedes and Volvo have rolled back their pledge to become fully electric by 2030. Japanese and American automakers like Toyota, GM, and Ford have also adjusted their electrification strategies to increase profitability, by including HEVs and plug-in hybrid vehicles (PHEVs) in their electrification scenario.

OEMs are modifying electrification strategies from “solely by BEVs” to “including HEVs and PHEVs”, reflecting the situation that PHEV yields higher profit margins than BEV.

Synthetic fuel may be another promising solution for decarbonization from a long-term perspective. Nonetheless, biofuel may be more viable in the short term. In France and the U.S. (in the State of California), demand for E85 (ethanol blended with gasoline at 85%) is increasing against the backdrop of soaring gas prices. Meanwhile, in emerging economies that have abundant agricultural resources, biofuel and FFVs (E0 to E85) are seen as more promising solutions, from the standpoint of improving trade deficits and energy security.

Future Outlook

In view of the situations of automotive industry amidst the call for decarbonization, we present our projections for the BEV ratios and FFV ratios through 2035.

We forecast that the BEV ratio will increase only modestly to 17.9% by 2027, even in our most optimistic scenario (“bold forecast”). This is based on the fact that many countries in Europe and the United States have recently reduced their BEV targets and softened emission regulations, reflecting the backlash against previously set aggressive targets and stringent emission standards.

Meanwhile, we believe the trend toward electrification is irreversible. Despite ongoing challenges in the medium to long term, countries are implementing policies aimed at increasing BEV targets and tightening emission controls in 2030s. Given this context, our bold forecast for the BEV ratio is 20.6% for 2030 and 25.3% for 2035.

Our bold forecast for FFV ratio is 4.3% for 2027, and 6.2% for 2035. We anticipate the growing popularity of hybrid flex vehicles (electric FFVs) in emerging markets, along with the global introduction of the "Well-to-Wheel" approach in emission control, will drive the adoption of FFVs.

Nevertheless, in our conservative forecasts, FFV ratio is 3.0% for 2027 and 3.8% for 2035. We expect that the rapid adoption of BEVs, stricter regulations on first-generation biofuels due to their environmental impact, and the expansion of “CN drop-in fuel” (carbon neutral fuel that can be used in existing vehicles) will hamper the growth of new FFV sales.

Research Outline

2.Research Object: Automakers, auto parts suppliers, energy (fuel) companies

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews), survey by telephone, and literature research

This survey focuses on the trends in the automotive industry (including automakers and auto parts suppliers) and energy companies as they undergo transformation toward decarbonization.

In this research, “BEV ratio” and “FFV ratio” are calculated using the global new car sales (units) of passenger cars and commercial vehicles (including buses and trucks) as denominator, and the global new car sales (units) of BEV or FFV as numerator. Data for the global new car sales for 2022 and 2023 were cited from statistics of International Organization of Motor Vehicle Manufacturers (OICA). Data for the global new car sales for 2024 and the global new car sales (units) of BEV and FFV are the estimates by Yano Research Institute.

Note that we did not include PHEV and HEV in Battery Electric Vehicles (BEV). Flexible Fuel Vehicles (FFV) refer to automobiles that are capable of operating on E0 (gasoline only) to E85 (85% ethanol)”. However, this does not include gasoline powered vehicles modified into FFV.

<BEV Ratio>

Our bold forecast reflects our analysis of the trends of BEV targets as well as the feasibility of adopting stricter emission control in each region.

Our conservative forecast reflects our analysis of the lost momentum for addressing climate change, along with the trends of policies supporting BEV adoption and emissions restrictions. Additionally, we anticipate a greater use of carbon-neutral fuels like e-fuel.

<FFV Ratio>

Our bold forecast reflects our analysis of the growing popularity of hybrid flex vehicles (electric FFVs) in emerging markets, along with the global introduction of the "Well-to-Wheel" approach.

Our conservative forecast reflects our analysis of the rapid adoption of BEVs, stricter regulations on first-generation biofuels due to their environmental impact, and the expansion of “CN drop-in fuel” (carbon neutral fuels that can be used in existing vehicles).

<Products and Services in the Market>

BEV (battery electric vehicles), connector-type EV charging stations, recycled batteries, FFV (flexible fuel vehicles), hybrid flexible fuel vehicles (electric FFV), synthetic fuel, biofuel, e-fuel

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.