No.3644

Automotive Films & Sheets Market in Japan: Key Research Findings 2024

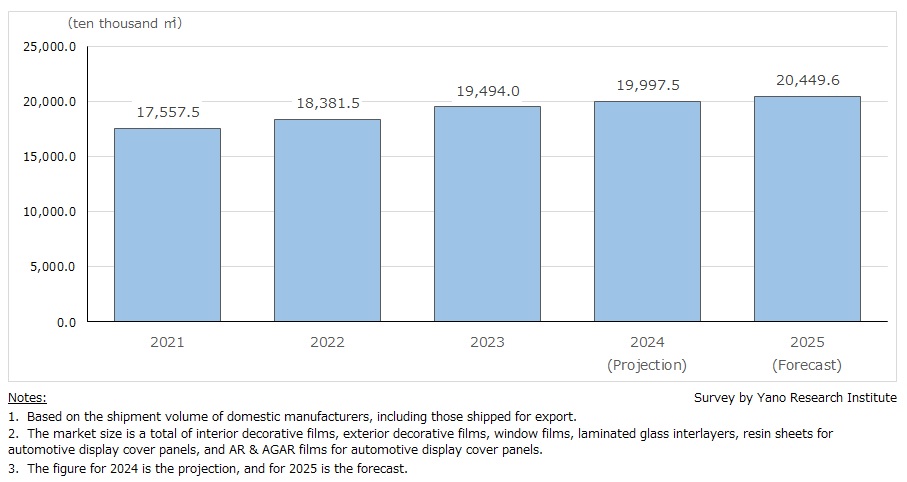

Shipment Volume of Automotive Films & Sheets Rose to 194,940 Thousand Square Meters in 2023, 106.1% of Previous Year

Yano Research Institute (the President, Takashi Mizukoshi) conducted a survey on the domestic automotive films and sheets market, and found out the trend by product segment, the market player trends, and future perspectives.

Market Overview

The domestic automotive display shipment volume in 2023 is estimated at 194,940 thousand square meters, 106.1% of the previous year (based on the shipment volume of manufacturers, including those shipped for export).

In detail, the shipment volumes (year-on-year growth) of each category were as follows:

- Interior decorative films: 15,535 thousand square meters (100.5%)

- Exterior decorative films 4750 thousand square meters (100.5%)

- Window films: 3290 thousand square meters (101.9%)

- Laminated glass interlayers 169,100 thousand square meters (106.8%)

- Resin sheets for automotive display cover panels: 690 thousand square meters (95.6%)

- AF & AGAF films for automotive display cover panels: 1,575 thousand square meters (115.6%)

In response to the increase in the number of panels mounted per vehicle, the expansion of display sizes, and the shift from resin to glass display covers in recent years, demand for AR (anti-reflective) and AGAR (anti-glare anti-reflective) films to improve driver visibility is rising.

Among interior decorative films, insert molding films for electrical components have been growing at an annual rate of 6-9%, driven by the trend of vehicle electrification, which has increased the demand for larger mounted displays and integrated displays with multiple functionalities.

Noteworthy Topics

AR & AGAR Films for Automotive Display Cover Panels

Automotive display cover panels are either made of glass or resin.

In general, glass display cover panels are coated with anti-shattering film to keep the glass in place even under harsh impacts. However, some manufacturers choose not to apply the anti-shattering film to preserve the natural aesthetic and tactile feel of the glass.

The trend of displays mounted in cars has evolved significantly in recent years. Luxury car manufacturers are increasingly opting for larger displays that stretch across the dashboard, integrating multiple displays into one, rather than the traditional design that installs CID (Central Information Display) and instrument cluster separately. Furthermore, as multi-display setups need to ensure visibility from various viewing angles, the demand for AR (antireflective) films and AGAR (antiglare and antireflective) films is growing.

Other notable trends include the popularity of dash-mounted display and the increase in instrument clusters without panel cover from aesthetic perspective. A major advantage of a dash-mounted display is that it minimizes the need for drivers to look around, thereby improving the line of sight and enhancing safety. Another benefit is its versatility and flexibility. With fewer restrictions regarding positioning and vehicle type, users can choose from various display sizes. However, dash-mounted displays and instrument clusters without panel covers are vulnerable to reflection of sunlight, which can reduce driver visibility. The increasing need to address this issue has led to a rise in demand for AR and AGAR films.

Future Outlook

Although automotive film and sheet manufacturers have been developing products to address areas of CASE (Connected, Autonomous, Shared, and Electric), they have not yet been successful in creating or expanding demand significantly. However, technologies for next-generation vehicles are steadily advancing, and the movement toward the realization of CASE is irreversible.

Some believe that, within the next two decades, the landscape of automated driving, powertrains, production volume, business models, and Mobility as a Service (MaaS) will face a major transformation, and the automotive industry is expected to undergo a fundamental shift, centered around CASE.

While “automakers” used to be sole designers and developers of automobiles, the shift to EVs and electrification of vehicles have encouraged consumer electronics and ICT equipment manufacturers to develop concept cars. In line with this trend, expectations are growing for the utilization of car cabin as living space (living room, theater room, workspace) and for utilizing the rechargeable battery and solar charging system mounted on EVs as energy source in the event of a disaster.

With the change in the use of vehicles beyond transportation, automotive film and sheet manufacturers foresee the creation of new demand. For example, to use a vehicle cabin as a living room or a study, the interior must become more tactile, built with materials and decorative films that are scratch-proof, stain-resistant, and easy to replace.

In addition, sound insulation will be important if the car cabin is to be used as a workplace, meeting space, or theater room. From this perspective, the use of laminated glass interlayers, which have been mainly used for windshields, is likely to expand to side and rear windows.

As the automotive industry go through technological innovation with an emphasis on CASE areas, numerous opportunities for growth are emerging across the sector. Automotive film and sheet manufacturers are required to make use of accumulated knowledge to create products that meet the needs of CASE and environmental responsiveness. To stay ahead, they must contribute to the sustainable growth of the automotive industry, which is said to be undergoing a “once-in-a-century” period of great change.

Research Outline

2.Research Object: Manufacturers of automotive interior decorative films, manufacturers of automotive exterior decorative films, window films, laminated glass interlayers, resin sheets for automotive display cover panels, and AR & AGAR films for automotive display cover panels

3.Research Methogology: Face-to-face interviews by our expert researchers (including online interviews) and literature research

About Automotive Films & Sheets Market

The automotive films & sheets market in this research refers to the market targeting interior decorative films, exterior decorative films, window films, laminated glass interlayers, resin sheets for automotive display cover panels, and AR & AGAR films for automotive display cover panels. The market size is calculated based on the shipment volume (including those shipped for export) by domestic manufacturers.

*Reference: Press Release “Global Automotive Display Market: Key Research Findings 2024”

https://www.yanoresearch.com/en/press-release/show/press_id/3632

<Products and Services in the Market>

Interior decorative films (water pressure transfer printing films, IMR [in-mold release transfer printing] films, IMF [Insert Molding Forming] films, OMF [Out Mold Forming] films), exterior decorative films, window films, laminated glass interlayers, resin sheets for automotive display cover panels, AR & AGAR films for automotive display cover panels

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.