No.3632

Global Automotive Display Market: Key Research Findings 2024

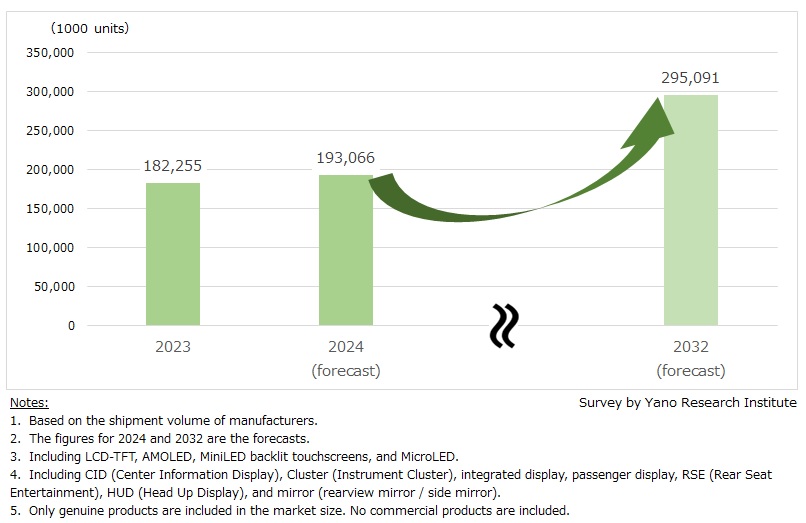

Global Automotive Display Shipment in 2024 Projected to Grow by 5.9% From Previous Year

Yano Research Institute (the President, Takashi Mizukoshi) has carried out a survey on the global automotive display market and has found out the market trends by type, part, inch, the trend of manufacturers, price trends, and future perspectives.

Market Overview

The global automotive display shipment volume is estimated at 193,066 thousand units, 105.9% of the previous year (genuine products only; including LCD-TFT, AMOLED, miniLED backlit touch screens, and MicroLEDs; based on the shipment volume of manufacturers).

In 2023, global shipments of automotive displays saw significant growth, reflecting the overall expansion of the global automotive market. However, demand for vehicles is expected to decline globally in 2024, partly as a response to the previous year's trends. The reduction in electric vehicle (EV) sales in China and Europe, chiefly due to the end of subsidies, is affecting the global shipment volume of displays for EVs. Despite this, global shipments of automotive displays are forecasted to reach 105.9% of the previous year's level.

Noteworthy Topics

Major Changes in Cockpit Display Design: Trend of Integrated Display and Passenger Display

Notable trends expected for automotive displays beyond 2025 include the increase of integrated display and passenger display for cockpit module.

The layout of display design for the cockpit module on the front of the driver's seat of a car has entered a transitional phase and is expected to change in earnest. There is a trend to shift to “multiple display” (that show multiple information on a single display) or “integrated display” for cockpit module, instead of a super-long full-width displays.

In the Chinese market, installing automotive instrument cluster with large center information display (CID) is becoming the mainstream. On the other hand, in the European markets, the adoption of integrated displays, including passenger display, is gaining momentum. We expect the passenger display market will expand in Europe in particular as the standardization of passenger display installation has been promoted in the region. In addition, from a safety perspective, "switchable privacy displays" utilizing viewing angle control technology are being increasingly implemented. The market is witnessing a growing demand for high-value-added automotive displays.

Future Outlook

The increase of automotive display shipment volume has always exceeded the increase of automobiles, because multiple panels are installed per automobile. However, this may not be true from 2025. As the number of panels mounted per vehicle changes, the growth rate of global shipment volume of automotive displays may be equivalent to that of automobiles.

Larger display is increasingly gaining ground. Adopting two displays of 9-inch or larger for the cockpit module, instead of installing multiple smaller or medium-sized displays to reduce costs, is becoming the standard practice. Besides, the expansion of design that integrates two functions into one display, such as “CID and Cluster” and “CID and passenger display”. For these reasons, the display shipment volume is expected to decline.

On the other hand, by value, the size of the automotive display market is expected to grow at a high rate, due to the increase of high value-added automotive displays. The market expansion is underpinned by the rise of high-performance automotive displays, such as automotive OLED panels, large and high-brightness integrated displays with LED back light, displays coated with antiglare (AG)/low reflection (LR) film, and in-cell touch displays. Changes in layout design of cockpit modules will lead to the increase of high-end automotive displays, such as around 15-inch & 20 to 50-inch large CIDs, integrated displays, and passenger displays, supporting high market growth by value.

Research Outline

2.Research Object: Automotive display manufacturers

3.Research Methogology: Face-to-face interviews (including online interviews) by our specialized researchers, literature research

The Automotive Display Market

The automotive display market in this research has been calculated by the sales at enterprises for center information display (CID) for cockpit module, instrument cluster (cluster), integrated display, passenger display, rear-seat entertainment (RSE), head-up display (HUD), thin film transistor liquid crystal display (TFT LCD) for mirrors (rearview mirror, side mirrors), active-matrix organic light emitting diode (AMOLED) display, and miniLED backlit screens, and Micro LED.

Only genuine products are included in the market size and no commercial products are included.

<Products and Services in the Market>

Automotive TFT-LCDs, automotive AMOLED, Automotive Mini/Micro LEDs

Published Report

Contact Us

The copyright and all other rights pertaining to this report belong to Yano Research Institute.

Please contact our PR team when quoting the report contents for the purpose other than media coverage.

Depending on the purpose of using our report, we may ask you to present your sentences for confirmation beforehand.